Besides changes in institutions and social norms, other phenomena could explain a rise in the profit share.

My friend Michalis Nikiforos along with Simon Grothe make essentially two points related to my blog, which had questioned the evidence of profit-led inflation when only looking at profit shares in value-added or markups over unit labor costs. They note that some sectors benefited from higher profit margins because of rising prices as determined on world markets (or on futures markets), a point I had conceded in one sentence of my blog. Their second point is that if there is a rise in the price of imported materials accompanied by a fall in real wages (at constant labor productivity), this becomes part of their definition of profit-led inflation, or more precisely what they call a cost-push-profit-led inflation. Thus, if individual firms try to push back on workers an increase in the cost of materials, or at the national account level if firms try to push back on workers an increase in the cost of imported materials, there would be profit inflation. Everyone is free to use their own definitions. Personally, I prefer to stick with the idea of profit-led inflation when markups on unit direct costs (labor and materials) are rising. It seems to me that this kind of situation, where either the profit rate or the real wage must fall is at the heart of what most post-Keynesians would call conflict inflation.

But even this latter definition may be misleading. What if there is an increase in the capital-to-capacity ratio (the degree of capital intensity), due to new techniques or a change in the composition of economic activity towards firms or industries with higher degrees of capital intensity? As long as firms set prices on the basis of normal cost pricing, or more precisely on a target-return pricing procedure, as recalled by Frederic Lee (1998, p. 205) in his book on Post Keynesian Price Theory, this should induce an increase in the overall markup and hence in the profit share. Is this profit-led inflation? I would tend to say no, as long as the rise in the markup would occur at a constant target rate of return. Bob Rowthorn (1981, p. 21) may have been right after all in wondering why his colleagues at the time ‘focus their attention on the share of profits in output rather than the rate of profit.’

Besides changes in institutions and social norms, or bargaining power, which Nikiforos and Grothe rightfully mention, other phenomena could explain a rise in the profit share. In the Godley and Lavoie (2007, p. 277) book, we explain that when sales exceed production, thus leading to a fall in inventories, this mechanistically leads to a rise in the profit share in national income, with constant markups and without taking into account overhead labor costs (with or without inflation). I grant right away that this effect is likely to be small with real data, although the pandemic saw wide fluctuations in output and sales.

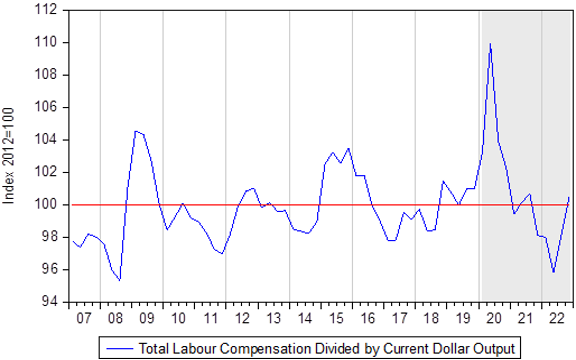

Finally, Nikiforos and Grothe say that ‘2020 did not see a meaningful drop in the profit share.’ This may well be the case in the USA, but in Canada, using here the wage share data and figure provided by my colleague Mario Seccareccia, there was a huge drop in the profit share in 2020, with the wage and profit shares going back later to their trend values of the 2010s.