A relief, perhaps, to see some attempt at boosting the economy. But in a column that appears to praise Bernanke for doing something—anything—Martin Wolf still suspects the policy will fail to live up to hopes, and I am inclined to agree.

How should we understand QE3? The Fed promises to buy MBS, and possibly other assets, at a fixed and steady pace until employment improves. The immediate effect is to absorb such assets from elsewhere in the financial system. This is, in the first instance, a boost to the liquidity of these securities: when a big-time buyer is out there, it will be easier to sell, and knowing that a big-time buyer will continue to be out there, others will be more likely to buy.

Large-scale purchases (and $40B a month is quite large-scale) can also be expected to raise the price of the securities, and anticipation of such effects went immediately to the benefit of bank share prices, which spiked after the policy was announced.

The existing supply is unlikely to be enough to meet the Fed’s demand for too long, and so it will have to be met with new origination of the underlying mortgage loans. The Fed’s statement says it aims to “put downward pressure on longer-term interest rates.” What channel would make this work? The Fed could be hoping that its presence as a buyer will support new lending. If this new lending facilitates an increase in sales of new homes, equity withdrawals (or refinancing) to finance consumer demand, it could increase aggregate demand and GDP.

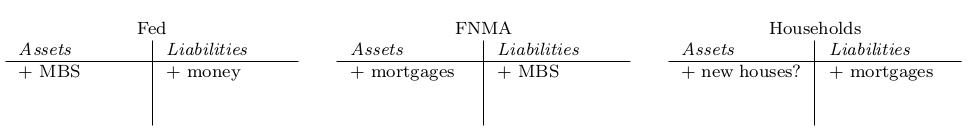

In balance sheets, the channel looks like this:

But this is quite an indirect way to generate demand. Narrowly, a spread already seems to be opening between rates faced by borrowers and MBS yields—the origination channel, so to speak, can not be counted on to transmit the asset purchases all the way to households. The yield on MBS rises, but rather than mortgage rates falling, originators are capturing a wider spread between the two rates. The rise in MBS prices, that is, leaks out as increased fees to the financial sector.

At the highest level, finally, does QE3 get at what is keeping aggregate demand down? If the problem remains, still, overindebted households unwilling to increase their demand for newly produced goods and services, then this liquidity-providing operation will have very little effect. If there is too much debt out there, and it is to be reduced, someone will have to write that debt down against equity. This is not a feature of QE3 as announced.

Special video feature

This final observation on QE3 offers a passable segue to the ECB’s announcement of outright monetary transactions earlier this month, and George Soros’s plan to address eurozone sovereign indebtedness. After a conversation this morning, I decided to take the US, in words, and Perry took Europe, in a video: