November 9 is not a dull day in economic history. On November 9, 1494 a banking family (the Medici of lore) became the rulers of Florence, sponsoring the economic innovations that gave the world modern international trade and finance. On the same date in 1989, the East German government opened the Berlin Wall, in a bow to the popular repudiation of Soviet socialism — a moment that, in retrospect, would also be read as the apex of the neoliberal counterrevolution in economics that began with the collapse of the Bretton Woods system in the early 1970s.

The most recent November 9 of historical significance came just weeks ago, when the doors of the White House swung open to Donald Trump. This is a moment that augurs unprecedented uncertainty for the future shape of the neoliberal market order, because Trump will be the first President of the United States in more than half a century whose Reaganite tax cuts and pro-deregulation views are accompanied by promises of return to protectionism. Will this be yet another iteration of nationalist neoliberalism, or the beginning of the end for this globally dominant approach to governance?

Talk was rife after the 2008 crisis about the meltdown of US-led global neoliberalism as an intellectual movement or policy regime, and the potential embrace of alternatives in Washington. However, not only were these expectations dashed soon afterwards; they were also confronted with a rude awakening, especially in Europe, to the renewed politics of austerity, privatization and further weakening of what remained of labor-market institutions. It is perhaps too early to say if this time will be different. What we could clarify, however, is the confusion over what exactly we mean by neoliberalism, and the reasons for its remarkable diversity and resilience to date.

What is neoliberalism?

What many observers have in mind when they anticipate the demise of neoliberalism at the hands of Viktor Orban, Donald Trump and Marie Le Pen is a definition of market fundamentalism or some idealized version of neoclassical economics imbued with anti-government fervor. In a recent book, I show that this widespread view is flawed. Whether we focus on neoliberalism as a purely economic doctrine or as a set of practices (policies, institutions, programs), real-existing neoliberalism is a set of social facts that should not be conflated with either purist pro-market ideology or neoclassical economics, a much broader corpus of economic ideas.

A raft of scholarship has demonstrated that far from being an intellectually purist paradigm, neoliberalism is a hybrid set of ideas and institutions that can coexist — albeit uneasily — with a range of very different political projects (from liberal-democracy to political Islam) and economic approaches (from Chinese planning to Scandinavian welfare state). We know much less, however, about when a hybrid ceases to be a neoliberal hybrid, and how we should think about the policy implications of that hybridity. Also, neoclassical economics was used by very different political projects, from market socialism to neoliberalism.

Peter A. Hall and Mark Blyth come in handy, here, with their Kuhnian argument that a policy paradigm is as good as its core of key goals. The rest (the policy instruments and the policy settings) can be tinkered with. The significance of this insight, here, is that if we look at the theories that constitute neoliberal economics, from New Classical macro, New Growth theory to the New Neoclassical Synthesis, we note that they all solve economic policy trade offs in favor of the three main goals: (1) trade and

The “editing” of neoliberal scripts can be explained by the role of popular protest, interest group and electoral strategy. It is commonplace to argue that these forms of politics can prevent some neoliberal ideas from being implemented as policies. Yet, the specific form that neoliberalism takes among dominant policy elites in a certain country over time can only be explained if we look at the economic ideas embraced by the policymakers by virtue of their training or other forms of professional socialization before such potent forms of politics kicked in.

Why hybridity matters

Consider contemporary scholarship in macroeconomics: Despite some budding diversity, most of the theory underpinning mainstream models is steeped in a mix of New Classical ideas (Real Business Cycles and Rational Expectations) and Keynesian ones (fiscal multipliers, wage and price stickiness). Leaning more towards the former generally entails orthodox policy advice (frontloaded austerity based on expenditure cuts for all countries) while leaning towards the latter yields more revisionist policy lessons (expansion for those with fiscal space, backloaded austerity balancing expenditure and tax measures for the rest). Indeed, far from announcing paradigm shifts, the events subsequent to the Lehman crisis demonstrated neoliberalism’s openness to hybridity, coexistence with incongruous ideas, productive incompleteness, adaptive recalibrations and incremental transformations that seem to ensure its constant rebirth.

Hybridity is the rule in domestic policy practice, as well, with local intellectual traditions and competing foreign ideas being absorbed into the neoliberal theoretical nebulae. Tea Party politicians in the US or center-right economic ministers in the Baltics may, indeed, look like genuine market fundamentalists. Yet, most real-existing neoliberals do not. In Spain, successive Socialist governments of the ’80s and ’90s tried to emulate German fiscal and monetary rigor alongside select supply-side policies of Thatcherite inspiration, yet they argued just as passionately for universal social rights and progressive taxes.

Confusion is guaranteed if one goes to Scandinavia, Austria or Slovenia with the definition of neoliberalism as market fundamentalism or neoclassical economics. Policymakers there are famously orthodox on macroeconomic, financial and trade policy, yet they see in politically coordinated industrial relations, generous welfare states and progressive tax systems the means to achieving not just social fairness, but also market competitiveness and credibility.

Indeed, from Spain to Romania, neoliberal ideas became ruling ideas and proved resilient to several near-death experiences in part because their local translators in academia, government institutions or think tanks have flexibly absorbed the political and economic ideas of oppositional social forces, be they local or transnational. Where the fit with pre-existing traditions was not ideal, local translators creatively reinterpreted them to make them fit in counterintuitive ways. In my book, I consider the translation of neoliberal economics in two large countries from, respectively, Europe’s Southern and Eastern “periphery” — Spain and Romania.

In Spain, the mainstream right hybridized neoliberalism with Catholic social thought while the left added the local version of select German social democratic ideas about market-society relations. In policy practice, this hybrid meant macroeconomic orthodoxy and supply-side reforms combined with progressive taxation, collective bargaining and universal economic rights backed by serious fiscal commitments. For all its internal contradictions, this translation facilitated the emergence of embedded neoliberalism as the dominant paradigm among Spanish policy elites across party lines. Imbued with these ideas, Spain’s policy economists predictably rushed to make the most of the revisionist turn on fiscal policy and the role of the state taking place in US economics and the IMF around 2008. That all this happened despite the localization of strongly anti-Keynesian Ordoliberal ideas as early as the 1940s and 1950s makes the crafting and cementation of this hybrid even more interesting.

In contrast, the Romanian translation of neoliberalism by key policy stakeholders absorbed intellectual strands of thought that were very different due to the country’s historical and geopolitical context. The local hybrid included a robust mix of anti-communist politics and structuralist economics with deep historical roots, but also increasingly intense flirtation with the contemporary US version of Austrian School economics. The battle for turning these ideas into the new normal of late postcommunism was fierce, especially as long as nationalism and organized labor were still viable social forces. But by the 2000s, the policy implications of the neoliberal script were cemented with off-script ideas and policies such as a radical libertarian flat tax system, compulsory private pensions, pro-cyclical tax cuts for the high earners and corporations as well as a clear preference for austerity packages whose extreme social unfairness was criticized by the IMF. Like in Spain, left governments tried to offer workers and the poor more social compensation, but, overall, this disembedded neoliberalism hybrid became the only game in town. Unlike in Spain, however, most of Romania’s policy economists rushed to defend neoliberal orthodoxy from the international revisionist turn that followed 2008.

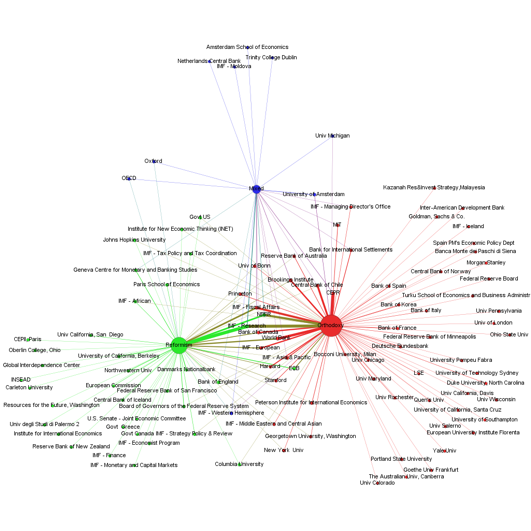

These varieties of neoliberal hybrids are highly consequential for the real world of policy making because the orthodox-revisionist tension at the heart of neoliberalism is a central cleavage in any international or domestic policy institution staffed with people holding advanced degrees in economics. Consider the austerity debate at the IMF: The network analysis below visualizes the cleavage between, and the affiliations of, hundreds of orthodox and revisionist economists cited in the IMF’s official statements of fiscal policy doctrine between 2008 and 2013. The network tells us who are the economists that the IMF considers to be reputable and whose support for policies derived from New neoclassical Synthesis and mainstream DSGE models accommodate more demand-side policies in recessions and are critical of harsh and frontloaded austerity. Moreover, with network analysis we can also figure out how much institutional weight the IMF’s external allies have. Thus, we find that fiscal revisionism came largely from within the Fund’s own ranks, a specific set of elite US academic departments (UC Berkeley, UC San Diego, Northwestern University), INET fellows, Paris School of Economics faculty and, contrary to conventional wisdom, from several central banks.

Figure 1: Professional affiliations of economists cited in the IMF’s World Economic Outlook (2008-2013)

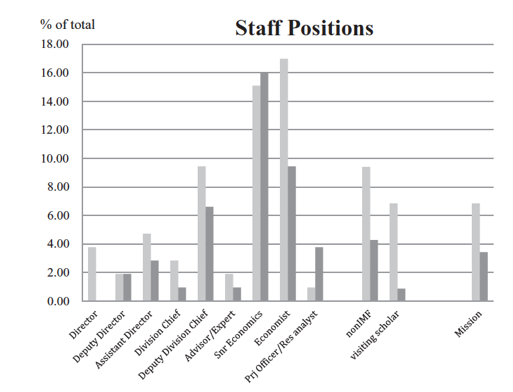

If, indeed, most revisionism comes from within the Fund, we can use content and organizational analysis to assess the strength of the revisionists in the hierarchy of this international financial institution. By looking at the bureaucratic positions of the 144 IMF economists involved in this debate, one can note that the revisionists (light grey) had the support of the top brass and staffed the bulk of the research apparatus of the Fund, whereas the orthodox (dark grey) were squeezed in less consequential middle positions (figure 2). It’s not enough to say that neoliberalism is a hybrid. For political economists interested in the power of this policy paradigm, the extra mile is represented by the analysis of the main policy thrust of that hybrid and the extent to which it has significant power in the policy arena.

Figure 2: The institutional power of the fiscal revisionist (light grey) and the fiscal orthodox economists (dark grey) at the IMF (2008-2013).

Between center and periphery

By themselves, localization and the cobbling of local resonance chambers by local translators do not explain the extraordinary success of the global spread of neoliberal economics. For a fuller causal story, we need to look at the resources invested in its global success: professional status, experience, money and access to the policy process for willing local advocates. Funding for graduate training, prestigious international degrees, continued professional training in esteemed institutions, stints in international organizations and research funds all contributed to tilting the playing field in favor of the local advocates. Given that, more often than not, they started the journey as professionally marginal, following money, status and institutional resources is key.

But contrary to expectations, greater local integration into neoliberalism’s transnational diffusion networks worked to moderate local neoliberalism. In Spain’s highly transnationalized economic profession and policy institutions, an individual’s LSE Ph.D., MIT postdoc or long stint in OECD invited experimentation with hybrids that incorporated local traditions about social fairness or imported Nordic ideas about social-democracy. Nonetheless, such hybrids remained recognizable to the policy maker’s international peers. The opposite was the case in Romania, where no important policymaker had a Western Ph.D. or any other consistent international professional socialization. Here, the result was a synthesis of mainstream neoliberal schools of thought (New Neoclassical Synthesis, supply-side economics etc.) with radical pro-market ideas culled from the likes of Austrian School economics and a local brand of conservative social philosophy. It was no surprise that when the Lehman crisis struck, the IMF’s fiscal adjustment package was scorned as “socialist propaganda.” Peripheral countries like Romania are more vulnerable to external pressures demanding harsh austerity and institutional reforms than are core countries like Spain. Yet, evidence also shows that the further radicalization of these reforms in Romania (and their attempted moderation in Spain) cannot be adequately understood without taking seriously the role of the neoliberal intellectual hybrids that local policymakers had built into the policy sphere over many years.

Where do we go from here?

Neoliberalism is an intellectual hybrid with a solid core of focal goals whose protean nature cannot be fully understood as a simple matter of intellectual history. Instead, we also have to examine the heaving waves of economic turbulence and international coercion; the degree of support from the centers of policy and expert authority; the meticulous rebuilding of domestic policy spheres through material and professional status transfers from abroad; and the institutional politics of who gets to have a say in the local economic policy regime.

The historical evidence suggests that neoliberalism does not lie on its deathbed every time its adherents in government face a crisis of legitimacy. For that to happen, its three goals (openness, competitiveness and credibility) must cease to be the fulcra of economic policy in core countries that have been neoliberalism’s historical originators and exporters. One can speculate that given the global centrality of Washington and its economic expert networks in the spread and resilience of neoliberalism worldwide, the election of Donald Trump and his promise to violate a central goal of neoliberalism (trade openness) may turn out to be as decisive for the erosion of this paradigm as the election of Ronald Reagan was for its ascent. Yet, if the thesis presented here holds any water and if the Trump moment is a harbinger of American decline, then one could anticipate that most of the rest of the world would probably move on, driven by the localized neoliberal hybrids cemented into place during America’s hegemonic decades.