These worries are misguided, and get taken down by informed commentators who point to low core inflation, low TIPS yields, or to high unemployment and low wage growth. There’s another response, which responds more directly to the indictment and which I don’t often hear articulated. Here goes.

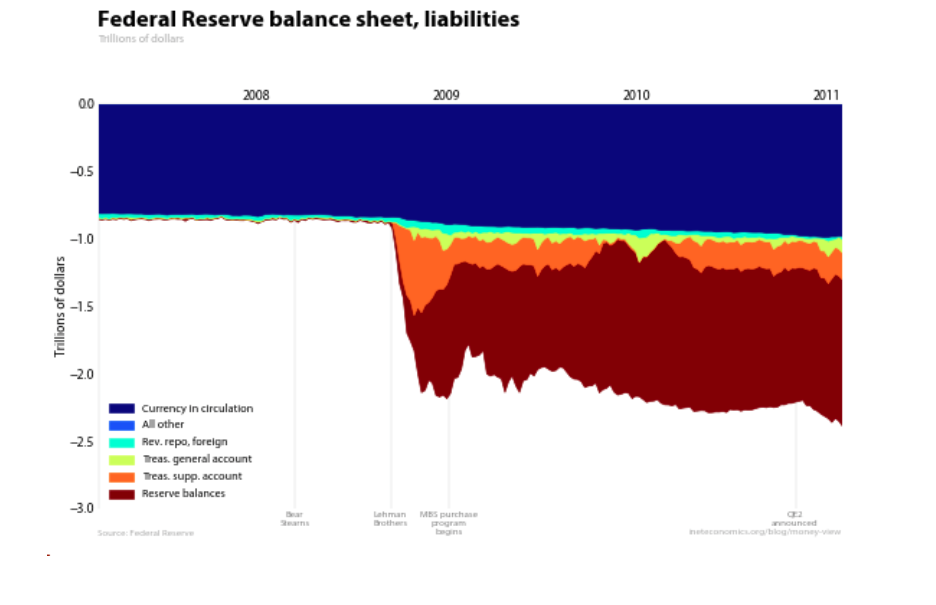

The Fed’s balance sheet has expanded, to be sure. I discussed the asset side recently. Here’s the liability side:

One of the things that this graph says is that the monetary base (liabilities of the Federal Reserve, mostly currency and the reserves of the banking system) was expanded dramatically after Lehman and a bit more since then, and that the net expansion was effected through the creation of reserves.

The inflation argument, charitably interpreted, must stand on a mechanical interpretation of the equation of exchange, which would then say that expanded monetary base must lead to higher prices: inflation. I don’t think that the equation of exchange actually says much that is of interest. But whether it does or not, there is a fundamental question here, which is whether the money supply has expanded at all.

Base money has, to be sure. But other things are money too—retail bank deposits, for example, which are part of the M1 measure of money supply, but not of M0. You could pull up lots of measures of the amount of money and start comparing them.

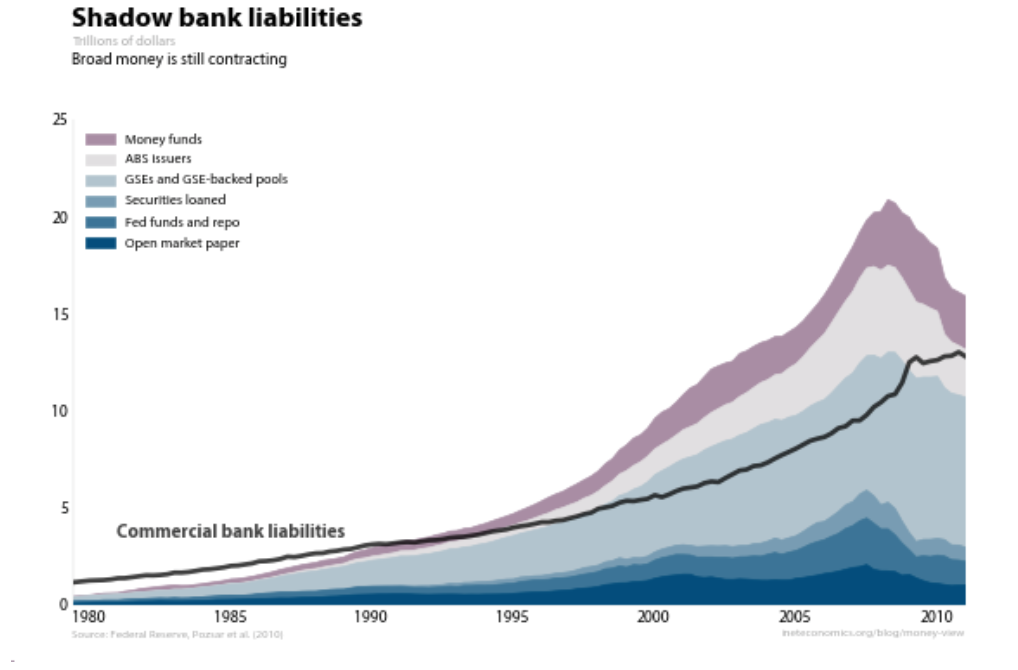

I will just look at one such measure, which focuses on banking activity done outside of traditional banks. The following is a recreation of Figure 1 of Zoltan Pozsar et al.’s (2010) Fed staff report Shadow Banking, following their footnote on the same page. (Errors are my own, but it does seem to agree with their figure.)

Like the deposit liabilities of commercial banks (black line), the liabilities of shadow banks, or parallel banks if you like, can serve as money. Money funds (MMMFs) issue shares that can usually substitute for FDIC-insured deposits. Repo lending is money too, as you go a bit deeper into the financial system. And so on.

What the figure makes clear is that, from the peak of the crisis to the present, this measure of shadow money has collapsed, by at least $5 trillion. This dwarfs the expansion of base money, and commercial bank liabilities are stagnant, not making up the difference.

All this is to say that when someone argues that post-crisis money creation will lead to inflation, we can challenge not only the effect, but also whether there has even been post-crisis money creation.