The United States Treasury Department, in its Semiannual Report on International Economic and Exchange Rate Policies, charged that the German current account caused a “deflationary bias for the euro area, as well as for the world economy.” International observers have been ridiculing the German government, with its obsession with export surpluses, wage and price competitiveness, and fiscal discipline (see here, here, here and here).

There is a widespread fear that Germany’s beggar-thy-neighbor policies may push the euro zone into a Japanese-like deflationary trap. Even the European Commission seems to “utter the unmentionable”to the Germans – that their persistent current account surplus is not a sign of a healthy economy but in fact a macroeconomic imbalance subject to the EU’s macroeconomic imbalance procedure.

The current discussion about Germany’s trade surplus is, of course, part of the much broader debate about global current account imbalances, which are widely seen as a major underlying cause of the Great Recession starting in 2008. Fiscal policy and real exchange-rate misalignments are agreed to be important factors behind the imbalances. Yet, the important role of income distribution in the widening of global imbalances since the 1980s has not been widely recognized, as we explain in two new working papers (here and here) that are part of a project funded by the Institute for New Economic Thinking.

Several economists (here, and here) have pointed out the link between the secular rise in (top-end) income inequality, the fall in household saving, the rise in household debt, and the decrease in the current account in the United States and other Anglo-Saxon countries.

The most compelling variant of the story is one of upward-looking status comparisons, or “expenditure cascades.” The bulk of real income gains over the three decades prior to the Great Recession went to the very top (“the 1%”) of the income distribution, but households below the top have emulated the higher standard of living of the rich and superrich, by saving less and less by and going more and more into debt. This has contributed to the rising current account deficits and ultimately to the household-debt crisis.

In recent years, an impressive amount of research has gone into studying the evolution of top household income shares over time and across the world. This has made it possible to analyze the effects of changes in top-end personal income inequality on national current account positions. Michael Kumhof and Romain Rancière of the International Monetary Fund and their co-authors have shown that higher top income shares are negatively related to the current account in a macroeconomic panel of developed countries.

They also find that the rise in top income shares can explain a substantial fraction of the decrease in the current account in countries like the United States or the United Kingdom. In these countries, top income shares have followed a “U-shape” pattern, showing a strong secular increase since the early 1980s, after an equally strong decrease following the Great Depression and continued after the Second World War.

Clearly, the current account deficits of one group of countries are the current account surpluses of other countries. In countries such as Germany or Japan top income shares have not increases nearly as much as in the Anglo Saxon countries; they have followed an “L-shape” pattern. With top-end income inequality stable, there was no need for households below the top of the income distribution to engage in expenditure cascades. Part of the current account surpluses of these countries was therefore simply the result of inequality-induced overspending in the United States, the United Kingdom and elsewhere.

There is more to it than just this mirror-effect, however. Income distribution also plays a very important role in explaining the persistent underspending and weakness of private demand in the current account surplus countries. In fact, the popular distinction between U-shape and L-shape countries (in terms of top-end inequality) is misleading to the extent that there has been a stronger decline in the household-sector and labor income shares in some major L-shape countries than in the main U-shape countries.

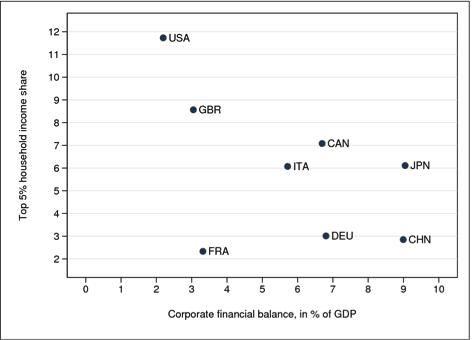

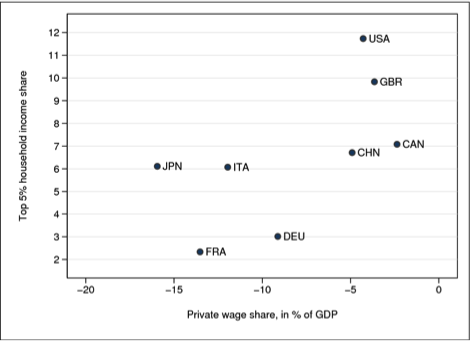

Interestingly, the strong decline in the wage share in some important L-shape countries went hand in hand with substantial increases in corporate sector saving, as shown in the figure below. While corporations in the U.S. and U.K. have largely passed on their rising returns to households in the form of top executive remuneration, bonuses, or dividends, thereby exacerbating top-end income inequality, corporations in the current account surplus countries have retained their profits but not increased their spending proportionally, i.e., they have accumulated financial surpluses. This has weakened private consumption, to the extent that households’ spending reacts more strongly to increases in their current real income than to notional capital gains of the firms of which they are the owners (household do not fully ‘pierce the corporate veil’). In sum, the shift in functional income distribution at the expense of the household sector has weakened domestic demand resulting in a higher current account balance.

The figure shows the change in the corporate financial balance as a % of GDP (left panel) and the private wage share (right panel) on the horizontal axis against the change in the top 5% household income share on the vertical axis, for the period 1980/3-2004/7 (four-year averages). For the United Kingdom changes are shown for the periods 1984/7-2003/7 (corporate balance in % of GDP) and 1980/3-2004/7 (private wage share). For China changes are shown for the periods 1992/5-2000/3 (corporate balance in % of GDP) and 1984/7-2000/3 (private wage share). Behringer/van Treeck (2013)