What Strategies can Break This Dependency?

The dollar system has proven resilient in the face of recent extreme and unexpected shocks, but it has also failed to foster sustainable growth and prosperity. Can it survive its contradictions? Evidence from the latest Trade and Development Report of UNCTAD suggests better South-South and commodity producers-consumers agreements are needed, on the way to a more inclusive international monetary system.

In a climate of fiscal austerity, unconventional monetary policy has been at the forefront of macroeconomic stabilization efforts since 2008, with the beginning of the Federal Reserve’s quantitative easing (QE) programs. At the time, when the fiscal channel dried up (after a short-lived stimulus) but growth and inflation remained low, developed countries relied on large purchases of bonds and other securities by their central monetary authorities to support long-term credit creation while maintaining the smooth functioning of the money markets.

Within a few years, all major central banks developed their own QE programs, sometimes exceeding the Fed’s both in value and as a share of GDP. Nonetheless, the role of the Fed has remained crucial since dollar-denominated liabilities held by entities outside the United States and the trades necessary to fund them have become even more prominent in the past decade: “US dollar funding remains below its peak of a decade ago relative to the size of the global economy, despite having grown in nominal terms. However, the share of international funding that is denominated in US dollars has risen compared with other major international currencies, reaching levels last seen in the early 2000s and making it the dominant international funding currency” (Committee on the Global Financial System, 2020, p. 1; see also Lysandrou and Nesvetailova 2022).

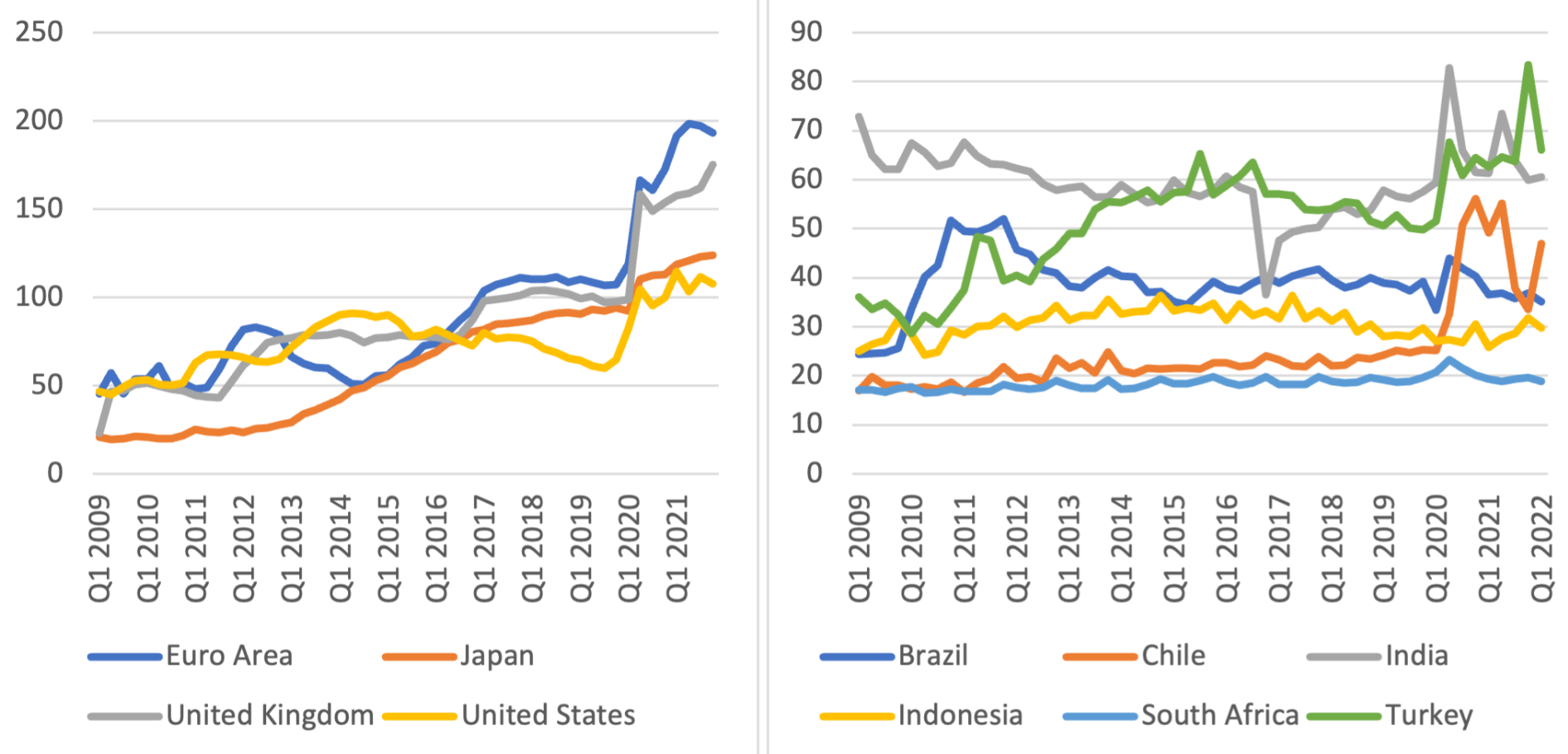

Figure 1 Monetary base (% of GDP), selected developed and developing countries.

Sources: UNCTAD 2022, data from IMF, International Financial Statistics, Monetary and Financial Accounts.

As a result, as explained in UNCTAD’s 2022 Trade and Development Report, the Fed’s decisions reverberate globally via at least three channels.

First, it is able to affect liquidity in key domestic and international markets. In particular, through swaps and repurchase agreements (repos) of various collateral from private domestic and public foreign entities, it has repeatedly been able to prevent money market freezes, at least in the core of the global financial system. However, it has been far less efficient in disciplining cyclical expansions of global finance in the context of international capital mobility.

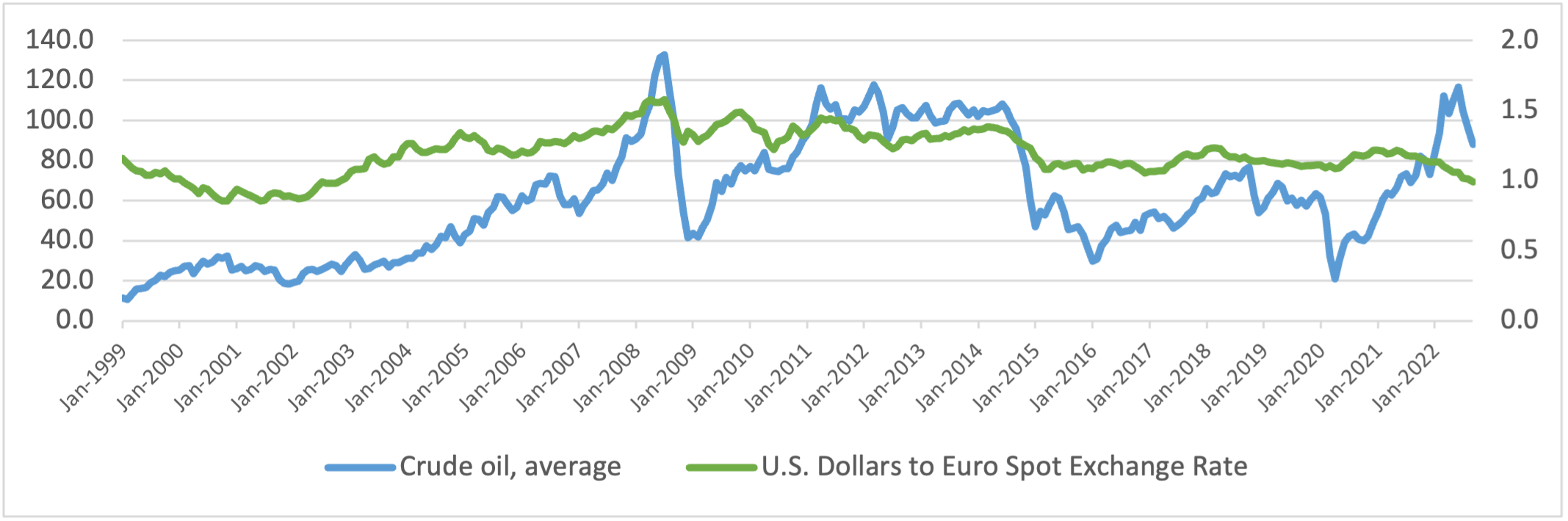

Second, it affects the value of the dollar and, thus, the price of imports and exports domestically and abroad. It ensures that it provides a floor for interest rates in other regions which cannot allow their currencies to depreciate too much against the dollar to avoid over-exposure of their balance sheets to dollar-denominated debt (Moreno Brid et al. 2022). From the early 2000s until 2021, oil price movements provided a mitigating factor, thanks to their negative correlation with the US dollar.

Figure 2 Dollar-euro exchange rate and crude oil price, January 1999–September 2022

Sources: UNCTAD 2022, data from World Bank and Federal Reserve Bank St. Louis

Third, it affects US growth and private demand, including imports, thus affecting global growth. During the Covid-19 crisis, the Fed’s accommodative stance and its activity in the international repo markets prevented extreme stress in the global money markets and allowed central banks of developing countries to reduce interest rates quite significantly. Indeed, while in many cases they themselves engaged in asset purchases, it was mostly to control liquidity risk rather than to provide stimulus, which was predominantly supplied in the form of loans, including to public banks (Aguilar and Cantù, 2021).

Finance First

As soon as the US economy started emerging from the crisis and the Fed signaled its intention to raise interest rates in May 2021, the favorable conditions just mentioned reversed, forcing interest rate increases in many developing countries, especially those most exposed to dollar-denominated debt.

The announcement of May 2021 was followed by a crucial decision to make two standing repo facilities, which had been functioning in a temporary mode for some months, permanent: one dedicated to United States domestic primary dealers and soon to include additional depository institutions (Standing Repo Facility), and one for foreign and international monetary authorities (FIMA repo facility). The move showed that the Fed’s commitment to global financial stability remains unchanged (Mehrling, 2022). That, together with the preparations for such eventualities by the central banks of many emerging economies, has so far prevented a repeat of the 2013 taper tantrum.

But, as argued in the Report, the impact on the real economy cannot be stopped. With fiscal policy heading towards austerity, with crude oil and gas still at elevated prices, the increased cost of credit is going to affect the most fragile sectors and regions of the world economy through reduced investment, wages and employment growth, and liquidity stress, hitting hard the unemployed and low and medium wage earners everywhere, as well as firms and governments with elevated external debt in developing countries (UNCTAD 2022).

Hence, while central bankers in the core of the international system focus pragmatically on avoiding short-term systemic instability, the real economy deteriorates, a fact that is increasingly overlooked by policymakers. What is particularly worrisome is that the commodity price rally initially followed expectations of a global growth rebound, but when the Fed’s moves, coupled with fiscal austerity and new international supply-chain disruptions, changed the economic scenario, many financial markets remained buoyant. The world was denied its economic recovery while speculators continued profiting.

A clarification is needed, here: The Fed claims policy normalization is aimed at reducing inflation. But, to be more precise, its policy levers operate indirectly, ideally affecting prices by subduing the bubble in commodity markets as well as GDP growth, thus preventing higher import and energy costs from spreading through to wages. However, the Fed does not have a monopoly on liquidity creation: private financial institutions matter too. Moreover, large dollar reserves held abroad can and have been mobilized. What matters, eventually, is that the Fed is stuck as a lender/dealer of last resort.

The Covid-19 economic crisis reinforced again the Fed’s position at the vertex of the global financial and monetary system. Within that context, its main concern is financial stability, and thus its activity focuses pragmatically on those markets that appear to be systemically relevant. As a result, liquidity is not guaranteed everywhere, and pockets of gluts and scarcity persist (Eren et al., 2020) and could widen. This is particularly true during a monetary tightening, but periods of financial expansion are not free from peril, especially for emerging markets that can attract disruptively large speculative inflows of capital. The various strategies implemented to protect themselves have included accumulating reserves and developing swap agreements between central banks that integrate, in an uncoordinated way, the Fed’s channels. The central bank of China and associated development banks have played an important role in this context, largely by increasing their lending capacity (UNCTAD 2022).

This dollarized financial system has recently proven resilient to extreme and unexpected shocks, but it has also failed to promote sustainable growth and prosperity. The pragmatism of the central bankers, who are forced to safeguard the financial stability of an unequal and stagnant economy, is not free from dangerous consequences. Its success can buy the world some time, but it also inevitably intensifies the unsound separation of the financial and real economy and of liquidity and solvency concerns. This inconsistency became especially evident in 2021 when speculative and oligopolistic increases in prices appeared even as economies remained below their pre-Covid levels, triggering the premature tightening. For all the pragmatism of its managers, the inadequacy of its underlying vision makes the global dollar system vulnerable to growing political stress.

For a Few Dollars Less: Towards a More Inclusive International Monetary System

The current crisis is signaling clearly an alternative direction, which requires some degree of de-linking from the global financial cycle while relying on more patient capital funding that reconnects credit with development (UNCTAD 2005; 2022). Similarly, economic models that assign complete control of price formation to speculative markets have proven particularly vulnerable and incapable of inducing sound investment strategies. As detailed in the Report, that is quite evidently the case for energy markets, which in many countries joins the worst of two models: the shadiness of price negotiations in concentrated markets, coupled with the risk of boom-bust dynamics, due to sudden shifts in the prevailing conventions and expectations. Indeed, this system, to which we should add the privatization and liberalization of national distribution networks in all developed countries, has produced alternating episodes of very low and very high prices (UNCTAD 2011, 2022). This instability is not favorable for most producers, especially smaller ones and those based in developing countries, or for consumers, and has damaging long-run consequences, the more so as the energy sector has to play a pivotal role in climate change mitigation planning (UNCTAD 2022, ch. III). It is, instead, highly profitable for speculative trading companies and vertically integrated giants.

The end of the commodity super-cycle in 2014, for instance, marked the beginning of a period of extremely low prices for oil. A game changer was the lifting of the ban on United States oil export in 2015 and the normalization of the relations between the United States and Saudi Arabia. The price recovered for a few years until 2020, when it dropped dramatically, partly because of a fall in demand and partly because of the failure of producers to agree on a cut in production. Production actually increased, and prices of some crudes even went below zero, with the market in deep contango (i.e. future prices were much higher than spot prices) with companies running out of storage space and resorting to floating storage (Fattouh, 2021). This period was financially debilitating for many producers – and this explains partly their reluctance to engage in further production as prices started their climb in 2021.

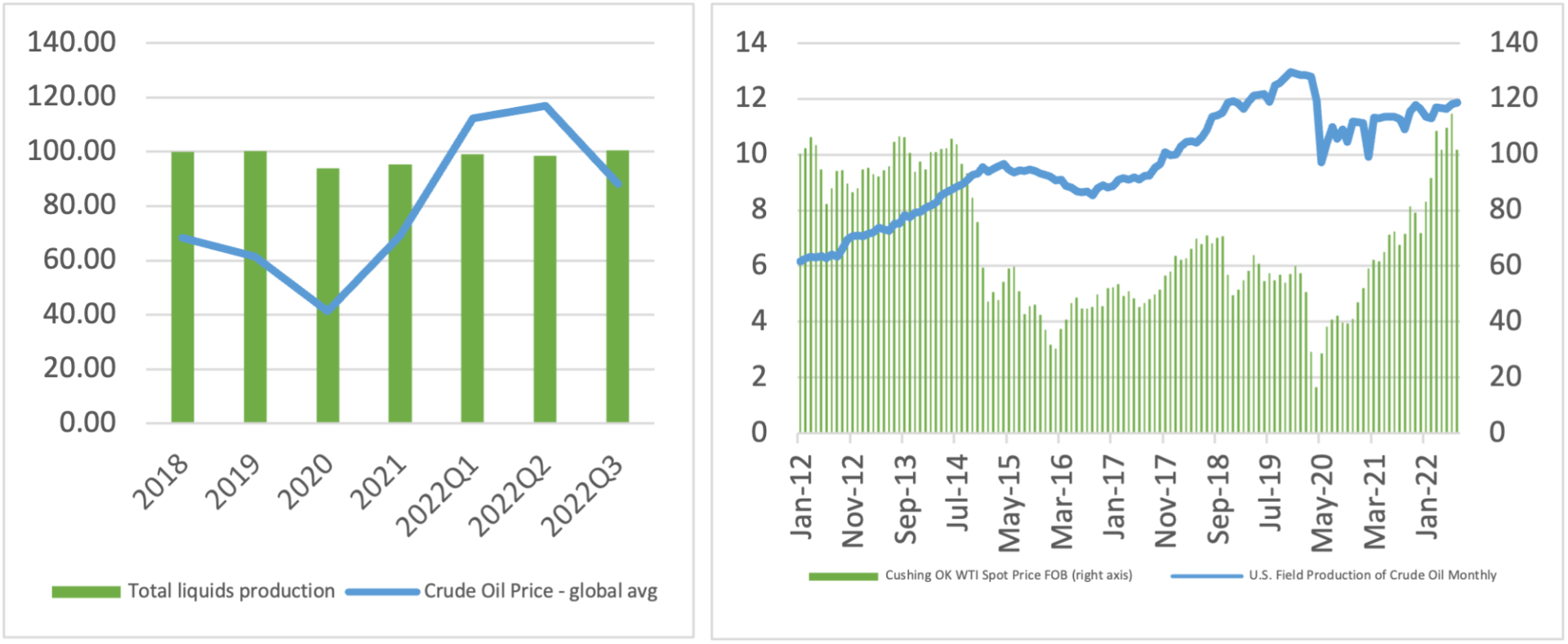

Figure 3 Global and US crude oil production (million barrels per day) and crude oil prices (dollars per barrel).

Source: UNCTAD 2022, data from OPEC, World Bank and U.S. Energy Information Administration.

Large state producers, such as Saudi Arabia, Qatar, and Russia, are often accused of strategically holding onto reserves or production. However, as UNCTAD’s Trade and Development Report clarifies, the de-centralized shale oil sector in the United States appears to be equally hesitant to increase production when prices increase, citing Wall Street investors’ pressure as the main reason (figure 3, McCormick, 2022, UNCTAD 2022).

Clearly, thus, it is urgent to establish a more sensible regulation of energy markets, including making explicit plans for the reduction of fossil fuel consumption. It is crucial that those plans be made together with producers to avoid taking advantage of periods of extremely low prices to leverage a power that disappears as soon as the price trend reverses. That should go hand in hand with an intensification of international cooperation to support global liquidity, public investments for development, adaptation, and mitigation of climate change (UNCTAD 2019, 2022, Gallagher and Kozul-Wright 2021).

As is often the case, the idea is not new. “Between the 1940s and the 1950s, some prominent economists were called upon by international institutions to contribute to [a very similar] debate including: John Galbraith, Nicholas Kaldor, Albert Hart, Mordecai Ezekiel, Gerda Blau, Jan Tinbergen, Richard Kahn, James Angell, and Colin Clark. Among the most active institutions, a major role was played by the United Nations through the Economic and Social Council (ECOSOC) and the Food and Agriculture Organization (FAO), which promoted some of the boldest plans in this field.” (Paesani and Rosselli 2014) From that period, particularly famous has remained Nicholas Kaldor’s plan, later elaborated by A.G. Hart and J. Tinbergen, for a commodity-based reserve currency to stabilize prices and the trade cycle. The plan was presented at the first UNCTAD conference in 1964 and involved an encompassing reform of the international monetary system through the establishment of an international reserve currency backed by a multi-commodity buffer-stock.

Back from Geneva, “Kaldor informed Hart that the first world countries were striving to keep all monetary matters out of UNCTAD, including [his own plan]. The developing countries, on the other hand, were trying to form an expert group on commodity and currency problems that was to report back to UNCTAD and ECOSOC” (Paesani and Rosselli 2014).

Indeed, already in 1954, Gerda Blau, the Chief of the Commodity branch at FAO, was quite lucid about the political challenge faced by those kinds of projects involving a multilateral reconsideration of the monetary and trade system, arguing that “any agreement between consumers and producers would be successful only if both parties perceived it as a sort of contract of mutual insurance against the same risk. This was the case of price volatility […] but not the case of long-term declining trend in the terms of trade between industrial and agricultural products” (Blau 1954, cited in Paesani and Rosselli 2014) and of the related international monetary reform needed to face it. Blau herself favored, for pragmatic reasons, a commodity-by-commodity approach, coupled with compensatory finance (Fantacci et al. 2012).

Some 70 years later, we might indeed be facing a window of opportunity for more regional, South-South, and sector-specific agreements to regulate commodity prices to see the light of day. Developed countries need to realize quickly that stability in these essential markets as well as monetary coordination are also to their advantage.

Note

The views expressed here are the author’s only.

References

Aguilar A and C Cantù (2021). Monetary policy response in emerging market economies: why was it different this time? BIS Bulletin, No. 32, p. 9.

Committee on the Global Financial System (2020). US Dollar Funding: An International Perspective. Report prepared by a Working Group chaired by Sally Davies and Christopher Kent. Committee on the Global Financial System (CGFS) Papers No. 65.

Eren E, A Schrimpf and V. Sushko (2020). US dollar funding markets during the Covid-19 crisis: the international dimension. BIS Bulletin No. 14. Bank for International Settlements. Available at https://www.bis.org/publ/bisbu… (accessed 16 August 2022).

Fantacci, L., Marcuzzo, M. C., Rosselli, A., & Sanfilippo, E. (2012). Speculation and buffer stocks: the legacy of Keynes and Kahn. The European journal of the history of economic thought, 19(3), 453-473.

Fattouh B (2021). Saudi oil policy: continuity and change in the era of the energy transition. Oxford Institute for Energy Studies Working Paper 81.

Gallagher, K. P., and R. Kozul-Wright. (2021) The Case for a New Bretton Woods. New York: John Wiley & Sons.

Lysandrou, P., and A. Nesvetailova (2022). Why the Ukraine crisis will make little difference to dollar supremacy. Institute for New Economic Thinking. Available at https://www.ineteconomics.org/perspectives/blog/why-the-ukraine-crisis-will-make-little-difference-to-dollar-supremacy (accessed 1 August 2022).

McCormick M (2022). US oil producers ignore Biden’s rallying call to drill. Financial Times, 11 June.

Mehrling P (2022). A money view of international lender of last resort. Jahrbuch fur Wirtschaftsgeschichte, vol. 63, No. 2, pp. 1–16.

Moreno-Brid JC, L Nalin and E Pérez-Medina (2022). External challenges to the economic expansion of emerging markets in the post-Covid-19 and post-COP26 era: a balance-of-payments constrained growth (BPCG) perspective. UNCTAD Background Paper.

Paesani, P., and Rosselli, A. (2014). The case for a supra-national control on commodities in the post-WWII world: novel perspectives from FAO and Kaldor archives. The case for a supra-national control on commodities in the post-WWII World: novel perspectives from FAO and Kaldor Archives, History of Economic Thought and Policy, vol. 2014, No. 1, pp. 5-30.

UNCTAD (2011). Trade and Development Report: Post-crisis policy challenges in the world economy. United Nations Publication.

UNCTAD (2019). Trade and Development Report 2019: Financing a Global Green New Deal. United Nations Publication.

UNCTAD (2022). Trade and Development Report 2022: Development prospects in a fractured world: Global disorder and regional responses. United Nations Publication