The prominence of the debate over ‘reswitching’ has obscured the importance of Piero Sraffa’s profound contribution to economics. It’s time to revisit and build on that body of work

It would be, I believe, a mistake to see (as has been sometimes suggested) in Sraffa’s analysis a causal system rival to the standard neoclassical model of the determination of prices, quantities, and the distribution of incomes. Sraffa was changing the nature of the inquiry—toward an important but neglected theme—rather than providing a different answer to a given question already in vogue in contemporary economics. — Amartya Sen (2004, p. 588, emphasis in original).

When Piero Sraffa’s book Production of Commodities by Means of Commodities was published in 1960, it was received with perplexity by the larger economics community. It was not clear what the work was all about. Though leading economists of the day perceived that there was something profound in it, they were not able to put their finger on what that was. Sir Roy Harrod’s (1961) review of Sraffa’s book is the case in point. Though Harrod showed a profound lack of understanding of Sraffa’s treatise, he nevertheless acknowledged that “The publication of this book is a notable event. … A reviewer would be presumptuous if he supposed that he could give a final assessment of the value of its net product, or even single out what may prove to be its most lasting contributions. Before that result could be achieved, much prolonged consideration and reconsideration would be required” (p. 783).

The book came to prominence in mid-1960 when the now famous capital theory debates between the “two Cambridges” reached their climax. Apparently, Paul Samuelson at the MIT, Cambridge, Massachusetts, had set his doctoral student David Levhari the task of disproving a proposition of Sraffa regarding “re-switching of techniques.” Levhari published his refutation of Sraffa’s proposition in the Quarterly Journal of Economics in 1965.

Geoffrey Harcourt once recounted to me that he was perhaps the first person in Cambridge, UK, to have come across this paper by Levhari at the Applied Economics Library. He went straight to Sraffa and told him that “there is a chap at MIT Cambridge who claims that your re-switching proposition is false.”

Sraffa responded: “No, he is wrong, and you show it to him!”

Harcourt responded: “Me? I can’t do matrix algebra.”

To which Sraffa responded: “Neither can I.”

So Luigi Pasinetti was asked to do the job, and the rest is history.

In 1966, Samuelson organized a symposium in the QJE, in which it was accepted by all parties, including Samuelson himself, that Levhari had made a mistake and that Sraffa’s proposition is, of course, robust. The proposition in question refutes the Clarkian-type neoclassical explanation of the rate of interest on capital on the basis of the “marginal productivity of capital,” which requires measurement of “intensity” of capital independently of the rate of interest. Sraffa’s “re-switching” proposition showed that, in general, there is no logical way by which the “intensity of capital” can be measured independently of the rate of interest — and hence the widely held neoclassical explanation of distribution of income was logically untenable.

This victory was hailed as the crowning glory of Sraffa’s book, but it came at a high price. The orthodoxy interpreted Sraffa’s re-switching proposition as his main contribution to economic theory; they accepted its truthfulness and argued that the modern general-equilibrium orthodox economics need not aggregate capital independently of prices or the rate of interest, and hence the Sraffa critique of the orthodox theory was not fatal but rather minor. Samuelson’s (1959) non-substitution theorem had already shown that a General Equilibrium model with the assumption of constant returns to scale and no possibility of technical substitution can generate classical-type price solutions independently of demand functions. In 1982, Frank Hahn published an influential paper in the Cambridge Journal of Economics in which he claimed that Sraffa can be incorporated as a special case of the inter-temporal General Equilibrium Model (see Sinha 2010, 2016 for a rebuttal). All this led to a general perception among the orthodox that the book on Sraffa can finally be closed. In a strange way it appeared that Sraffians lost the war after winning the great battle.

One reason for this, was that perhaps the war was fought on side issues. My last several years of archival research (largely funded by INET and CIGI, see Sinha 2016) has led me to conclude that the battles, both in the areas of pure theory and history of thought, were fought on the wrong terrain—the question of re-switching of techniques was not the central aspect of Sraffa’s pure theory. It is a book that was designed to challenge the orthodox economic theory in a more fundamental way—there lies a methodological and philosophical sub-terrain underneath the apparent economic theory of the book. We should not forget that Ludwig Wittgenstein credited Sraffa for “the most consequential ideas” of the Philosophical Investigations (1953) and had put him high on his short list of geniuses. Wittgenstein had regular discussions with Sraffa for more than a decade during 1930s and ’40s in Cambridge, England, and at many occasions he told his friends that those discussions “made him feel like a tree from which all branches had been cut” (Monk 1990, p. 261). Thus the philosophical sophistication and sharpness of Sraffa’s mind is beyond doubt. Unfortunately, Sraffa’s revolutionary contribution to economic theory was lost to the intellectual world because economists did not pay attention to the philosophical underpinnings of his economic theory.

Actually, the book was designed to challenge the usual mode of theorizing in terms of essential and mechanical causation — prices are shown to be neither ultimately caused by labor or utility/scarcity, nor are they determined by the forces of demand and supply. It, instead, argues for a descriptive or geometrical theory based on simultaneous relations. Sraffa demonstrates that on the basis of observed input-output data of an interconnected system of production, one can show, by simply rearranging them, that the rate of profits of the system can be determined without the knowledge of prices, if the wage rate is given from outside the system. In this context, prices have only one role in the system and that is to consistently account for the given distribution of the net output in terms of wages and the rate of profits (introduction of rent of land does not make any difference to the result). Prices, in this context, do not carry any information that prompts “agents” to adjust their supplies and demands to bring about an equilibrium in the market. The questions of equilibrium as well as market structure are simply irrelevant to the problem.

A consequence of this approach was a complete removal of “agent’s subjectivity” or demand, and “marginal method” or counterfactual reasoning from economic analysis — the two fundamental pillars of orthodox economic theory. What Sraffa’s alternative economic theory establishes is that income distribution in terms of wage rate and the rate of profits are linearly related to each other and can be taken as given independently of prices. Now prices for any given input-output data must be such that those given distributional variables are consistently accounted for — a conclusion that stands in stark opposition to the orthodox economic theory, which maintains that both the size and distribution of income are determined simultaneously with prices. Sraffa’s discovery of the “Standard commodity” plays the central role in establishing this thesis; and his reinterpretation of classical economics is also rooted in the above proposition.

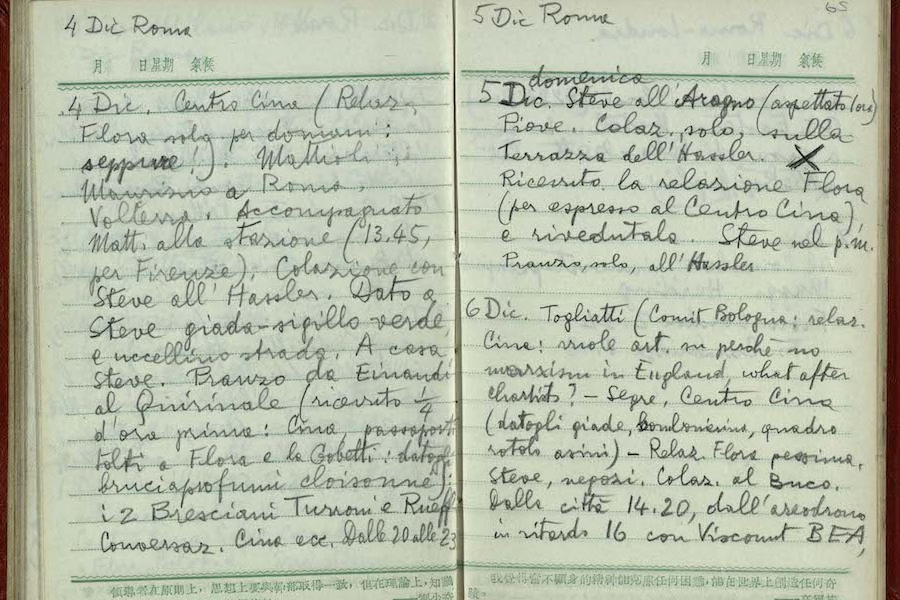

Though the work on the propositions finally published in 1960 had started in 1927, it appears that most of the intense work took place in two concentrated bouts of three years —1927-31 and 1942-45, with a decade break in between. Actually, there is almost a complete gap of twenty years of work in Sraffa’s archive, for the period 1931-41 and again for the period 1945-55, which is highly puzzling. In any case, the first period was intensely devoted to the broader philosophical and methodological questions. The idea of establishing a non-causal descriptive theory of prices in opposition to theories built on essential cause and mechanical causation was worked out during this period and the main theoretical problem to be solved was: “How to ‘justify’ or explain the equal percentage added to initial stock of each industry. This assumes tacitly a sort of ‘equality’ that has not been postulated” (file # D3/12/6: 10, Winter 1927-28, see Sinha 2016, p. 54). This was a problem because a solution to his system of equations required the assumption of a uniform rate of profits for all industries but his non-causal theory could not use the classical explanation, which uses the mechanism of gravitation, because that assumes constant returns and mechanical causation to bring about the required adjustments in inputs and outputs through the movements of “market prices” to “natural prices.”

During the 1942-45 period, Sraffa concentrated on a problem, which he referred to as “My Hypothesis.” The “hypothesis” in his own words, was: “What is demanded of a model is that it should show a constant (constant with respect to variations of r) ratio between quantity of capital & quantity of product. If this can be constructed and proved to be general, a number of important ‘consequences’ follow” (file # D3/12/16: 14, dated Aug. 1942, see Sinha 2016, p. 115). That is, the value of the ratio of net output to total capital of a system remains constant as the rate of interest, r, is varied from zero to its maximum value R, which is the ratio of the value of net output to capital. Now, given a system in a “self-replacing state,” i.e., when all inputs can be deducted from outputs in physical terms, we have in general a physical ratio of net output to total capital of the system that is made up of heterogeneous goods. The value of this ratio can only be found out when physical outputs and capital goods are multiplied by their prices.

The problem is that, in general, variations in r leads to variations in prices, which in turn leads to apparent variations in the value of this ratio. Sraffa, however, finally succeeded in showing that such changes in the net output-capital ratio happen due to the arbitrary nature of the measuring standard. By rearranging (i.e., rescaling) the input-output data of the real system, Sraffa derives another system of inputs and outputs, which, in some sense, represents the average of the given system and is mathematically equivalent to that system. Sraffa called it the Standard system — in this system the aggregate inputs and outputs are made up of same goods occurring in the same proportion, thus the ratio of net output to capital is well defined in physical terms and is independent of prices. The aggregate of the Standard system can be seen as the average industry of the real system in the sense that the ratio of capital to labor of the Standard system represents the average ratio of capital to labor of the real system and that this system produces a composite commodity, which can be characterized as the “average commodity” of the real system. Sraffa called this composite commodity, the Standard commodity and showed that if the Standard commodity is chosen as the standard of measure for measuring prices and the given wages then it can be shown that the ratio of net output to capital remains constant with respect to changes in r. Thus the Standard commodity allows us to see that for any given system the relationship between wages and the average rate of profits is given by: r=R(1-w).

Given that it has been proved that R is independent of prices and hence remains constant with respect to changes in r, we know that r and w are linearly related to each other; so given the value of w, we can calculate the value of r without any knowledge of prices—this proves that for any given system of production, distribution can be taken as given independently of prices. Now, prices can be found out by plugging r, which is derived from the above equation, in the original equations. The original system of equations now turns into a linear system of equations—just like equations for subsistence economies (this explains why Sraffa’s book starts with a description of subsistence economy). This also explains why Sraffa’s interpretation of Ricardo (and classical economics in general) heavily relies on Ricardo”s problem of the “invariable measure of value” and its relation with variations in the rate of profits in his theory of value.

Unfortunately both the followers of Sraffa, led by Pierangelo Garegnani, as well as his critics, led by Paul Samuelson, did not understand the significance of the Standard commodity in Sraffa’s theoretical scheme. This was perhaps because they read his theory to be an equilibrium theory of prices in a competitive market economy. My contention is that this interpretation was built on a false understanding of the condition of a uniform rate of profits across industries in Sraffa’s book. With the help of overwhelming evidence and mathematical reasoning, I argue that the condition of a uniform rate of profits in Sraffa’s system of equations is not a reference to the equilibrium position in a competitive market, but is rather a logical necessity or a mathematical property of his system of equations, once wages are taken to be given from outside—the result follows from the property of average and the Standard system being the average of the real system.

In his endorsement of my book (Sinha 2016), Samuel Hollander puts it thus: “Sinha puts paid thereby to alternative readings of that enigmatic work [Sraffa 1960], including that of the late Pierangelo Garegnani, Sraffa’s student and the leading Sraffian commentator.” After the publication of this book, I hope scholars interested in pure economic theory and history of thought would take a second look at Sraffa’s contribution to economics and see what could be built on the new foundation provided by him.

- 1. Hahn, F. 1982. “The Neo-Ricardians,” Cambridge Journal of Economics, 6: 353-74.

- 2. Harrod, R. F. 1961 “Review of Production of Commodities by Means of Commodities: Prelude to a Critique of Economic Theory,” The Economic Journal, LXXI: 783-87.

- 3. Levhari, D. 1965. “A Nonsubstitution Theorem and Switching of Techniques,” Quarterly Journal of Economics, LXXIX (February): 98-105.

- 4. Monk, R. 1990. Ludwig Wittgenstein the Duty of Genius. London: Vintage

- 5. Samuelson, P. 1959. “A Modern Treatment of the Ricardian Economy: I & II,” Quarterly Journal of Economics, 73(1): 1-35 and 79(2): 217-31.

- 6. Sen, Amartya. 2004. “Economic Methodology: Heterogeneity and Relevance,” Social Research, 71(3): 583-614.

- 7. Sinha, A. 2010. Theories of Value from Adam Smith to Piero Sraffa, London: Routledge

- 8. Sinha, A. 2016. A Revolution in Economic Theory: The Economics of Piero Sraffa, AG Switzerland: Palgrave Macmillan

- 9. Sraffa, P. 1960. Production of Commodities by Means of Commodities, Cambridge: Cambridge University Press.

- 10. “Symposium 1966 on Reswitching of Methods,” in Quarterly Journal of Economics, 81

- 11. Wittgenstein, L. 1953. Philosophical Investigations, Oxford: Basil Blackwell