In his classic 1921 book Risk, Uncertainty, and Profit, Frank Knight argued that “true” uncertainty arises from change that cannot be fully foreseen with probabilistic rules. Knight’s profound insight was to focus on the key reason why change is unforeseeable: as time passes, change in the economy’s structure is triggered by events that do not exactly replicate past events. Because these events are (at least partly) “unique,” one cannot fully predict when they will occur or their impact on the consequences of economic decisions. As Karl Popper put it, “quite apart from the fact that we do not know the future, the future is objectively not fixed. The future is open: objectively open.”

It seems self-evident that economic change – and social change more broadly – is triggered by events that are not exact repetitions of events in the past. However, economists have been reluctant to acknowledge that they as well as market participants face unforeseeable change and the “true” uncertainty that Knight identified with such change. Arguably, this reluctance stems from a widespread belief that Knightian uncertainty is incompatible with formal economic theory, and, more importantly, makes economic arguments impossible to confront rigorously with real-world observations. Our new INET Working Paper shows that participants in the stock market do recognize that they face Knightian uncertainty, and provides concrete evidence that researchers can actually arrive at empirical conclusions that matter for explaining daily volatility. We provide one such measure of Knightian uncertainty based on narrative analytics of stock-market news reports over the 200-plus trading days in 2020.

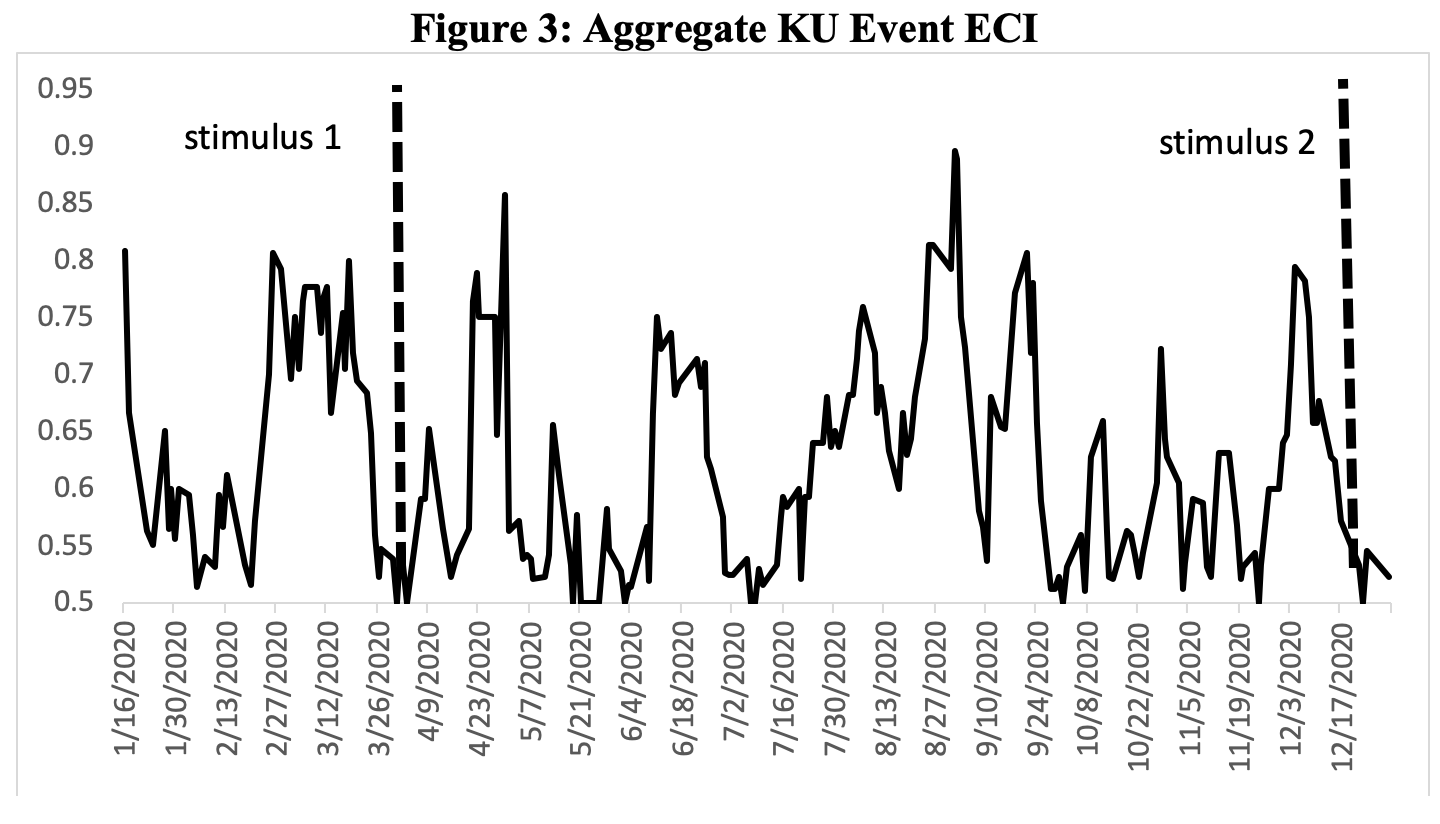

Stock-market volatility has reached ten-year highs since the start of the COVID-19 pandemic. The VIX Chicago Board Options Exchange’s Volatility Index spiked in March and October 2020 at levels not seen since the 2008 Global Financial Crisis and 2011 US Fiscal Cliff and Debt Sequestration. The VIX is referred to as the “Fear Index,” because it reflects expected volatility – as measured by underlying S&P500 options prices – and spikes when historically unique events occur that increase the uncertainty of future stock returns. However, major non-repetitive events rarely occur in isolation. Rather, they typically play out simultaneously at the intersection of government policy – as occurred during the pandemic with congressional enactment of major stimulus packages in March and December 2020. Consequently, stock-market volatility depends on the Knightian uncertainty market participants face as a result of the interplay between historic events and public policy.

How, then, can individuals and policymakers assess the impact of historically unique events and government policy on stock-market volatility? The answer, we argue, lies in the degree of expectations concordance across relevant historical events occurring at a point in time. When market participants’ interpretations are more similar in the aggregate, whether bullish or bearish, their views are reinforcing and lead to greater stock-market volatility. Conversely, when interpretations are more conflicting, the views to some extent offset and reduce volatility.

In order to assess expectations concordance, we rely on narrative analytics. By scoring Bloomberg News stock market reports, we are able to identify which historical events are deemed relevant by market participants for expected returns, and which interpretations, bullish versus bearish, were formed in response to each event. No one could have foreseen the COVID-19 pandemic, the importance of congressional stimulus negotiations, or the interpreted impacts on the stock market. Under Knightian uncertainty, narrative analytics provide a way forward. Indeed, there is a growing literature on stock-market narratives and the connection between novel events and the instability of underlying processes driving outcomes (one of us has a forthcoming book in INET’s book series with Cambridge University Press on just this topic).

In our working paper, we find that non-repetitive events mattered for stock market volatility on nearly every trading day in 2020. On some days, major events, such as the pandemic and congressional stimulus negotiations, had positive impacts on price movements; on other days, news was interpreted negatively. We score the bullish and bearish views connected to historic events with +1s and -1s, respectively, which allows us to develop an Expectations Concordance Index (ECI) measuring the degree to which interpretations are more similar across an aggregate of historical events during the 2020 year. Interestingly, we find that when pandemic factors like new cases and death rates increase concurrently with the passage of congressional stimulus packages, stock market volatility is lower as the bearish and bullish views, respectively, somewhat offset. Figure 3 from our paper illustrates this finding of low ECI following the enactment of both stimulus packages.

Results from our empirical analysis show that higher ECI values are significantly connected to higher stock-market volatility. And the results hold for both realized volatility and that implied by the VIX. We also show that ECI (Granger) “causes” the VIX, but not vice versa.

Our paper suggests that standard theories of finance that ignore Knightian uncertainty are grossly incomplete. Stock-market volatility in 2020 depended on the interplay between the unfolding pandemic and the federal government response, which cannot be measured probabilistically. This interplay was particularly pronounced during 2020, but it is always present. Accounting for the effects of Knightian uncertainty will significantly enhance the ability of researchers, regulators, and policymakers to comprehend asset-market dynamics – and social outcomes more broadly – and the impact of state intervention.