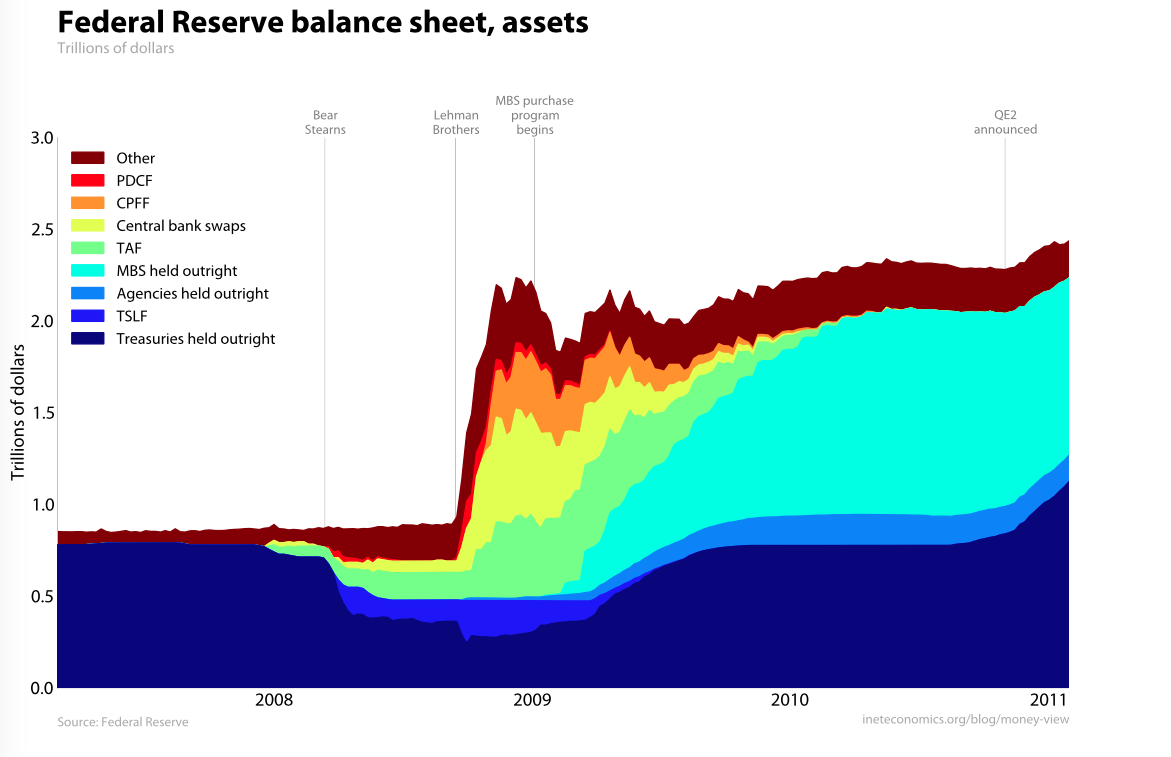

This graph tells a big part of the story. It’s the asset side of the Federal Reserve’s balance sheet, from just before the crisis through the present.

Prior to the crisis, fluctuations in the size of the Fed’s balance sheet were minimal—just the small adjustments needed to keep the Fed Funds rate on target. After Lehman failed in September 2008, the Fed added over a trillion dollars in assets. With QE2, it is in the process of adding half a trillion more.

What does this change mean, and what does it tell us about the Fed’s future?

The crisis hit hardest in parts of the financial system that the Fed wasn’t quite prepared for. The emergency funding facilities—some never even used—make the graph colorful, and record the Fed’s attempt to catch up.Until Bear, the Fed thought it could rely on normal monetary policy—it had to work a little harder to keep rates stable, but no more than that. Bear’s failure showed that that was wrong. From Bear to Lehman, the Fed thought it could wade gingerly into the shadow banking system, providing liquid collateral here, improving discount-window lending there. Lehman (and AIG, and the other events of the fall of 2008) showed that that was wrong too.

From Lehman to the end of 2009, the Fed took a very different path. Everyone wanted out of their positions in mortgage-backed securities, and the normal system of securities dealers could no longer make that happen. The Fed did what the dealers could not—it took the system’s MBS position onto its own balance sheet, to the tune of $1.25 trillion. This is the expansion of the Fed’s balance sheet, the big jump in the graph above. (The steps it took to get there are enlightening too— stay tuned.)

Now the subprime crisis is over, but none of the reform plans on offer will fundamentally change the parallel banking system—what some call the “shadow banking system”—that created it.

I am not an apologist for the Fed, but neither do I think we should end it. When the next financial crisis rolls around, we need a Fed that is up to the task. To get such a Fed, we need to understand what happened to it during the last crisis. This also means getting a clearer picture of the parallel banking system, and designing regulations that make it safe (and that don’t just create new loopholes).