Articles

Articles and analyses from the INET community on the key economic questions of our time.

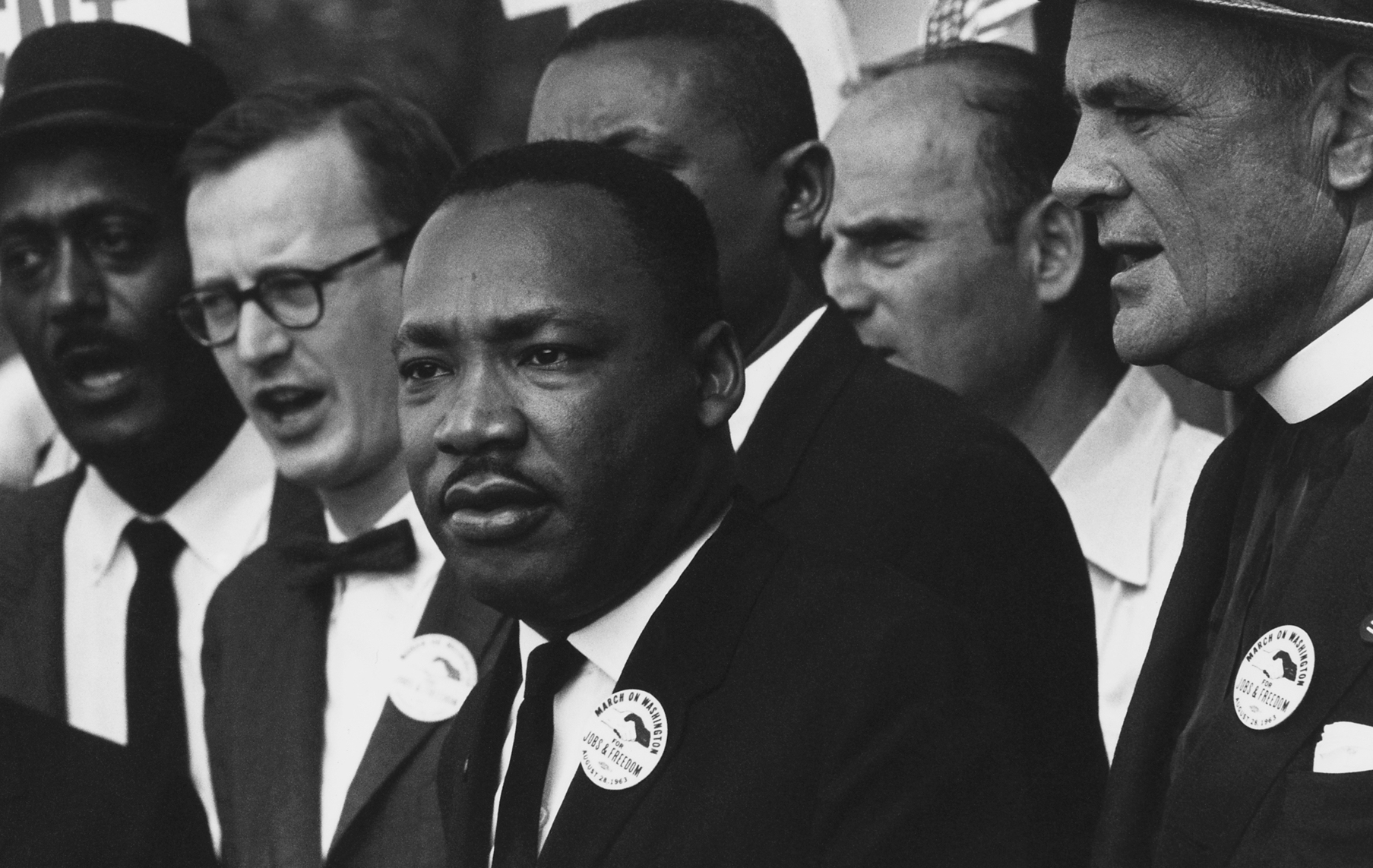

Samuel Bowles Remembers Martin Luther King

The economist reflects back on the racial justice leader who showed him the limits of his academic training.

Visions Beyond the Haunted House

Britney and the Bear: Who Says You Can’t Get Good Help Anymore?

From the Archives: In the wake of the Bear Stearns bailout in 2008, INET Research Director Tom Ferguson and President Rob Johnson say taxpayers rescuing banks are owed their due: “If the public is going to pay for [bailouts]… it should also get paid back for them.”

Waiting for the Chinese Bear Stearns

Unregulated, speculative lending markets nearly brought down the global financial system 10 years ago. Now, Western banks are exporting this failed model to the developing world.

Don't Want a Robot to Replace You? Study Tolstoy.

Economist Morton Schapiro, president of Northwestern University, and his colleague, literary critic and Slavic studies scholar Saul Morson, argue that—contrary to popular belief—studying the humanities is the key to not getting outsourced.

Even in France, Money Rules Politics

France, like many Western European countries, has strong campaign finance laws and a vibrant multiparty system. Yet even there, money has had a corrosive effect on democracy, as private donations have an outsized impact on electoral outcomes.

China’s Green Opportunity

Here’s Why Sexual Harassment Matters for Economists

To get justice, targets must show measurable harm. Economists can help

How Money Won Trump the White House

It wasn’t Comey or the Russians. Trump prevailed because his campaign carefully targeted key states with late infusions of big money from private equity, casinos, and other far right contributors, a remarkable wave of donations from small donors, and substantial infusions from the candidate himself.

Why Research and Innovation Are Vital for Southern European Economies—and Eurozone Survival

Austerity measures have battered the region and created instability throughout the Eurozone. Here’s one way out of the mess.

Nothing Natural About the Natural Rate of Unemployment

With unemployment reaching very low levels in major economies, despite low – and slowly rising – inflation, it’s time for central banks to rethink their reliance on the so-called natural rate. No numerical target for this rate can serve as an anchor for monetary policy.

Can Bitcoin Replace the Dollar?

America’s Rising, Invisible Debt

Why it’s time to repeal the debt ceiling and replace it with a ‘truth in borrowing’ act