Articles

Articles and analyses from the INET community on the key economic questions of our time.

Sex Uncensored

Improvements in data collection create potential for better outcomes for the LGBT community.

Johnson: The Fed is losing its aura of expertise

Past failures, present uncertainty, and a challenging political environment have vastly complicated the central bank’s task, says Institute President Rob Johnson

New Evidence Shows Gender Inequality in Top Incomes

Research by INET grantees Atkinson, Casarico and Voitchovsky shows that women are starkly underrepresented in top earning brackets across a range of different countries

The Private Debt Crisis

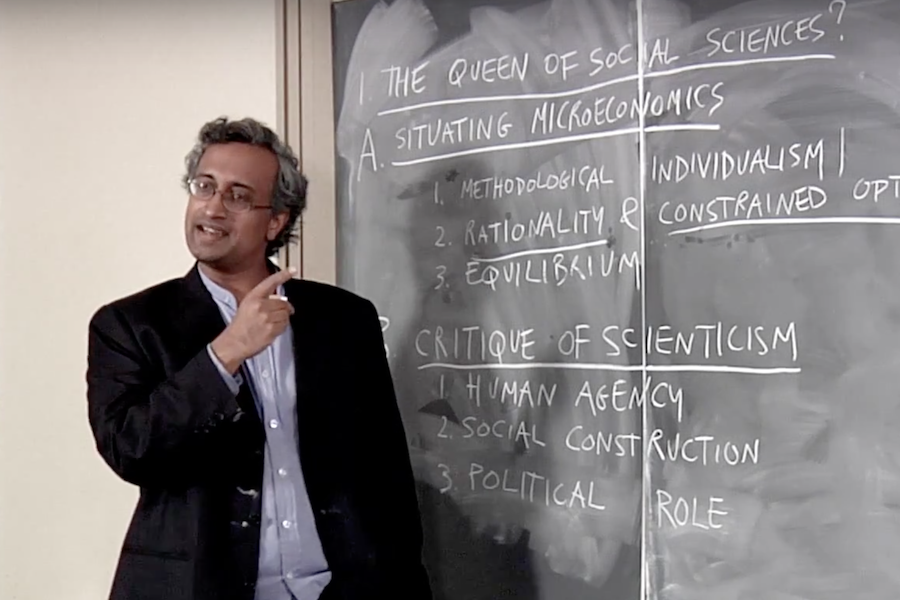

‘Advanced Microeconomics for the Critical Mind’ Returns in October

We are happy to announce that we are offering a second run of the online course which aims to introduce graduate students and interested persons generally to the basic methods and topics of standard microeconomics as taught at the Ph.D. level — with a bit of ‘attitude’!

Who Has Space for Renewables?

Estimated space requirements for solar energy sufficient to power the entire world are reassuringly trivial, at 0.5-1% of global land area. For individual countries however, the challenges vary greatly, reflecting dramatic differences in population density.

Demystifying Monetary Finance

The debate about so-called helicopter money is burdened by deep fears and unnecessary confusions: some worry that monetary finance is bound to produce hyperinflation; others argue that, in terms of increasing demand and inflation, it would be no more effective than current policies. Both cannot be right.

Racial Wealth Gap Won't be Fixed by Education Alone

Renewed attention on America’s stark and growing racial wealth divide requires critical thinking on policy remedies

Minsky's Many Moments

A rejoinder to Michael Grubb, Annela Anger-Kraavi, Igor Bashmakov and Richard Wood

We are grateful to Michael Grubb, Annela Anger-Kraavi, Igor Bashmakov, and Richard Wood for their interesting, empirically rich and structurally insightful commentary on our paper on the production-based and the consumption-based Carbon Kuznets Curve (CKC).

Carbon Decoupling?

A comment on Goher-Ur-Rehman Mir and Servaas Storm’s Carbon Emissions and Economic Growth: Production Based vs Consumption-Based Evidence on Decoupling

The Promise of Regrexit

From Brexit to the Future

The EU is preparing to take a tough line with Britain, in order to deter other member states from following it out of the Union. But it is the neoliberal agenda that has prevailed for last four decades, benefiting only the top 1%, that is fueled voter anger on both sides of the Atlantic.