ProMarket and the Consumer Welfare Standard

An output increase is not sufficient to increase welfare. Allocation—how goods are distributed—matters.

A central aim of Neoliberalism was to dismantle the antitrust regime put in place after World War II whose central goal was to protect democracy, small business, local control, and to prevent transfers of income from labor to large corporations with market power. The principal mechanism for limiting antitrust enforcement was the Consumer Welfare Standard popularized by Judge Bork and University of Chicago economists. The Consumer Welfare Standard restricts antitrust goals to preventing decreases in consumer surplus. In practice, this means the goal of antitrust is solely to increase output. The justification rested on an outdated and flawed theory that human welfare was advanced by more output alone, a theory that virtually every welfare economist has since abandoned, and one that only survives in some dusty industrial organization textbooks. The theory is defective because it ignores distribution: in the antitrust world, a dollar transferred from labor to a monopolist has no welfare implications. We have written several papers published by INET and professional journals about how fallacious this approach is.1 The response from Chicago partisans, not surprisingly, has been to ignore the issue.

Then we submitted a two-page blog to ProMarket, a publication of the University of Chicago’s Stigler Center, housed in the Booth School of Business. Our two-page blog demonstrated that even in the most general neoclassical model, an output increase is not sufficient to increase welfare. Allocation—how goods are distributed—matters.

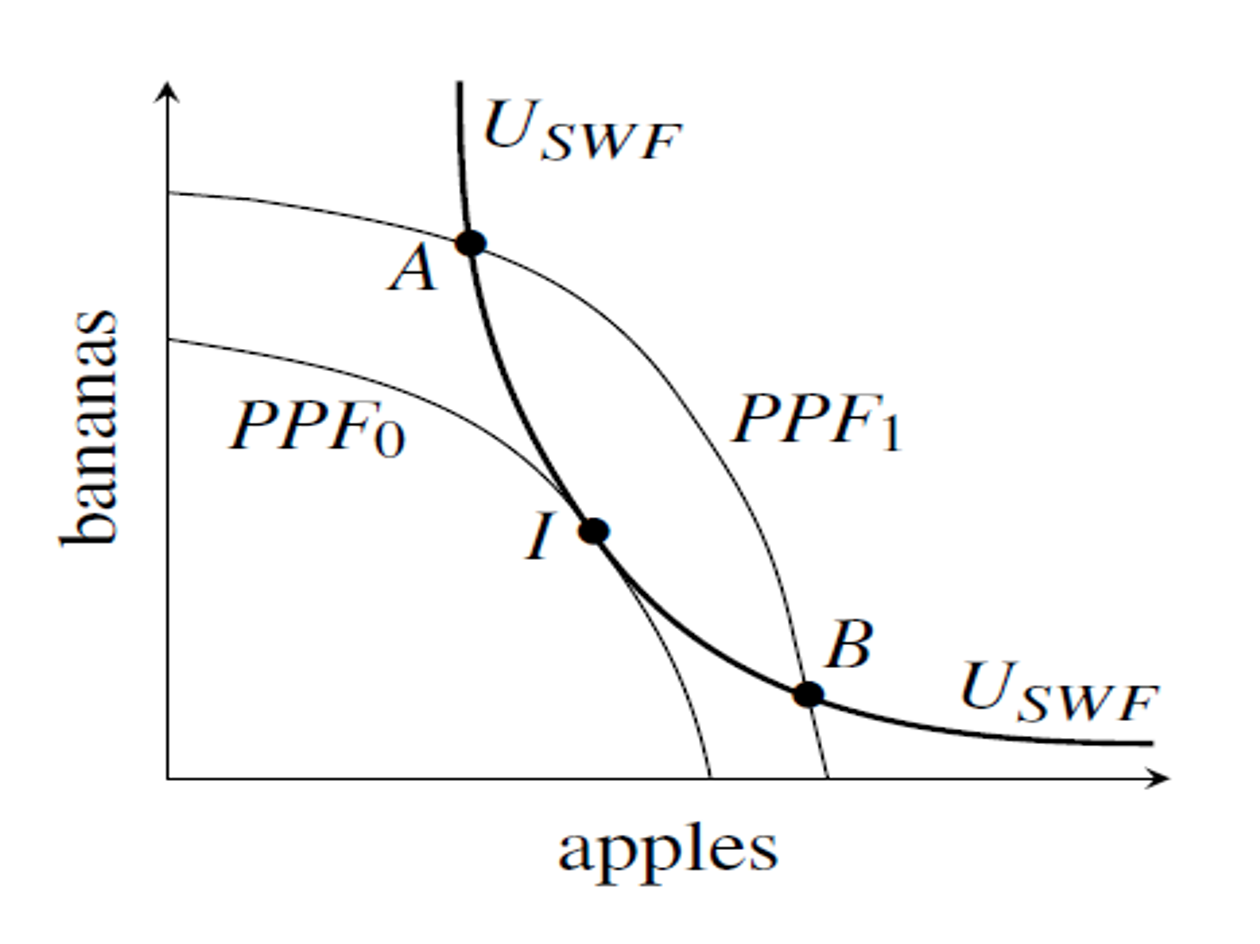

Our original post started with a production possibility frontier (PPF) and a social welfare function. The figure showed an outward shift of the PPF, an output increase. If there is no additional step of optimizing allocation, points below B or to the left of A would represent a decrease of social welfare.

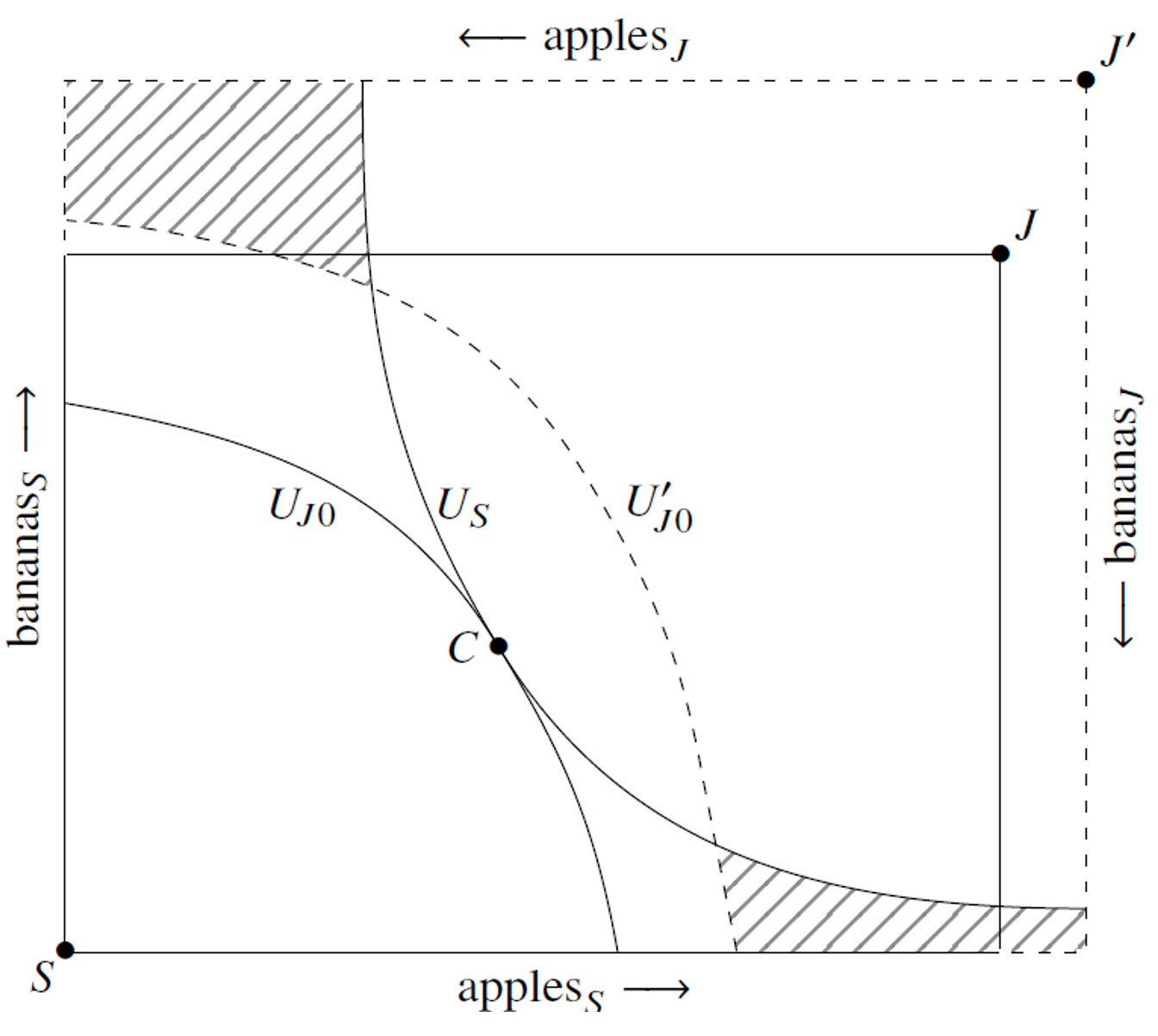

We next offered an Edgeworth Box example, which makes the same point if no social welfare function is defined.

The point of this figure is to show that an increase in output can decrease the individual utility of every person if output is allocated in certain ways.

ProMarket accepted the post and published it. But then something strange happened. An anonymous board member demanded to Editorial Board member Professor Luigi Zingales that it be retracted. At first, we were told our proof was wrong because if you fully optimize and welfare only depends on consumption and all the Arrow-Debreu assumptions are in place, then welfare increases. That one can pile assumptions on top of each other enough to increase welfare is obviously true but beside the point. The response actually implicitly proves our point – that output alone is insufficient.

We responded that whoever had complained should write a signed blog post critiquing our post. We also offered another version of the graphs in which there was no optimizing in the initial position, together with corresponding textual revisions; the conclusions were unchanged. ProMarket staff informed us that while they were prepared to post it as an update to our piece, alas Professor Zingales still felt it was not enough to have a proof that simply shows a possibility.2 Staff asked if we would like to withdraw the piece despite it being already published.

We declined. We then received an email from Professor Zingales. It stated that the original graphs didn’t have an equilibrium and that if the social welfare function is maximized then the proof doesn’t hold. Done right, output alone does increase welfare. Therefore, the proof is wrong.

What followed was a phone call with Professor Zingales and two of the authors. Zingales conceded that the point was in fact a correct description of the feasible set, but insisted that a description of the feasible set, without a full-fledged behavioral model that would specify exactly where on the feasible set the economy would end up, was not worth publishing.

The retraction was carried out with the following unsigned note to readers. We agreed to the language, as we were concerned that ProMarket would put a retraction notice out there that would injure our reputation. That would cause us to pursue litigation. The language reads:

“ProMarket published the article “The Antitrust Output Goal Cannot Measure Welfare.” The main claim of the article was that “a shift out in a production possibility frontier does not necessarily increase welfare, as assessed by a social welfare function.” The published version was unclear on whether the theorem contained in the article was a statement about an equilibrium outcome or a mere existence claim, regardless of the possibility that this outcome might occur in equilibrium. When we asked the authors to clarify, they stated that their claim regarded only the existence of such points, not their occurrence in equilibrium. After this clarification, ProMarket decided that the article was uninteresting and withdrew its publication.”

A recognition that output increases alone do not increase welfare is interesting, outside of the University of Chicago. It reveals that the opposite contention, which is a central tenet of the Consumer Welfare Standard, crucially depends on very particular modeling and equilibrium assumptions, because without those assumptions, increasing output may fail to raise welfare. The Consumer Welfare Standard is an important obstacle holding back antitrust policy from progressive reform. Many progressive economists have made the case that increased market power has caused irreputable harm to the economy and to the social fabric of the United States. For example, Professor Joseph Stiglitz has written on the importance of allocation. He states: “A closer look at those at the top reveals a disproportionate role for rent-seeking: some have obtained their wealth by exercising monopoly power…” Similarly, Thomas Philippon has demonstrated that increasing wealth inequality decreases reinvestment. Among non-mainstream economists that Chicago routinely ignores, Brett Christophers has documented an increased concentration of assets into the hands of a few, the rentier class.

Some ProMarket contributors have questioned the removal of our piece. Professor Herbert Hovenkamp questioned why the piece was removed when others have made similar points. As Professor Steve Salop noted, the second set of graphs we submitted should have taken care of any problem ProMarket had with the piece.

All of us know from Carl Sandberg that Chicago is a city of big shoulders. Its eponymous economics school has no business shrugging off so central a point. Of course, our conclusion is important, which is why ProMarket initially published it. The claim that it is of no interest is transparently a desperate effort to shore up a doctrine that is now collapsing.

The full piece is available at The Sling.

Notes

See, e.g., Mark Glick and Darren Bush, “The Chicago School, The Post Chicago School and The Neo Brandeisian Schools of Antitrust in Light of Modern Economics,” available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4417509. Mark Glick, Gabriel Lozada, and Darren Bush, “Why Economists Should Support Populist Antitrust Goals” 2023 Utah L. Rev. 769. Mark Glick and Gabriel Lozada, “The Erroneous Foundations of Law & Economics,” available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3812839; and Darren Bush and Mark Glick, Breaking up Consumer Welfare’s Antitrust Policy Monopoly, 56 Suffolk L. Rev. 203 (2023).

This is a close paraphrase of the communication we received, including the regretful “alas.” We would be very happy if ProMarket released its side of the correspondence to the public.