- While a debt financed stimulus might (if we believe in Ricardian Equivalence) be offset by the anticipation of an increased future tax burden

- … a money financed stimulus will be to the same extent offset by the anticipation of an “inflation tax”

This is however completely wrong, and rests on a failure to distinguish between the precise implications of an actual future tax and an inflation tax. In fact the undoubted reality of an “inflation tax” does not change in any way the fact that:

- A money finance deficit will always stimulate nominal demand

- …while a debt financed deficit might not do so in some circumstances

- So that the stimulative impact of a money finance deficit is always greater than or equal to that of a debt financed one

This paper sets out why this is the case both:

- In circumstances where the economy is already at full employment/full potential output and where an increase in nominal demand can therefore only produce an increase in inflation

- In the underemployment/below full potential output case, where an increase in nominal demand could produce some increase in real output as well as an inflationary effect

CASE 1 : with full employment/full potential output

In this case, and if we assume forward looking agents :

- A debt financed deficit will produce no increase in nominal demand and no increase in inflation

- While a money financed deficit will undoubtedly produce a rise in nominal demand and an increase in inflation, with the fact that there is an “inflation tax” making no difference to this conclusion

Case 1(a) : a debt financed deficit . In this case, a Ricardian Equivalent (RE ) anticipation of future taxes to pay back the debt can offset any stimulative impact on nominal demand. Thus:

- The government either increases public expenditure or cuts taxes, creating a fiscal deficit which is funded by the issue of interest-bearing debt

- This issue of interest-bearing debt produces an increase in the gross nominal financial assets of the private sector – since the private sector now holds as much money as before plus the newly issued bonds

- But this debt will need to be repaid out of future taxes, and the future tax burden will be equal to the initial deficit

- As a result, if taxpayers rationally anticipate the future tax burden, there will be (as per Barro 1974) no increase in private sector financial net worth (real or nominal) since the future debt repayment burden which the government has incurred on their behalf equals the value of the bonds that the private sector now holds

- In a rationally forward-looking RE world, therefore, increased saving by taxpayers (to enable them to pay the future taxes) will fully offset the stimulative impact of the debt financed fiscal deficit

- And there will be no increase in nominal demand and no increase in inflation

Thus in Case 1 (a) an RE anticipation of future taxes fully offsets any stimulus to nominal demand. There is no increase in real output ( by Case 1 definition ) but there is also no increase in inflation.[1]

Case 1(b) : a money financed stimulus. In this case even full anticipation of the future inflation tax will not offset in any way the impact on nominal demand and thus on inflation. Thus:

- The government either increases public expenditure or cuts taxes, creating a fiscal deficit which is funded by a permanent increase in the monetary base

- This increase in the monetary base produces an increase in private sector gross nominal financial assets. And since in this case there is no future increased actual tax burden, the increase in gross nominal financial assets is also an increase in private sector nominal net worth

- But there can be no increase in the long-term real value of gross financial assets, since an inflation tax is bound at some time to emerge. And in a rationally forward-looking world, this inflation tax will be anticipated both where the stimulus takes the form of a public expenditure increase and where it takes the form of a tax cut :

- oIn the case of a public expenditure increase there will be an immediate positive impact on nominal demand ; but given that we are already at full employment/full potential output this can only produce inflation which reduces the real value of private income and consumption

- oAnd in the case of a tax cut , individuals will know what that while they now hold more nominal financial assets ( both gross and net ) , they have received no increase in real financial assets (gross or net) because the value of these assets will in future be eroded by inflation

- The existence of an inflation tax is therefore clearly important. But it does not offset the stimulative effect of the money financed deficit on nominal demand and inflation in either a fully RE or a non-RE world:

- oIn a non RE world individuals receiving a tax cut will suffer under the delusion that they have received an increase in real net worth, and will seek to spend some of that increased wealth, producing an increase in nominal demand and thus inflation

- oWhile in the RE world, some individuals who rationally anticipate future inflation, will seek to spend some of their money to buy goods and services (or other assets) before the inflation actually occurs

- Either way there will be an increase in nominal demand and inflation

And indeed it is surely obvious that there must be an increase in inflation for there to be an inflation tax.

It is therefore quite wrong to think of an inflation tax as having the same impact on nominal net worth and nominal demand as an actual future tax.

- An anticipated actual tax can mean that a debt financed deficit today does not increase rationally perceived nominal net worth ( let alone real net worth )

- But an anticipated inflation tax cannot offset the increase in nominal net worth ( and thus nominal demand ) even though it offsets any apparent but illusory increase in real net worth

Thus to sum up on Case 1 : in a full employment/full potential output world, where by definition no increase in real output is possible ;

- An anticipated actual future tax burden can ( as per Barro 1974) offset the nominal impact of a debt financed fiscal stimulus, so that it has no impact on nominal demand and thus inflation

- But an anticipated (or unanticipated) inflation tax does not offset the nominal impact of money financed fiscal stimulus. A money financed fiscal stimulus will always stimulate nominal demand.

Case 2 : with economy starting at under employment/under full potential output

In this case it is possible that an increase in nominal demand (however induced) will have some positive real effect, as well as a purely inflationary effect. This does not however change the fact that a money financed stimulus is bound to produce an increase in nominal demand which is greater than or equal to that produced by a debt financed stimulus

Case 2 (a) A debt financed stimulus. In Case 2 (a) it is now possible for there to be an increase in nominal demand (and real output) even if there is a full RE anticipation of future taxes. This follows because

- Rational forward-looking agents can anticipate that if a debt financed stimulus today produces an increase in nominal demand this will produce some increase in real output

- Such a rationally anticipated increase in real output increases total societal real net worth

- Even therefore if the future tax burden to repay the newly issued debt is fully anticipated, private agents today will rationally perceive that their real net worth has increased[2]

- As a result , the stumulative impact of the debt financed deficit on nominal demand ( and real output) will not be fully offset by the RE anticipation of the future debt burden[3]

So if we are in an underemployment/under full potential output situation, debt financed deficits can stimulate nominal demand even if there is full RE anticipation of the future debt servicing burden, and can in turn produce some increase in real output.

Case 2(b) But in these circumstances a money finance deficit will be still more stimulative to nominal demand since agents will rationally perceive that

- Their real net worth has been increased by the future increase in real output - exactly to the same extent as in the debt financed case

- Their nominal net financial worth has been further increased by the fact that they have additional gross financial assets not matched by any future debt servicing burden.This additional nominal increase in net worth does not arise in the debt financed case, due to the future debt servicing burden

In Case 2 therefore, as in Case 1, a money finance deficit is bound to produce an increase in nominal demand greater than or equal to a debt financed deficit.

Summary

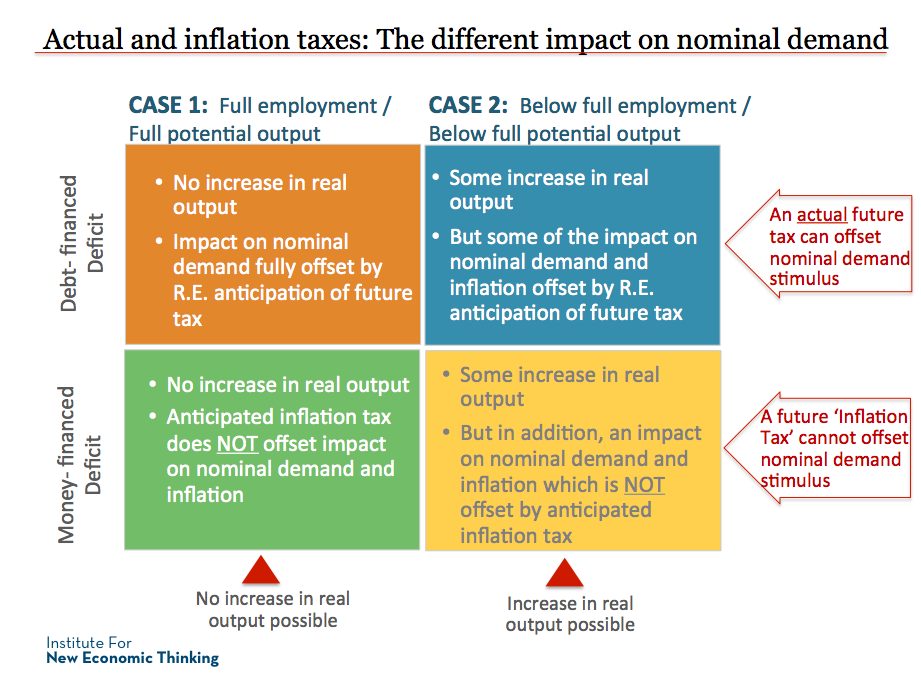

The exhibit below summarises the conclusions for the different cases:

Case 1 : full employment/full potential output .

- (a)Debt financed deficits

- There is no increase in real output

- And the impact on nominal demand and inflation could be fully offset by the anticipation of future actual taxes

(b) Money financed deficits,

- There is no impact on real output

- But even a wholly anticipated inflation tax does not offset the stimulative impact on nominal demand and inflation

Case 2 : underemployment/under full potential output

- (a)Debt financed deficits

- Some increase in real output is possible

- But some of the impact on nominal demand is offset by anticipation of future actual taxes

- (b)Money financed deficits

- Some increase in real output is possible

- But in addition there is an impact on nominal demand and inflation which is not offset by anticipation of an inflation tax

Footnotes

[1] The question also arises : what impact will a debt financed deficit have in conditions where RE does not apply but where, as per Case 1, no increase in real output is possible? The answer is that the debt-financed deficit could produce an initial stimulus to nominal demand and inflation, but with this reversed in a later period. Thus :

Since there is no RE the debt financed deficit produces an initial illusory increase in apparent nominal and real net worth

But since no real output increase is possible, this can produce only an inflationary effect, which, once apparent , reveals the illusory nature of the real net worth increase

And since there is an actual additional debt servicing requirement in a later period , the illusory nature of the increase in even nominal net worth will become apparent once fiscal tightening plans are announced and implemented

As a result , any initial increase in nominal demand and inflation will be reversed in a later period

[2] Note that Barro 1974 did not consider this possibility since he implicitly assumes a Case 1 situation in which the economy is already at full employment /full potential output

[3] This is essentially the same as the idea that in conditions where output is below potential, a debt financed deficit can to a degree “pay for itself” ( see e.g. Delong and Summers 2012 )