The famous scene in Gabriel García Márquez’s One Hundred Years of Solitude epitomizes Magical Realism: army troops machine gun striking banana workers and their families in the town square and toss the bodies into railway cars for disposal. But José Arcadio Segundo is only lightly wounded and jumps from the train when he comes to. When he finally picks his way back to his hometown of Macondo, a surprise awaits: everyone flatly denies any massacre took place. At night the authorities hunt for rebels from house to house; by day, they deny everything. Eventually, an extraordinary proclamation is made to the nation, repeated until finally accepted: “there were no dead [and] the satisfied workers had gone back to their families.”

Contemporary Economics has more than one Magical Realist moment like this – just look at how the basic building block of the Keynesian Revolution – the decisive role of the principle of effective demand – all but vanished from sight after the late nineteen seventies. But there is another, almost equally fateful: the Cambridge Capital Controversy, which came to consummate expression in a memorable issue of the Quarterly Journal of Economics in 1966.

Probably no summary of the issues at stake in this giant dust up has much hope of gaining assent from all the stakeholders. The issues are so complex and the background so ideological that one can easily understand how one commentator on an early contribution by Robert Solow exclaimed that “perhaps the whole problem is too complicated for adequate reflection in a formal model.” [1]

But with the caution that on this treacherous terrain readers are well advised to protect themselves from bias by sampling the classic contributions for themselves, one might venture to describe the Capital Controversy as the Waterloo of the idea that you could explain the distribution of income in terms of the balance of supply and demand for comparable factors of production reflecting purely physical (or “technical”) production relations. [2]

The most durably influential of these schemes appealed to an “aggregate production function” to partial out the separate effects of capital and labor on overall output. [3] The approach led easily to a theory of distribution according to which capital and labor are each rewarded in proportion to their relative scarcity. In equilibrium, capital should receive its marginal product, while workers should receive a real wage equal to the marginal product of labor.

If this sounds familiar, it is because it is. Just like the non-stop propaganda in Macondo, the refrain is incessantly repeated in contemporary economics – it is almost the Rosary of modern microeconomics. Virtually all textbooks still reflect this approach: divergent cases, such as monopoly, or obvious political distortions (“rent seeking”), are sometimes recognized but taught as deviations from this norm. When you listen to some private equity trader carrying on in the major media about how he (they are mostly he’s) really deserves all the money he is swilling down, because that reflects his contribution to the economy, it is this theory that you are hearing and journalists are witlessly repeating.

But the Cambridge Capital Controversy demonstrated that this approach to production and distribution led to impossible inconsistencies. Some economists, notably Knut Wicksell, who might be accounted the father of the whole “production function” line of thinking, were at least sometimes wary of its logic. Even some protagonists on the MIT side of the controversy occasionally voiced reservations, but they stuck with it. As late as 1964, the sixth edition of Paul Samuelson’s famous textbook proclaimed that the turn of the twentieth century version of the theory advanced by John Bates Clark, “although simplified, is logically complete and a true picture of idealized competition.” [4]

In the nineteen fifties, Joan Robinson, who had been reading Wicksell, started asking loudly how heterogeneous capital goods could be valued in monetary terms without first knowing the rate of interest to discount them by. Piero Sraffa, who himself resembled a character in a Márquez novel, eventually zeroed in on what such approaches assumed about changes in techniques of production at varying levels of wages and profits and showed that prices won’t predictably change when distribution changes. Gradually, battle lines formed between Cambridge, England on one side, which considered the production function approach hopelessly misleading, and Cambridge, USA, led by Paul Samuelson and Robert Solow, which, with increasingly dense qualifications, defended it.

In 1965, Luigi Pasinetti, whom INET is delighted to interview here, produced a decisive counterexample demonstrating that such production functions could not work in a world of more than one good (or technique of production). Concluding that “there is no connection that can be expected in general between the direction of change of the rate of profit and direction of change of the ‘quantity of capital’ per man,” Pasinetti argued that the Neoclassical approach to analyzing production needed to be abandoned in favor of something much closer in spirit to Classical Economics. [5] A number of notable economists confirmed his analytical critique, though they often interpreted its implications differently.

Paul Samuelson, at least, took the point. He repudiated a “non-switching theorem” associated with work by him and his students and handsomely acknowledged that Cambridge, UK, was correct. “Pathology illuminates healthy physiology. Pasinetti, Morishima, Bruno-Burmeister-Sheshinski, Garegnani merit our gratitude for demonstrating that reswitching is logical possibility in any technology…If this causes headaches for those nostalgic for the old parables of neoclassical writing, we must remind ourselves that scholars are not born to live an easy existence. We must respect, and appraise, the facts of life.” [6]

But Samuelson’s generous response was not typical of the economics profession as a whole, which to this day collectively continues to brush aside and deny the relevance of this controversy and, in fact, suppresses virtually all reference to it. Even before Pasinetti’s result became known, however, some Neoclassical economists had explored whether their general approach to “factor rewards” and “marginal productivity” could be pursued by jettisoning production functions and appealing to notions of general equilibrium. [7]

There are good reasons for doubting this program can really go much beyond sketches for analyzing any real economy. Subsequent research on general equilibrium has emphasized how precarious any such momentary equilibria are. [8] In addition, as emphasized by Joseph Halevi in some recent lectures, the Cambridge dispute has destructive implications for the stability of Neoclassical versions of growth theory.[9] Not surprisingly, some economists who attend carefully to the Cambridge results think they require a wholesale rethinking of economic theory and especially of the theory of distribution, since the technical conditions of production cannot determine a unique solution for the distributive variables..

But for mainstream economics, we remain in the Magical Realist world of Macondo. Contemporary students of economics rarely hear of the controversy or Samuelson’s straightforward concession to the Cambridge, U.K. critics. Pasinetti’s subsequent work on growth, income distribution, finance, and structural dynamics, as well as the other work of Sraffa, Kaldor, and Joan Robinson are only rarely discussed. Instead, growth models that feature cheerfully guilt free old style production functions proliferate, with most of their consumers and producers seemingly unaware of their fragility. Central bankers and many affluently supported monetary theorists also talk airily about “natural rates” of interest, without realizing that the Cambridge results shake that notion, too. [10]

Now, however, developments in the world economy, especially soaring inequality within countries and anxieties about the mainsprings of economic growth, are once again bringing to the fore the issues of growth and “factor rewards” that fueled the Cambridge Capital Controversy. Not one, but several reviews of Thomas Piketty’s invaluable Capital in the Twenty-First Century, for example, have emphasized the importance of the Cambridge discussions.[11]

Believable “general equilibrium” approaches to this brave new world are few and far between. At best one finds highly contrived Dynamic Stochastic General Equilibrium Models that have nothing to say about soaring corporate compensation, the real political economy of tax cuts and starvation public budgets, or rising mark ups in major big business sectors.

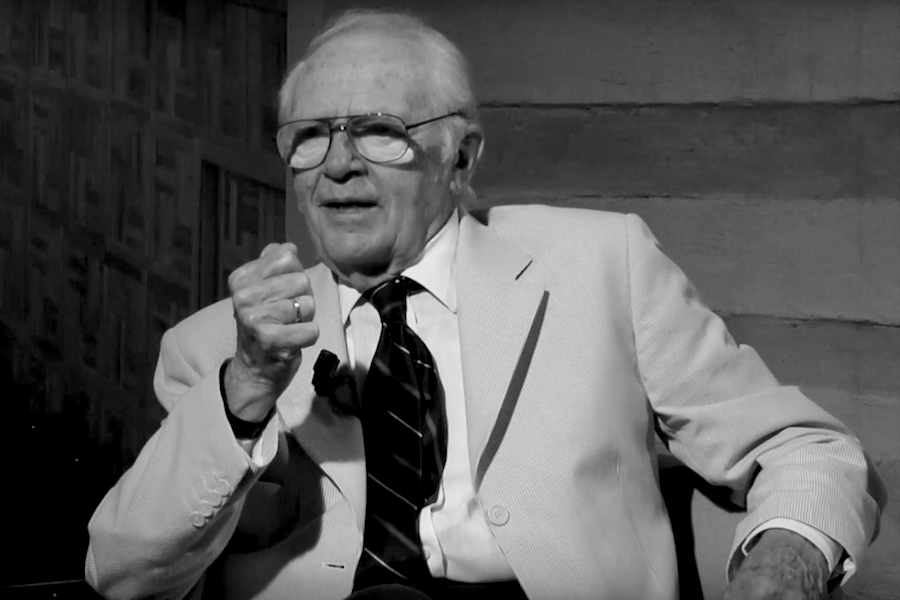

Sometimes the fastest route to new economic thinking begins with a careful study of existing strands of economic theory, especially when its protagonists have so clearly been right about so many subsequent policy questions and won the basic theoretical debate. [12] In the summer of 2014 the Institute for New Economic Thinking interviewed Professor Luigi Pasinetti for several hours over the course of a week. Dr. Nadia Garbellini was the interviewer. I also interviewed Professor Pasinetti and Dr. Marcello de Cecco together for one special session.

Professor Pasinetti relates some of the high points of his distinguished career in the videos: Born near Bergamo in the north of Italy, he compiled a brilliant academic record that eventually won him fellowships to Cambridge University, Oxford, and Harvard. He describes how his thinking evolved at Cambridge, where he was first supervised by Richard Goodwin, then by Richard Kahn, and actively engaged with Nicholas Kaldor, Joan Robinson, and Piero Sraffa.

One of the high points of the whole series is his discussion of the conference panel at which he first presented his famous paper on the Capital Controversy. But many viewers and readers may find Pasinetti’s discussions of growth and income distribution, multi-sectoral economic models, and international trade a very helpful way into his later work. There are some other good sources also, including Pasinetti’s website at the Catholic University of Milan.[13]

In Márquez’s novel, when the government declared that up was down, it poured rain in Macondo for almost five years, leading to floods that washed away most of the town. But economists ought to be capable of coming in out of the rain. Our hope is that these interviews with one of the great figures of contemporary economics will lead to some serious rethinking of fundamental tenets of mainstream thinking.

Pasinetti’s Intellectual Formation; Italy and the two Cambridges

Pasinetti’s Critique of the Solow Growth Model

Pasinetti on the Economics of Production

Financialization and Production: Pasinetti’s Critique of Modigliani and Miller

Pasinetti on the Theory of Value: Smith, Ricardo, Marx, Sraffa, Pasinetti

Pasinetti Discusses The Cambridge Capital Controversy

An Interview on Economics, History, and Policy: Marcello de Cecco and Luigi Pasinetti

Selected Bibliography

1959

“On Concepts and Measures of Changes in Productivity,” in The Review of Economics and Statistics, vol. 41, pp. 270-282, with “Comment” by Robert M. Solow, pp. 282-285, and “Reply” by LLP, pp. 285-286.

1960

“A Mathematical Formulation of the Ricardian System,” in The Review of Economic Studies, 1959-60, vol. 27, pp. 78-98.

1962

“Rate of Profit and Income Distribution in relation to the Rate of Economic Growth,” in The Review of Economic Studies, 1961-62, vol. 29, pp. 267-279.

1966

“Changes in the Rate of Profit and Switches of Techniques” (opening article of “Paradoxes in Capital Theory: A Symposium”), in The Quarterly Journal of Economics, vol. 80, pp.503-517.

1969

“Switches of Techniques and the ‘Rate of Return’ in Capital Theory,” in The Economic Journal, vol.79, pp. 508-531.

1

970

“Again on Capital Theory and Solow’s Rate of Return,” in The Economic Journal, vol. 80, pp. 428-431.

1973

“The Notion of Vertical Integration in Economic Analysis,” in Metroeconomica, vol. 25, pp. 1-29. Reprinted in: L. Pasinetti (ed.), Essays on the Theory of Joint Production, London: Macmillan, 1980, and New York: Columbia University Press, 1980, pp.16-43.

1974

Growth and Income Distribution - Essays in Economic Theory, Cambridge: Cambridge University Press, pp. x + 151.

Italian version: Sviluppo Economico e distribuzione del reddito- Saggi di teoria economica, Bologna: Il Mulino, 1977, pp. 203.

Spanish translation: Crecimiento económico y distribución de la renta - Ensayos de teoría económica, Madrid: Alianza Editorial, 1978, pp. 178.

Portuguese translation: Crescimento e Distribuição de Renda - Ensaios de Teoria Econômica, Rio de Janeiro: Zahar Editores, 1979, pp. xi +179.

Japanese translation: Tokyo: Iwanami Shoten, 1985, pp. xii + 209.

1977

Lectures on the Theory of Production, New York: Columbia University Press, and London: Macmillan pp. xiv + 285.

Italian version. 1975, Lezioni di teoria della produzione, Bologna: Il Mulino, second edition 1981, pp. xvi + 378.

Japanese translation: Tokyo: Orion Press, 1979, pp. xvi +341.

Spanish translation: Lecciones de teoría de la producción, Madrid (1983) and Mexico City (1984): Fondo de Cultura Económica, pp. 373.

French translation: Leçons sur la théorie de la production, Paris: Bordas/Dunod, 1985, pp. xvii +302.

German translation: Vorlesungen zur Theorie der Produktion, Marburg: Metropolis Verlag, 1988, pp. 313.

1977

“Reply to Stiglitz,” contained in: Morishima, Michio, “Pasinetti’s ‘Growth and Income Distribution’ Rivisited,” in The Journal of Economic Literature, vol. 15, pp. 57-58.

1978

“Wicksell Effects and Reswitchings of Technique in Capital Theory,” in The Scandinavian Journal of Economics, vol. 80, pp. 181-189. Reprinted in: John C. Wood (ed), “Knut Wicksell - Critical Assessmments,” vol. II, London: Routledge 1994, pp. 115-124.

1981

Structural Change and Economic Growth - A Theoretical Essay on the Dynamics of the Wealth of Nations, Cambridge: Cambridge University Press, pp. xv + 281.

Italian version: Dinamica strutturale e sviluppo economico - Un’ indagine teorica sui mutamenti nella ricchezza delle nazioni, Turin: U.T.E.T., 1984, pp. xix + 326.

Japanese translation: Tokyo: Nihon Keizai Hyôron-sha, 1983, pp. xii + 340.

Spanish translation: Cambio estructural y crecimiento económico, Madrid: Ediciones Pirámide, S.A., 1985, pp. 270.

1984

“The Difficulty, and yet the Necessity, of aiming at Full Employment: a Comment on Nina Shapiro’s Note,” in Journal of Post Keynesian Economics, Winter 1984-85, vol. 7, pp. 246- 248.

1988

“Growing Sub-systems, Vertically Hyper-integrated Sectors and the Labour Theory of Value,” in Cambridge Journal of Economics, vol. 12, pp. 125-134.

1989

“Ricardian Debt/Taxation Equivalence in the Kaldor Theory of Profits and Income Distribution,” in Cambridge Journal of Economics, vol. 13, 1989, pp. 25-36.

1993

Structural Economic Dynamics - A theory of the economic consequences of human learning, Cambridge: Cambridge University Press, pp. xvi +186.

Italian version: Dinamica economica strutturale. - Un’ indagine teorica sulle conseguenze economiche dell’apprendimento umano, Bologna: Il Mulino, pp. 294.

Japanese Translation: Tokyo: Nihon Keizai Hyôron- sha, 1998, pp. xx + 247.

1997

“The Social ‘Burden’ of High Interest Rates” in: Philip Arestis, Gabriel Palma, and Malcolm Sawyer (eds.), Capital Controversy, Post-Keynesian Economics and the History of Economic Thought, Essays in Honour of Geoffrey Harcourt, volume I; London and New York: Routledge, pp.161-168.

1998

“The myth ( or folly ) of the 3% deficit/GDP Maastricht ‘parameter’,” in Cambridge Journal of Economics, vol. 22, N. 1, pp.103-116.

2000

“Critique of the Neoclassical Theory of Growth and Distribution,” in PSL Quarterly Review vol. 53(215), pp. 383-431. Also published in Italian: “Critica della Teoria Neoclassica della Crescita e della Distribuzione,” Moneta e Credito, N. 210 (2000), pp. 187-232.

2001

“The Principle of Effective Demand and its Relevance in the Long Run,” in Journal of Post Keynesian Economics, vol. 23, pp. 383-390.

2002

“Una Crisi Strutturale” in: Jader Jacobelli (ed.), Dove va nel 2003 l’economia italiana?, (Proceedings of the Forum for the Economic Forecast, organized by Centro Culturale Saint- Vincent, Saint Vincent, 18-19 October 2002), Catanzaro: Rubbettino Editore, pp. 130-136.

2002

“Due modi diversi di fare teoria economica. L’influenza recondita della storia,” in: Pierluigi Ciocca (ed.), Le Vie della Storia nell’Economia, Bologna: Il Mulino, pp.183-190 (articles originally published in Rivista di Storia Economica).

2002

“An ‘Analytical’ Approach to the ‘Just’ Rate of Interest: the Priority of Labour over Capital,” in Rivista Internazionale di Scienze Sociali, n. 3, July-September, pp.v323-330, a comment-article on a contribution by Edmond Malinvaud, “A Gap in the Social Doctrine of the Church about the Priority of Labour Over Capital: The Proper Role of Finance,” in the same issue of Rivista Internazionale di Scienze Sociali, pp. 303-322 (originally presented to the Congress Work as Key to the Social Question, Vatican City, 12-15 September 2001).

2012

“Piero Sraffa and the future of economics,” in

Cambridge Journal of Economics, vol. 36 (6), pp.1303-1314. Alternative version in: Enrico Sergio Levrero, Antonella Palumbo, Antonella Stirati (eds), Sraffa and the Reconstruction of Economic Theory: Volume III, 2013, pp. 153-173.

2012

“A few counter-factual hypotheses on the current economic crisis,” in

Cambridge Journal of Economics, vol. 36(6), pp. 1433-1453.

2015

“On the Origin of the Theory of Rent in Economics,” in Baranzini, M., Rotondi, C., Scazzieri, R. (eds),

Resources, Production and Structural Dynamics, Cambridge University Press, Cambridge, pp. 35- 52.

2015

“From Sraffa: backwards, to a better understanding of Marx’s Values/Prices ‘transformation’; and forward, to a novel view of growing economic systems,”

Cahiers d’économie politique, 2015 (69), pp. 73-96, with Nadia Garbellini.

[1] Smithies, A, “Comment on Solow,” American Economic Review, Papers and Proceedings, LII (1962), pp. 91-92.

[2] The literature is gigantic. A classic account with many references is Harcourt, G.C., Some Cambridge Controversies in the Theory of Capital (Cambridge University Press, 1972).

[3] This bland sounding description conceals a host of assumptions that not everyone swallows easily. An elegant and readable summary of the mathematical conditions is Pasinetti, L., “Critique of the Neoclassical Theory of Growth and Distribution,” Banca Nazionale del Lavoro Quarterly Review, No. 215 (Dec., 2000), pp. 384-431; http://ojs.uniroma1.it/index.php/PSLQuarterlyReview/article/view/9924/9806 In institutional terms the argument assumes an absence of market power, zero transactions and information costs, no information asymmetries, and free entry and exit.

[4] Samuelson, P., Economics (6th ed.; New York: McGraw Hill), p. 526, quoted in Pasinetti, “Critique,” p. 394. As Pasinetti records, James Meade voiced similar sentiments at just about the same time.

[5] Pasinetti, L., “Changes in the Rate of Profit and Switches of Techniques,” Quarterly Journal of Economics, Vol. 80, No. 4 (Nov., 1966), pp. 503-17. See also the articles in the same issue by Morishima, Levihari and Samuelson, Pierangelo Garegnani, and others. The absence of a simple relationship between the rate of profits and the quantity of capital implies that that stories about relative scarcity and the “price” of capital can diverge. There is no necessary relation between the total value of capital and profitability. A very readable summary of Sraffa’s role is Foley, D., “Sraffa’s Legacy,” Cambridge Journal of Economics, 27 (2003), pp. 225-38.

[6] The quotation is from Samuelson, P., “A Summing Up,” Quarterly Journal of Economics, Vol. 80, No. 4 (Nov., 1966), pp. 582-83; see also Levihari, D. and Samuelson, P., “The Non-Switching Theorem is False,” in the same issue of the Quarterly Journal of Economics, pp. 518-19.

[7] See, e.g., the discussion of Solow in Harcourt, Cambridge Controversies, p. 46.

[8] See, for example, S. Abu Tarab Rizvi, “The Microfoundations Project in General Equilibrium Theory,” Cambridge Journal of Economics, 18 (1994), pp. 357-77; Rizvi, “The Sonnenschein-Mantel-Debreu Results After Thirty Years,” History of Political Economy, Annual Supplement, 38 (2006), pp. 228-45; also Pasinetti, “Critique.”

Note that another line of criticism of aggregate production functions exists; see the discussion of Franklin Fisher’s and other work in, e.g., Felipe, J. and McCombie, J.S.L., The Aggregate Production Function and the Measurement of Technical Change (Cheltenham, U.K.; Elgar, 2013).

[9] Halevi, in lectures at the International University College of Turin, in May 2016, observes that stories in which changes in the capital intensity of production compensate for the “knife edge” instabilities of growth revealed in the Harrod-Domar (and many other) growth models can’t survive the possibility of the reswitching of techniques revealed by the Cambridge Controversy. The implication is that in a growing economy the Invisible Hand likely waves an unsteady goodbye.

[10] Rogers, C., Money, Interest, and Capital: A Study in the Foundations of Monetary Theory (Cambridge: Cambridge University Press, 1989), Chapter 2.

[11] See, e.g., the reviews by James Galbraith, “Kapital for the Twenty-First Century”? https://ineteconomics.org/ideas-papers/blog/kapital-for-the-twenty-first-century; Galbraith’s point about the relative importance of changing financial valuations vs. physical profitability in, for example, the changes in the valuation of French capital stock after World War I is an important one. See also Taylor, L, “Veiled Repression: Mainstream Economics, Capital Theory, and the Distributions of Income and Wealth,” INET Working Paper # 32, https://ineteconomics.org/uploads/papers/WP32Lance-Taylor.pdf as well as the symposium in the International Journal of Political Economy, Vol. 43, Issue 3 (2014).

[12] On policy, see the discussion in Joseph Halevi’s INET Working Paper discussed below.

[13] See also Pitelis, C. N., “Learning, Innovation, Increasing Returns and Resource Creation: Luigi Pasinetti’s ‘Original Sin’ of, and Call for a Post-Classical Economics,” Cambridge Journal of Economics 2016, in press.