Articles

Articles and analyses from the INET community on the key economic questions of our time.

The Coming China Crisis

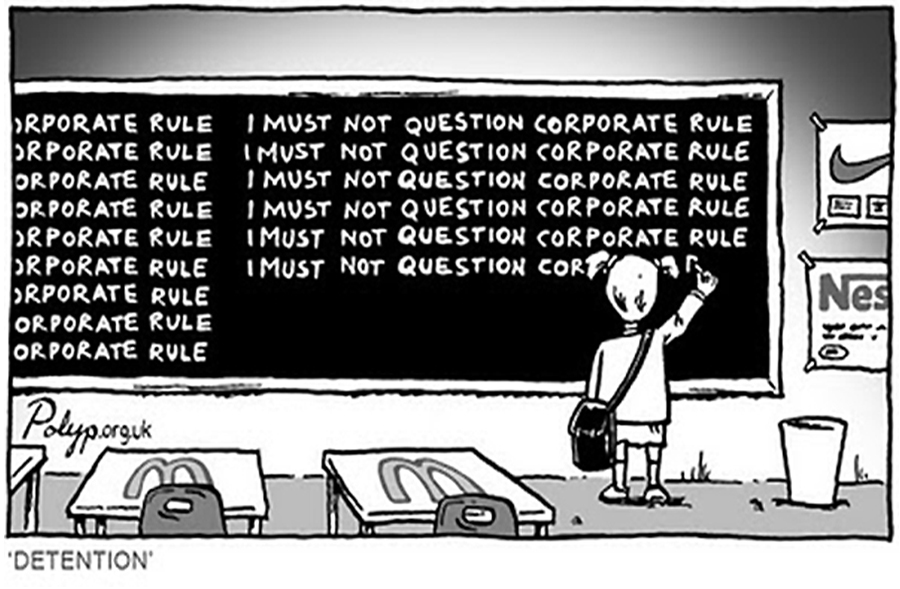

Can Democracy Survive Aggressive Global Capitalism?

Rana Dasgupta shares his view of the contradictions and tensions of India’s economic and political scenes.

Drooping Green Shoots

Paul Krugman on the MIT History

What does Yanis Varoufakis want?

Finding Till Düppe

The Wealthless Recovery

A sparsity based model of bounded rationality

A more realistic version of how people “maximize utility”

Numbers Show Apple Shareholders Have Already Gotten Plenty

Apple should be returning profits to workers who have invested their time and effort into generating its products and to taxpayers who have funded the investments in the physical infrastructure and human knowledge so critical to Apple’s success.

How Financialization Leads To Income Inequality

The paper referenced in this post, “Financialization and U.S. Income Inequality, 1970–2008,” recently was awarded the 2014 Outstanding Article Award from the Inequality, Poverty, and Mobility section of the American Sociological Association.

All Together Now?: Inequality and Growth in US Metro Areas

With the publication of Thomas Piketty’s Capital in the 21st Century, the American public has become increasingly concerned about the scale and impact of inequality in economic life.