Debate continues over what is the right level for the dollar–renminbi exchange rate. I find it hard to see how focusing on this one price will lead to a productive outcome, politically or economically. Debating the exchange rate focuses the attention on the metric that guides policy. A better approach is to focus on the other side of the coin, namely reserve accumulation.

China’s accumulation of US dollar reserves, mainly Treasury debt these days, is not a by-product of its exchange-rate policy. It is the exchange-rate policy.

The approach of the PBoC is to print renminbi to buy up the flow of dollars entering the country via its current account, in fact mostly via its trade account. Policymakers sit down in the morning and decide on a target exchange rate, and initiate a quantity of asset purchases that they believe will make the exchange rate hit the target. (As with other forms of monetary policy, expectations and credibility also play a role.)

It could just as easily be called a trade-surplus policy. Policymakers would sit down in the morning and decide on a target level of the trade surplus, and initiate a quantity of asset purchases that they believe would make the trade surplus hit the target.

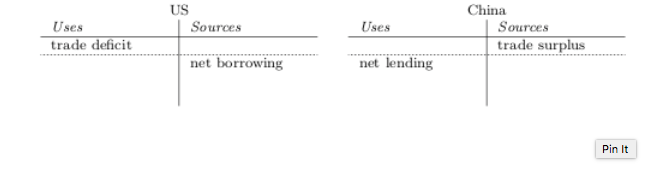

With China’s capital account relatively closed to most private actors, the public sector is relatively free to choose the level of net lending abroad for the country as a whole. Net lending abroad is, in turn, equal to the trade surplus: each dollar China lends abroad that is not borrowed from abroad must come from net exports. This is moneyflows accounting, with both sides shown as net figures:

A trade-surplus policy would be, to a first approximation, identical to targeting the exchange rate itself. Either way, the PBoC buys dollar assets to counter an inflow of dollars deriving from net exports. (To a second approximation, there would be differences: the trade surplus cannot be observed every day; expectations could be harder to manage; and so on.)

The natural consequence of focusing on quantities, rather than prices, is a discussion not of what level to target for the dollar–renminbi exchange rate, but of how to bring down the US trade deficit with China.

Adjustment to a smaller US–China trade balance is likely to be messy. As Yao Yang noted in last Friday’s Financial Times, reducing the flow of Chinese imports into the US would not necessarily increase domestic demand—imports could just shift to other source countries.

What Dr. Yao did not note is that buying fewer US would be a very difficult choice for Chinese policymakers, as it would immediately take a toll on economic growth there, and would almost certainly undermine the expectations that underpin the massive extension of credit to export industries and, indirectly, to property holdings.

In the medium run, both China and the US must develop domestic sources of demand. Focusing on the exchange rate seems like a losing proposition for both sides. Turning the discussion to reserve accumulation would be an improvement.