Lance Taylor provides a second and final response to Andrew Smithers’ criticism of his working paper on the role of the “Global Savings Glut”

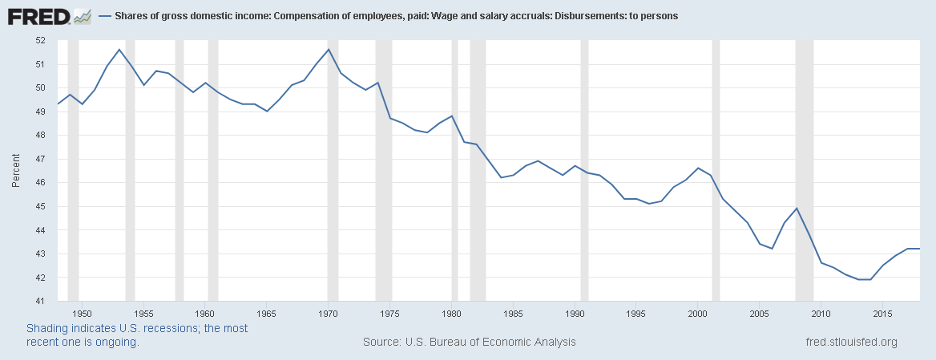

For half a century the American economy has gone through traumatic restructuring – the opening of a yawning current account deficit, hollowing out of production and employment, and a falling share of payments to labor in domestic income. The take-home wage share of gross domestic income (GDI) typically lags rising output in a business cycle upswing (real wages increase and productivity growth slows) but the general trend is down. The share is now around 43%, dropping from 52% in 1970. See the diagram.

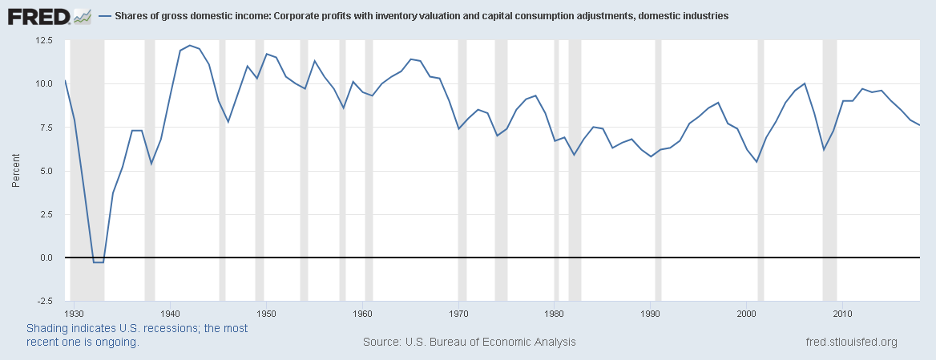

In my “Savings glut…” paper, I used profit trends to illustrate the secular fall in the labor share. In his comments, Andrew Smithers seized on measures of profits, but that was not the key point that requires elucidation. For a business, profits are a residual, equaling revenues minus costs. This observation carries over to the national income and product accounts constructed by the US Bureau of Economic Analysis (BEA). It makes sense to look at how shaky the BEA estimates of profits really are.

GDI summarizes the costs of production to meet aggregate demand for goods and services, or gross domestic product (GDP). Aside from wages, 2018 shares of other items in GDI included supplements to labor income for insurance, pension funds, etc. (10%); proprietors’ earnings (8%); and rental income of persons (4%, mostly imputed rent including depreciation on owner-occupied housing – a standard fixture in national accounts).[1]

Households thus accounted for 68% of GDI. Of the remaining 32%, indirect taxes amounted to 7% and there were other entries including interest (4%) and depreciation of government capital (3%), leaving 18% for corporate profits including depreciation (estimated at 9%). Net profits before taxes and financial transfers thus amounted to 8% of GDI. With business and government depreciation and imputed rent being estimated to be consistent with observable payments flows, the precision of the net profits numbers is open to question, but the story they tell is consistent with wage repression.

Here is the picture over time, with a downward trend as profits swing up after recession and then drop off.

John Hicks was a great economist, and Smithers’s preference for:

net profits divided by net domestic income

as the proper estimate of the profit share instead of:

gross profits divided by gross domestic income

is consistent with Hicks. Regardless, many analysts prefer to work with profits gross of depreciation because the numbers are bound to be imprecise.

The profit share based on net flows would be a bit smaller (and the wage share a bit larger) than in the other case but trends would be similar.[2] In any case, fine points about profit shares are not really what my work is analyzing or something that can tell us very much about actual wage shares which are based on observations of market outputs, wages, and employment. There is an obvious, undeniable fall in the wage share since the seventies.

Notes:

[1] These numbers are obviously subject to round-off error; “minor” payments flows in the range of $100 billion per year are not being considered.

[2] Smithers’ “reversion to mean” for the ratio of net flows is based on sparse data at the end of the sample, and should be explored with more thorough statistical analysis.