Articles

Articles and analyses from the INET community on the key economic questions of our time.

Why American Life Expectancy is Falling Behind Globally, Falling Apart by State

In a discussion with INET’s Lynn Parramore, researcher Steven H. Woolf explains how the peculiar features of life, policy, and economics in America are killing us sooner, and what we can do to change it. *This is Part 1 of a two-part interview.

Red Tech and American Politics: Nick French Interviews Thomas Ferguson

Venture-backed “tech capital” is reshaping U.S. politics through campaign finance, platform gatekeeping, defense/AI procurement, and policy entrepreneurship. In an interview with Nick French, INET’s Research Director Thomas Ferguson discusses these channels of influence, examining their macro-distributional consequences, and outlining guardrails to restore democratic accountability and broadly shared gains.

Hungry for Development: The leadership of the Global South from G20 to COP30

Since 2007, recurring food-price spikes reveal hunger as a problem of market design and underinvestment, not scarcity. With Brazil’s COP30 on the horizon, aligning climate commitments with food systems could cement policy space to manage markets and advance the right to food.

Bretton Woods: A System That Can’t Be Fixed—But Can Be Made Fairer and More Effective

The IMF and World Bank can no longer function as instruments that discipline some member countries while deferring to others. Their challenge is to transform the exercise of power among member countries into a framework of mutual respect and cooperation.

Time Bomb: How Uninsured Stablecoins and Crypto Derivatives Threaten Financial and Economic Stability

The GENIUS Act is a disastrous law that poses grave and unacceptable threats to our financial and economic future. Congress must remove those threats by (1) repealing the GENIUS Act and passing legislation that requires all stablecoin providers to be FDIC-insured banks, and (2) adopting legislation that requires all crypto derivatives to comply with the rules governing non-digital derivatives under Title VII of the Dodd-Frank Act.

Jim Chanos on Crypto, AI, and Casino Capitalism

The famed short-seller reminds us that technology might advance, but we’re still a pretty predictable bunch of apes.

Uneven Development Without Social Relations—The Trouble with Nievas and Piketty’s Unequal Exchange

Why do market-centric fixes for “unequal exchange” fall short? Sidelining social relations and production power turns colonialism into a pricing problem—and hides the mechanisms that keep uneven development in place.

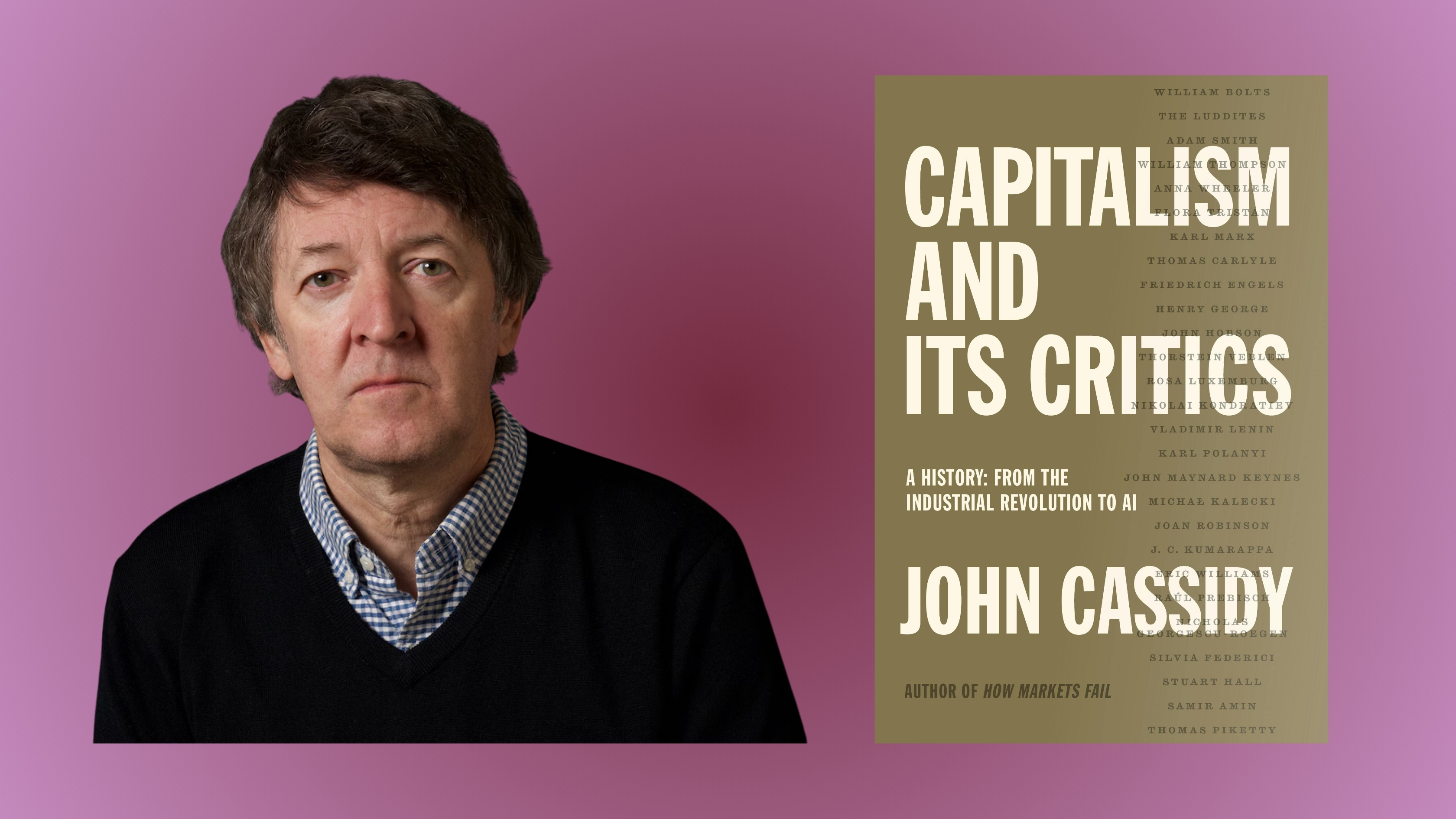

What’s Next for Capitalism — Reinvention or Authoritarian Rule?

In Capitalism and Its Critics, New Yorker writer John Cassidy brings to life the figures who warned of monopoly power, inequality, environmental peril, and authoritarianism—forces still at work today. He discusses his book with Lynn Parramore.

Tariff Turmoil and the Money Markets: Single Payer Insurance to the Rescue

In Treasury markets, there are no libertarians, only grateful recipients of single-payer insurance for ailing financial markets.

“Founders Would Be Horrified”: Renowned Historian Drops Truth-Bomb on American Revolution and Lessons for Today

Professor Marc Egnal of York University joins the Institute for New Economic Thinking’s Lynn Parramore to explore why historians cling to an inaccurate and misleading narrative, and what we can learn from the real history about tyranny, checks and balances, imperialism — and resistance.