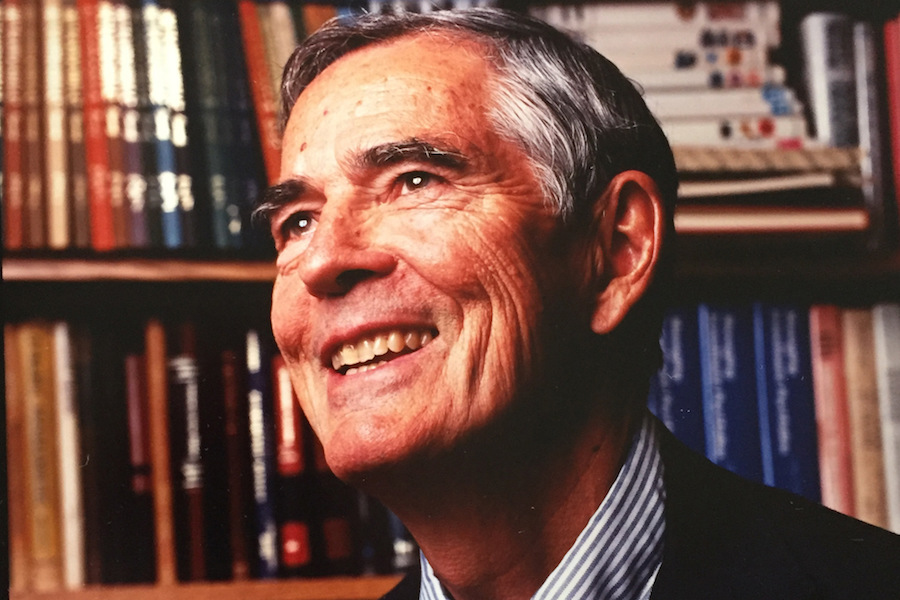

Perry G. Mehrling is professor of economics at Pardee School of Global Studies at Boston University. He was professor of economics at Barnard College in New York City for 30 years. There, he taught courses on the economics of money and banking, the history of money and finance, and the financial dimensions of the U.S. retirement, health, and education systems. His most recent book is The New Lombard Street: How the Fed became the dealer of last resort (Princeton 2011). His best-known book Fischer Black and the Revolutionary Idea of Finance (Wiley 2005, 2012) has recently been released in a revised paperback edition. Currently, Prof. Mehrling directs the educational initiatives of the Institute for New Economic Thinking, one of which is his course Economics of Money and Banking, available on Coursera at www.coursera.org/course/money.

Perry G. Mehrling

By this expert

Financialization and its Discontents

Focusing on what money really is – whether gold or state fiat – shifts attention away from what credit really is, which is to say away from the center of discontent.

Channeling Charles Kindleberger on Brexit

The economic historian would have seen the British vote to leave the European Union as part of a larger drama of centralization versus pluralism

The Bank for International Settlements Looks Through the Financial Cycle

The BIS offers a comprehensive picture of the state of the world economy, and of dysfunctional policies holding it back

In Memoriam, Jack Treynor

Remarks at a memorial service for pioneering financial analyst Jack Treynor Memorial, MIT Chapel, June 19, 2016

Featuring this expert

Making Finance Work for Innovation

How can we get the financial sector back to serving its intended function?

Playing with the History of Economics

How to become a historian of economic thought? Members of the profession gather just once a year at the annual conference of the History of Economic Society but otherwise are dispersed in universities and archives all around the world.

Piero Sraffa's Price Theory Without Equilibrium

Piero Sraffa’s classic work Production of Commodities by Means of Commodities has been variously interpreted as a special case of modern neoclassical general equilibrium or a foundation stone for the revival of the classical tradition of Smith and Ricardo.

The Next Economic Frontier and the Wild World of Non-Rational Expectations

One of the fundamental ideas of modern economics — that people have rational expectations, an unbiased, statistically correct view of the future — is, in reality, a simple hypothesis.