This floor has in practice been a peg, as the pressure has been in only one direction, downward (that is, in the direction of CHF appreciation).

Image via FT Alphaville

As funds fled the euro crisis last summer and fall, the Swissie appreciated, putting in jeopardy the competitiveness of Swiss exporters. The SNB first intervened, first in an ad hoc way and then as a formal policy commitment. As long as the pressure is toward appreciation, this policy cannot run out of ammunition: the SNB can always meet the demand for francs against euros by creating new franc-denominated reserves to purchase euro-denominated assets. Before it runs out of ammunition, though, the policy could run up against other constraints, about which more below.

By fixing the exchange rate, Switzerland was joining the euro, albeit in a limited way. A unified payment system is what knits together a monetary union. Within the eurozone proper, this role is played by TARGET2. A euro deposit in Athens is guaranteed to extinguish a euro of debt in Berlin, and that guarantee is backed by the operation of TARGET2. The national central banks allow claims among themselves to clear payment flows for the system as a whole.

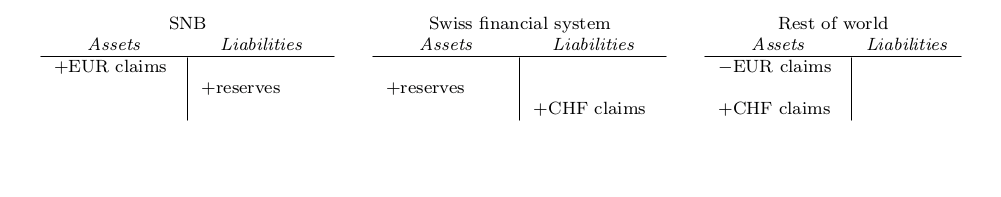

To hold fixed the exchange rate between the CHF-denominated Swiss banking system and the EUR-denominated eurozone, the SNB is in effect creating on its own balance sheet a payment system for the Swiss banking system, carrying correspondent balances for exchange against EUR for all its member banks. To achieve this, the SNB gives up the initiative in managing its balance sheet—it meets all demand for Swissies at 1.20 per euro. Here it is in balance sheets:

When you look at it this way, you can see the other side of the transaction too: the SNB is facilitating the world’s portfolio reallocation out of EUR and into CHF. Even fixed at 1.20 francs per euro, funds have been fleeing the euro area as the crisis heats up again. The SNB’s policy means that any net flow results not in price adjustment, but in fluctuations in the size of its own balance sheet. This permits expansion of CHF-denominated claims for the entire Swiss system. Now we see that this expansion is not fast enough to prevent all price adjustment: via Zerohedge, the yield on 2-year Swiss government debt has now gone negative.

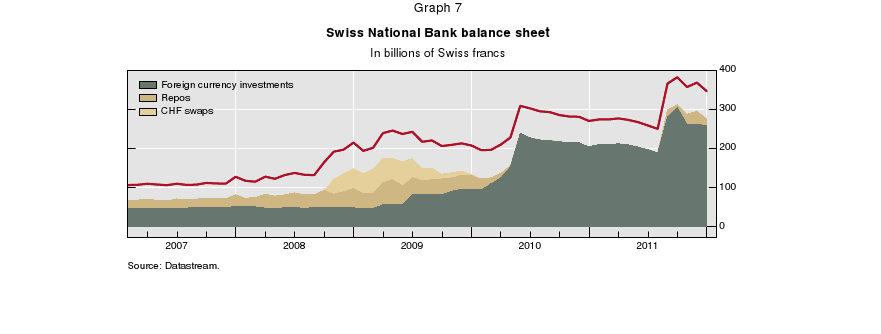

By fixing the exchange rate, Switzerland has, in a way, unilaterally joined the euro. As a haven destination, Switzerland faces problems not unlike Germany’s. Just as the Bundesbank’s claims on TARGET2 swell, so too are the SNB’s euro-denominated assets:

From a speech by Hervé Hannoun of the BIS

This entails some credit risk—if a peripheral country exits the euro, either central bank could take losses. Switzerland has some choice about what EUR assets it buys, where TARGET2 requires Germany to accept claims on other eurozone national central banks (though after Jens Weidmann complained, maybe BuBa is getting collateral for its TARGET2 assets?).

What if the SNB releases the peg? (Swexit is an unfortunate term, but it seems like the right one.) If the SNB abandons the peg, the Swissie will appreciate rapidly against the euro. Even leaving aside the consequences for the Swiss trade account, this will mean an immediate loss on the central bank’s asset portfolio. The SNB faces no liquidity constraint in CHF, so this is not immediately catastrophic, but prudent central bankers will want to avoid insolvency all the same.

There is also the risk of speculative attacks. We cannot yet see the SNB’s balance sheet as of May 31, but as conditions in e.g. Spain have worsened, it is likely that it has grown again after being mostly stable since the peg was introduced. If policy is credible, no one will risk loss by testing it, but as soon as doubts enter, the SNB will quickly have to absorb large speculative flows to defend the peg. Again, the SNB has the ammunition to do so, but it would be an uncomfortable situation.

I won’t hazard a forecast yet as to when the policy will come to an end. But Switzerland has put itself in an interesting and challenging position in the wider eurozone crisis, and Swexit will definitely come, sooner or later.