In the face of laissez-faire capitalism at home and resurgent nationalism across the globe, INET offers an innovative look at the causes of—and solutions for—the problems that ail a fissuring world economy.

2017 is a prime number of singular, even extraordinary properties, so some mathematicians may still look back playfully on last year. But judging from all the morose talk about the “long 2016” at year’s end, hardly anyone else would: The combination of Brexit and a new American president with wars, climate change, civil strife, and runaway inequality has exposed deepseated social malaise, even if the bourgeoning campaign against harassment and sexism lifted spirits at the very end.

We have as many misgivings about 2017 as everyone else. But in an operation like ours, the arrival of a new year also invites a glance backward. So, as with 2016, this essay surveys INET’s research output last year. The task this time is more daunting than usual—not least because INET staged another large scale plenary conference in Edinburgh, Scotland, in October.

So here we focus on the Working Papers, blog posts, and other written commentary linked to or published on INET’s own website by its grantees, including Edinburgh and INET’s major in-house research programs managed from New York, such as Financial Stability, Imperfect Knowledge Economics, and the Political Economy of Distribution.[1] We also gather together on one page the links to Lynn Parramore’s widely-read series of interviews with economists on their own work and on problems in economic theory.

Radical Uncertainity

We begin with a confession. From its inception, INET emphasized the importance of incorporating radical uncertainty into economic thinking. We have an entire research program on Imperfect Knowledge Economics directed by Professor Roman Frydman that does notable work in the area (including Frydman’s paper with Søren Johansen, Anders Rahbek, and Morten Nyboe Tabor published in INET’s Working Paper series in 2017). So when the world turns upside down, we often console ourselves with the thought that INET at least recognized from the outset that perfect—or even average—foresight is delusory. Of course, sometimes this conceit is pretty cold comfort.

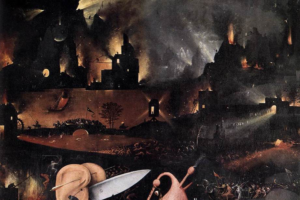

The crisis that rolled over the world in 2016 and 2017 clearly differs from that of 2008, even if it grew organically out of the earlier disaster. The relations between economics and politics are at once more obvious yet more complicated. At times, their interaction is almost surreal: Blithe talk about who has the biggest button, intensifying political stalemates and civic discord—amid incessant allusions to wars over trade or other issues—are producing a “new normal” reminiscent of a state of permanent emergency. That some stock markets have recently broken all records does not vitiate this statement: The surreal way cyclical upturns can mask underlying social disruption—for a while—is an enduring theme in world history.

For INET, the last year’s crisis posed a challenge. The task set by INET’s founders was to change economics and, particularly, economic theory. That is a big and very slowly moving target, even in emergencies. Basic theoretical work, like that INET sponsors and conducts on financial stability and bubbles, macroeconomics, and many microeconomic and regulatory issues, needs to proceed steadily; it cannot realistically turn on a dime. These elements of continuity show up in many discussions and much of the research output presented at our Edinburgh Conference, INET’s Working Papers, and other INET research.

The Dual Economy

But at a time when establishment analysts in the Atlantic world all but unanimously ascribed the rise of “populism” to irrational social-psychological or cultural reactions to the “Other,” INET set in motion studies of how economic issues linked to these hot-button discussions. By 2017, the timeliness of this new research was inescapable: Peter Temin’s INET Working Paper of November 2015 on “The American Dual Economy: Race, Globalization, and the Politics of Exclusion,” for example, morphed into a widely heralded, full-length study of The Vanishing Middle Class: Prejudice and Power in a Dual Economy published by MIT Press. Lynn Parramore’s interview with Temin as the book appeared set a record for the most-ever views on the INET website—more than a 100,000 when first released, and almost 400,000 to date. Later in 2017, Temin produced a chilling new Working Paper for INET on “The Political Economy of Mass Incarceration: An Analytical Model.”

In a paper and blog post, Servaas Storm deepened the discussion of dual economies with a detailed sector-by-sector critique of the role low wages played in the much-bruited “productivity crisis.” Work by Lance Taylor and his colleagues that INET published in 2017 also spotlighted the crucial role of low wages rather than, for example, monopoly, in manufacturing inequality. Several panels at Edinburgh addressed these issues of dualism and of ways to reverse it, incorporating the very important dimensions of race, gender and geography with not only Temin and Storm, but also Marcella Corsi, Mariana Mazzucato, Shannon Monnat (author also of a blog post on the epidemic of despair), Mario Seccareccia and Guy Standing.

Demand-Side Macroeconomics

INET’s steady focus on the importance of aggregate demand—i.e., total demand for goods and services—as a factor in sustaining national income also stood out in 2017 by comparison with mainstream economics. With discontent mushrooming in advanced economies, INET’s scorn for conventional economics’ reliance on measures of potential output that trail levels determined by flawed policy turned out to be prescient. Work by Joseph Stiglitz, Steve Fazzari, Antonella Stirati, Mario Seccareccia, Marc Lavoie, Lance Taylor, Orsola Costantini and other researchers supported by INET has hammered away on these themes, even as official policy in most countries responded to political discontent by doubling down on austerity.

Several presentations at the Edinburgh Conference illustrated the point. In the words of INET Governing Board member Anatole Kaletsky, who chaired one of the sessions, the papers as a group overturn the supposed relations between spending, growth, productivity, and inflation. Antonella Stirati presented a paper written with Daniele Girardi and Walter Paternesi Meloni— now part of our Working Paper series—that studied the reactions to fiscal stimulus in a panel of countries over ten years. It turns out that the effects of these so-called “demand shocks” persist in the long run, boosting typically supply-side variables like the capital stock and labor market participation, without statistically significantly affecting inflation. (See a schematic summary of the findings here). Steven Fazzari in his work with Barry Cynamon explored the private component of aggregate demand—particularly household spending—which drove American growth in the late 1990s and early 2000s, sometimes dubbed the Consumer Age. This happened despite growing inequality and put the middle class severely into debt. Borrowing postpones the hit to demand but also exaggerates fluctuations over the business cycle.

A major macroeconomic problem generated by inequality is that the affluent spend a smaller share of their income than the rest. This point figured in Lance Taylor’s hard-hitting critique of Donald Trump’s tax plan that INET published in December. Taylor makes it obvious that while deficit spending theoretically boosts growth, the composition of that spending matters a great deal. In the U.S.,,

the annual disposable income of all rich households is $2 trillion. Their consumption is $1 trillion in an economy with overall demand of $20 trillion. Their extra consumption from the tax windfall might be less than $40 billion, about 0.2% of total demand. Through this channel at least, the macroeconomic boost from upper income tax reduction would be barely visible.

The tax cut for the rich will however increase their wealth, intensifying inequality.

Those themes were further developed in an extended discussion on secular stagnation that INET hosted in New York on December 15th. Economists from different approaches, including Gauti Eggertson, Steven Fazzari, Adair Turner, Antonella Stirati and Larry Summers gathered to discuss whether the widely-heralded new mediocre “normal” is really inevitable. The conference produced intense debate and elicited a striking comment on the key issue of loanable funds from Servaas Storm (see a summary here).

Problems of inequality, stagnation, and of finding the appropriate composition of public budgets are hardly unique to America: They were at the center of the discussion about the Eurozone in Edinburgh. Giancarlo Corsetti, Carl Holtfrerich, Gustav Horn, Jean Pierre Landau, Annamaria Simonazzi and Servaas Storm all insisted on the necessity of studying a European plan of public investment. Especially debated was industrial policy which, as Simonazzi argued, most countries abandoned in the course of the 1970s in favor of deregulation and other strategies such as financialization and austerity. This eventually brought about a “hierarchical reorganization of European industries” with the creation of a Central European manufacturing core and two peripheries. But as Storm and Horn pointed out, imbalances exist not only between but also within countries, including those in the core. Dealing with them would require modification or repeal of the E.U.’s infamous Stability and Growth Pact, which mandates restrictive debt-to-GDP ratios. But how and to what end? This is where most speakers did not agree, revealing more or less explicitly their often large theoretical and political differences—a point that emerged strongly during the final discussion.

Competition, Innovation, and Regulation

Most of the macroeconomic works we have mentioned so far point to the influence of demand variables on the supply-side conditions of markets. Yet, as the latest experiences in the European Union have proven, regulatory issues are just as critical. INET research recognized from early on that theories of the firm, competition, and innovation desperately needed a reformation. Developing credible theories in these areas is an imperative in its own right; it also allows for support of relevant policy actions.

To that end, INET has supported the work of William Lazonick and his colleagues on executive pay, employment conditions, productivity, and innovation. Their research has fundamentally altered scholarly measurements of executive pay and shaped discussions in and out of Washington on the wisdom and practice of stock buybacks. (Lazonick’s INET research in this area was featured in the Financial Times, and later in the Washington Post.) In 2017, as questions about pharmaceutical pricing emerged as burning public issue, INET was ready: Lazonick, Matt Hopkins and coauthors released a major study of Big Pharma’s business model in INET’s Working Paper series. That paper, which was featured in Gretchen Morgenson’s column for the New York Times, has figured in many discussions around the world and continues to inspire further research and investigation. Lazonick and Hopkins also followed up their earlier studies showing that executive pay in the U.S. has been severely underestimated with advice to the Securities and Exchange Commission on its proposed “Pay Ratio” rule. (See a summary of findings here and here).

In 2017, just as in earlier years, unresolved issues of financial regulation continued to be pressing. INET’s concern with financial stability and measuring back-door subsidies to the financial sector is longstanding. Edward Kane contributed a major Working Paper that he also presented in Edinburgh on hidden subsidies for too-big-to-fail banks. The research examines how central banks support and subsidize major European banks—thus enabling them to postpone debt restructurings for the indefinite future. As in his other work, Kane concentrates on practical, market-based measurements that have the potential to move older discussions down from the clouds into realms of realistic measurement. Perry Mehrling also extended his analysis of finance and banking to new phenomena such as cryptocurrencies.

Debt

INET researchers also debated questions about the respective roles of private and public debt, both in Edinburgh and in various published papers we published. The relation between inequality and household indebtedness also did not escape attention. INET researchers approached this topic with the idea that money is not neutral with respect to the real economy, and thus examined how its role in household demand affects growth and income distribution.

Gender and Feminist Economics

Questions of gender and feminist economics received particular attention at INET in 2017. At Edinburgh, we hosted a panel in which INET researchers took the view that impressions of the health of the economy are not agnostic to the lens through which we view them. And those lenses can carry a gender bias that deeply affects the questions we ask and the ways in which we answer them. As Marcella Corsi pointed out, the financial crisis did not discriminate in its burden on women and men, but the responses to it appear to be doing just that. By focusing on targets such as budget deficits, policymakers lost track of other more critical economic magnitudes such as targets like investment, care, and equality. Similarly, standard measures such as GDP growth cannot, as Oxfam International Executive Director Winnie Byanyima explained, capture fundamental gender imbalances, as women are forced into lower-paying jobs.

Two researchers, Sheila Dow and Giulia Zacchia, put forward separately, in methodologically very different papers, the provocative idea that “the gender perspective provides a good context in which to consider how differently economics might be done” (Dow 2017). Sheila Dow distinguished between two theories of knowledge: on the one hand, the “masculine”/mainstream epistemology where science produces demonstrable truths and gender differences are treated as market imperfections and, on the other hand, the “feminist”/non-mainstream epistemology that requires a “broad situated knowledge.” Only the latter allows for appreciating elements such as “the emergent and non-dualistic nature of identity, the integral role of values and emotion in economic activity, the importance of social convention, and the role of power other than market power” (Dow 2017). Unfortunately, Giulia Zacchia’s INET Working Paper (summarized in her blog post) shows that recent institutional changes, including index-based practices for the evaluation of research, are shaping research toward a uniform “masculine”/mainstream perspective. Using Italy as a case study, she tested how women are particularly affected by this phenomenon, being increasingly incentivized to conform to the research activities and publishing habits of their male colleagues, in order to advance in their careers.

Climate Change

Another topic largely neglected by standard theory is climate change. INET Chairman Adair Turner opened the discussion in Edinburgh with a message of hope but also a yellow flag about the magnitude of the challenge ahead. He framed the discussion in terms of the size of the carbon budget if the world is to limit global warming to 2 degrees centigrade. Given the magnitude of emissions over the last two centuries, we will need to limit our global emissions to 900 gigatons of carbon over the next 85 years. The current rate is 40 gigatons per annum, which is clearly not sustainable. The good news is the costs of renewable sources of energy such as wind and solar have fallen dramatically in recent years as has the cost of battery storage. Yet, as Turner argued in a contribution to our blog with Arnaut De Pee, the pace of change will depend on a range of factors, not only technology.

Michael Grubb highlighted the policy actions that led to this fall in energy costs through collaborations between the public and private sectors to encourage innovation. But if we want to design different and more effective policy frameworks, economic models must take into account the way technological changes and institutions feed back on each other. In terms of policies, James Boyce showed how carbon pricing can help here, though he cautioned that economists should limit themselves to suggesting technical ways to achieve goals best left to scientists. Richard Heede assessed current attempts to allocate responsibility for carbon emissions to the corporations responsible for them. Many of these corporations have known for decades about the damage their products cause. But rather than focus on remediation they have engaged in obfuscation.

Political Economy

At Edinburgh, a series of panels attempted to empirically assess how political and economic factors combine to produce dramatic upheavals in the politics of relatively advanced countries—now and in the past. One session focused directly on the populist upsurges in so many major western countries, especially 2016’s stunning developments in the U.K. and U.S. All the presentations found clear evidence that economic factors were key to these upheavals. Robert Gold and Stephan Heblich showed the role imports played in disorienting German politics. Thiemo Fetzer analyzed the British case in the light of evidence about the European Union as a whole. Thomas Ferguson and Benjamin Page drew on data from the American National Election Survey to analyze what motivated American voters to vote as they did, finding that economic dissatisfaction added substantially to Trump’s voter support in the general election.

Trade and Globalization

Problems related to trade and globalization were certainly at the center of the popular discontent. Another panel at the conference critically evaluated the effects of international trade on work and income distribution within the advanced countries. What emerged was a picture in which trade—far from being the unquestioned gain for all that most economists have traditionally portrayed it as—comes with significant redistributive effects. Those with political and economic power can bring resources to bear to ensure they are protected from these costs. Arjun Jayadev explained how, for example, the pharma industry protected its profits in proposed trade agreements such as the TPP. But the less advantaged, including workers in the manufacturing sector, cannot do the same.

Indeed, while trade has been beneficial in raising wages and growth in many developing countries, the burdens within most advanced economies countries has fallen disproportionately on workers. They are hit with huge, sometimes debilitating, shocks with effects that, contrary to conventional economic expectations, last for years and in many cases recovery is not a possibility. Attempts to address redistributional issues arising from trade within the U.S., especially in the manufacturing sector, have been woefully insufficient. The human and economic costs have fed a political backlash, encouraging the rise of populism. Kevah Majlesi, in his work with David Autor et al., presented detailed empirical evidence on this point for the U.S.

Brad DeLong, one of the architects of NAFTA, explained that in fact most trade theorists understood the limitations of Ricardo’s theory of comparative advantage. This simplified description of the benefits of trade was something economists presented to lay outsiders, he said, while they in fact knew the trade-offs to be a much more complicated. Nadia Garbellini, meanwhile, showed how the structure of trade relationships between center and periphery countries ensured disproportionate gains for the center. Pia Malaney used the accounting concept of “goodwill” to encapsulate the many costs and externalities not captured directly by economic models. She examined the loss of trust that results when economists make decisions within a star chamber, and resulting redistributional burdens are concentrated among low-income workers.

Anything that affects trade in the developed world is likely to have major implications for developing countries. In particular, China, which saw exports fall significantly in the aftermath of the 2008 financial crisis, faces an increasing number of trade disputes, greater cross-border capital fluctuations and declining growth rates. India, while initially somewhat protected from the contagious effects of the crisis, is now experiencing its own populist surge. Discussions at this panel highlighted the consequences in the developing world—in China and India as well as Latin America—of policy decisions being made the U.S. and Europe in an increasingly interconnected global economy.

Lessons from History

What can go wrong if policy does not address the challenges posed by the wave of dissent was the subject of another panel in Edinburgh. It looked back at the most famous cases of the collapse of liberal democracies in the inter-war period: Germany and Italy. Tiziana Foresti, Nadia Garbellini, and Ariel Wirkierman presented their new study of the rise of Mussolini. Their “event analysis” offered new evidence on Mussolini’s March on Rome and his relations with various parts of Italian business, especially the Banco di Roma group. Thomas Ferguson, Peter Langer, and Joachim Voth discussed the German case. They reviewed detailed evidence that severely undercut the view championed by Henry Turner and Gerald Feldman that became popular in the mid-nineteen eighties that Hitler rose to power without major support from German big business.

Money in Politics

The tortoise-like pace at which governments and regulators tackle questions of improving financial regulation and reducing economic inequality has led citizens and many experts to wonder whether “The Real High Income Trap” that afflicts developed economies might be the role money now plays in politics. Two of the panel’s papers did nothing to quiet suspicions about the U.S. system. Mirko Draca’s careful econometric analysis of shadow lobbying demonstrated that many of the most influential lobbyists in Washington no longer bother to register as lobbyists, but exercise heavy political influence nonetheless. Thomas Ferguson, Paul Jorgensen, and Jie Chen’s detailed reconstruction of the political economy of the 2016 presidential election received widespread attention, including coverage in the Financial Times and other media outlets, when their INET Working Paper appeared this January.

A still widely influential current of thought rejects this view, however, holding instead that political money is really a pathology peculiar to the U.S. Julia Cagé’s presentation on the same panel of her paper with Yasmine Bekkouche—now issued as an INET Working Paper —should dispel illusions that money drives politics only the U.S. Their study of French parliamentary and municipal elections between 1993 and 2014 finds essentially the same “linear model” of the effects of money on votes that Ferguson, Jorgensen, and Chen found in an earlier INET Working Paper study of U.S. congressional elections. Bekkouche and Cagé’s result is all the more remarkable, since it concerns multi-party, parliamentary elections. How far these findings can be pressed remains to be seen. What is clear is that they differ sharply from what would be expected by conventional public choice theories in economics. This line of inquiry grows entirely out of INET’s support for researchers who are willing to try new methods and ideas on much larger collections of data.

Critiquing the Economics Discipline

We conclude this review with a look at INET research that critically reflects on economics itself. Two years ago, we asked ourselves why, despite obvious failures, the core of economic theory and practice has changed so little. The financial crisis and its aftermath had, after all, pointed up sharp limitations to many widely accepted tenets in macroeconomics and financial theory, and spurred debates about uncritical press circulation of defective theories and fake news. (We dedicated a full panel in Edinburgh to this last theme.) But the training and promotion of economists, the practice of journals, and the evaluation of research appeared not to have changed at all. Almost no one asked whether the failures of the theories so many recognized as the crowning glories of the profession suggested any weaknesses in how journals evaluated research or departments promoted scholars.

Inspired by Nobel laureates George Akerlof and James Heckman, we commissioned a series of papers that scrutinized the structure of networks and incentives within the profession. All this work will be gathered on the INET website, and a few studies are ongoing.

In Edinburgh, INET highlighted some of the main findings at a special lunch panel. Akerlof and Heckman led the discussion. The practice of relying on “top 5” journal publications for evaluating researchers began informally in the U.S., and soon became almost ironclad. The U.K. broadly followed the U.S.’ lead as it made changes to its national system of evaluations of universities and departments. Other countries moved in the same direction, though with important national variations. Italy came along relatively late, providing a chance for a natural experiment. An INET Working Paper by Carlo d’Ippoliti analyzes the many variables measured by citations: their “many-citedness.” As a result, citation-based indices of the quality of research reflect several biases: most importantly, they give heavy weight to publications in leading journals edited in the U.S. and U.K., and plainly reflect gender biases. D’Ippoliti’s blog post with Marcella Corsi and Giulia Zacchia about their work on citations underscores this last point.

The indices also display obvious institutional influences: Coauthors and ideologically close authors cite each other more frequently. Heterodox and minority approaches are automatically disadvantaged or actually wiped out of relevant positions and funding opportunities (a point García Fernández and Suprinyak also make about Brazil). The dominance of the Anglo-Saxon periodicals has the absurd consequence that scholars working elsewhere have little hope of publishing on their own countries’ problems in their countries’ own periodicals. Along similar lines, Matthias Aistleitner, Jakob Kapeller, and Stefan Steinerberger constructed an agent-based model of academic refereeing processes that fall even a little short of being perfectly correct about the quality of papers. The results were striking: With even modest rates of errors, very good papers could readily end up in low-rated journals; top-rated journals accepted poor papers; and the distribution of papers and journals overall moved far from a “rough and ready” approximation to a stratification system based on the quality of publications.

In another INET publication, Alberto Baccini and Giuseppe De Nicolao argue that such distorted systems of evaluation seriously impair both science and democracy. It’s especially problematic when these evaluations are conducted by national, politically-appointed agencies whose arbitrary power allows them to brush off challenges to their unscholarly methods.

Evaluations based on bibliometric metrics favor existing dominant networks. But how do those networks come to life and become dominant in the first place? At Edinburgh, Kevin Young, in a paper coauthored with Lasse Folke Henricksen and Leonard Seabrooke studied the ascent of neoliberal (free market) ideology in economics. Neoliberals from Chicago, they found, did not start out with many more financial grants or career advantages, but stood out starkly with respect to other prominent groups for their internal cohesion and hierarchical structure. As a result, they enjoyed a dense network of internal citations and collaborations. “Social norms of reciprocity and ‘insurgent solidarity’ played an important role in the neoliberal ascent,” they concluded.

Rather than merely chart what is, we also tried to begin a discussion of how things should be. A new, ongoing collection called “Experts on Trial” binds together contributions on the role economists should play in society. It also explores the types of changes our discipline should undertake to overcome the diminished cultural and moral authority of experts. Responses by Amit Bhaduri, Sheila Dow, and Alessandro Roncaglia suggest that economists should become more humble and be prepared to defend their ideas in a democratic arena—but as engaged citizens, not technicians pretending to know better than everyone else.

Also in the collection, Antonella Palumbo and Alex Izurieta double down on the responsibility of the economist. They suggest she should avoid models that blindly validate dominant ideological narratives. A critical, historical, and empirical approach should guide her in a constant dialogue with reality. Izurieta particularly dissects the models used by international organizations, and the appealing and simplistic assumptions which “allow them to survive their own failures.” Last but not least, we are reminded by Alex Molnar that much of the moral authority intellectuals would like to enjoy depends on the openness of the education system that promotes them. As Molnar writes, the policies of the past 35 years have sought to “subordinate the democratic mission of public education to a theory of market-driven economic development and social organization.” The result of this expert-driven process has been to reduce access to quality education across social groups, and to undermine the standing of a key pillar of democracy.

A Return to the Enlightenment

In the spirit of the Enlightenment, which inspired our Edinburgh conference, we would like to close on a hopeful note. Our special lunch session on Adam Smith and the Scottish Enlightenment reminded us all that sympathy is still a powerful force in human relations. Bruce Caldwell, Lynn Parramore, Craig Smith, and Gianni Vaggi accompanied us through the various aspects of Smith and his contemporaries’ thinking. So did Goncalo Fonseca with a contribution for our blog as the conference began. A key idea these contributions emphasized was the openness of Scottish Enlightenment thinkers to the various aspects of reality—including not only economic forces but also politics and human sentiment. Noteworthy (and instructive) were also their capacity to identify trends while remaining alert to counterforces; their awareness of the evils that rising capitalism was imposing on human societies even as it advanced human productive forces; and their skepticism about markets that contrasts strongly with so many of our contemporaries. The way these thinkers defended their opinions in open and truly challenging debates is another practice we feel economics needs to reinstate. This time around, economics must take seriously the contributions of women and others who have traditionally been left out or not heard—an area in which INET, we acknowledge, also needs to do better than it has. A more nuanced economics, freed from old blind spots, and aware of its limits, we hope, would stand a better chance at helping prevent future shocks and crises—and at making room for shared prosperity.

Footnotes

[1] INET has other important programs, including one on macroeconomics directed by Professor Joseph Stiglitz out of Columbia University; the network on Human Capital and Economic Opportunity headed by Professor James Heckman of the University of Chicago and Stephen Durlauf at the University of Wisconsin-Madison; and a project investigating the role of narratives in economics and how “preferences” are formed by contexts and social relations led by George Akerlof. INET also partners with several other major institutions to produce work that appears under their auspices.