in an attempt to foster empirical work.

The proposal

In January 1953, Oskar Morgentern wrote Alfred Cowles to suggest a change in the Constitution of the Econometric Society (ES) . The Fellow section stated that:

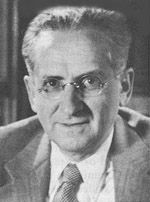

Instead, Morgenstern proposed that candidates be required to “have done some econometric work in the strictest sense” and be “in actual contact with data they have explored and exploited for which purpose they may have even developed new methods.” Though remembered as the coauthor of one of economics’ most prominent theoretical treatise, The Theory of Games, Morgenstern also had a longstanding interest in statistical work. His feeling was that the Econometric Society and Econometrica editors overvalued “purely abstract work,” while stimulus should be give, to “papers involving data.”

Instead, Morgenstern proposed that candidates be required to “have done some econometric work in the strictest sense” and be “in actual contact with data they have explored and exploited for which purpose they may have even developed new methods.” Though remembered as the coauthor of one of economics’ most prominent theoretical treatise, The Theory of Games, Morgenstern also had a longstanding interest in statistical work. His feeling was that the Econometric Society and Econometrica editors overvalued “purely abstract work,” while stimulus should be give, to “papers involving data.”

Negative reactions

Morgenstern’s proposal was circulated among fellows, and elicited all sorts of comments. Cowles Commission economists reacted negatively. Acting director Tjalling Koopmans argued that “a large majority of the fellows” did process statistical data in their papers. “Progress of economic knowledge requires concurrent work in economic theory, statistical inference, and economic work proper,” he continued, so that the ES constitution should allow for specialization. Former Cowles director Jacob Marschak commented in his usual laconic style:

Morgenstern’s proposal was circulated among fellows, and elicited all sorts of comments. Cowles Commission economists reacted negatively. Acting director Tjalling Koopmans argued that “a large majority of the fellows” did process statistical data in their papers. “Progress of economic knowledge requires concurrent work in economic theory, statistical inference, and economic work proper,” he continued, so that the ES constitution should allow for specialization. Former Cowles director Jacob Marschak commented in his usual laconic style:

Their statements reflected the uncertainties faced by economic theorists in the early 1950s. Pathbreaking contributions piled up in these years (proof of the existence of GE, game theory, rational decision under uncertainty), but the financial situation of the research bodies which produced them was far from secured. Cowles had just reoriented its research program from empirical work to theoretical investigation of decision, changing its motto from “Science is Measurement” to “Theory and Measurement,” but Marschak nevertheless instructed Koopmans to downplay the theoretical dimension of their project in his negotiations with the largest patron for economic research, the Ford Foundation.

Marschak and Koopman’s skepticism was endorsed by French Polytechnicien René Roy and by Berkeley mathematician Griffith C Evans’s. Swimming against the formalist tide, E vans had been an early advocate of measurable or quantifiable mathematical models. He nevertheless rejected Morgenstern’s suggestion – he too believed that some division of work should be preserved: “they are problems, e.g. the theory of money, in which statistics seems to play a secondary role,” he wrote in a (not so visionary) response.

Positive reactions

In contrast, Evans’ student Charles Roos, also associated with Cowles, found himself “in complete and hearty agreement” with Morgenstern, as many polled fellows did. Their endorsement however appeared more sociological than intellectual. Many expressed frustration that “pages crammed with formulae” was the hype in Econometrica. They feared that formalization may estrange their science from “the threads of economic and social reality.” The lack of empirical work was not due to data shortage, R. Geary insisted, since a large part of the data produced by national statistical offices was not put to scientific use. The nub of the debate was neatly summarized by Luigi Amoroso:

In contrast, Evans’ student Charles Roos, also associated with Cowles, found himself “in complete and hearty agreement” with Morgenstern, as many polled fellows did. Their endorsement however appeared more sociological than intellectual. Many expressed frustration that “pages crammed with formulae” was the hype in Econometrica. They feared that formalization may estrange their science from “the threads of economic and social reality.” The lack of empirical work was not due to data shortage, R. Geary insisted, since a large part of the data produced by national statistical offices was not put to scientific use. The nub of the debate was neatly summarized by Luigi Amoroso:

The constitution was not altered in 1953. The two-legged eligibility criterion still underpins Econometric Society’ s current organization. Its only change occurred after 1997, with the replacement of “analyses as have a definite bearing on problems in economic theory” with “problems in economics.”

Morgenstern’s vision of theory-data relationships

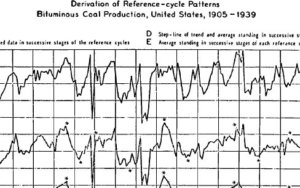

In spite of his constitutional reform proposal, Morgenstern was far from being a data enthusiast. His long-standing interest in statistical work was paired with an unrepentant concern with the multiple observational errors plaguing economic data. In a beautiful paper, Marcel Boumans relates the development of Morgenstern’s pessimistic take, one outline in a paper On the Accuracy of Economic Observation (1950, 1963). The problem, Boumans explains, is that Morgenstern’s benchmark was observations in the natural sciences, which were planned, designed, and guided by theory. Errors were the unsystematic result of human mistake, for nature “doesn’t lie deliberately.” But economic agents do, Morgenstern lamented, which adds to the lack of designed experiments, errors from questionnaires and instruments, and lack of definition. Years of “sampling in a hostile environment,” in particular dealing with the statistics produced by Germany, the Soviet Union and China at the League of Nations, had fueled Morgenstern’s belief that economic statistics were “not scientific observation.”

For Morgenstern, Boumans explains, every observation should be underpinned by theory. Theory reduces the amount of required measurement, and it attaches meaning to data. Otherwise, the researcher would be “merely looking.” Morgenstern nevertheless conceded that, in some cases, new data could be generated in a setting unbounded by theory. In Experiment and Large Scale Computation in Economics (1954), Morgenstern compared the use of the “high-speed electronic computer” with the age of the telescope and microscope, when

For Morgenstern, Boumans explains, every observation should be underpinned by theory. Theory reduces the amount of required measurement, and it attaches meaning to data. Otherwise, the researcher would be “merely looking.” Morgenstern nevertheless conceded that, in some cases, new data could be generated in a setting unbounded by theory. In Experiment and Large Scale Computation in Economics (1954), Morgenstern compared the use of the “high-speed electronic computer” with the age of the telescope and microscope, when

all that mattered was to take these wonderful new instruments and to look, to look practically anywhere. Some phenomena would turn up, totally unsuspected, be they the moons of Jupiter or some tiny amoebae in a drop of water […in] the comparatively undeveloped state of economics the ‘mere looking’ by means of computers occupies still a very large field for the future.

Morgenstern therefore allowed for the production of theory-free data, but only as a temporary stage in the development of economic science:

one would not get very far today either in astronomy or biology if one were merely to look around as one did then: now theory is guiding the direction of the search for facts and phenomena, sometimes for exceedingly esoteric and elusive ones

What does it mean for today?

It was the

discussions surrounding the rise of empirical work in economics and the recent pushback against the credibility revolution that brought me back to Morgenstern’s vision. In 1953, he claimed that empirical work was so crucial for the development of economics that no ES fellow should dispense with it. At the same time, he believed that scientific observation was necessary theory-driven. He acknowledged that the growing use of computer would throw economics into a period of data-driven analysis of new phenomena, but he believed such evolution to be transitory. His views challenge the optimism of randomistas and machine learning apostles and the skepticism of those who think data are mediated by theory. It questions the significance of neat categories such as inductivism and deductivism to describe the dynamics of economic knowledge. If “this time, it’s different,” then a better depiction of the transformed theory-data relationships emerging from new instruments, research designs, and algorithms is in order.

Note: These archives were unearthed from the AEA archives by Matt Panhans and John Singleton . Together with many other ES gems, they are visible here. A comprehensive history of ES fellowship by Olav Bjerkholt is available here.