Vice always comes disguised as virtue. No exceptions.

Introduction

The organizing ideas of a discipline determine what gets seen and what does not. Because they dominate disciplinary commonsense and operate as a system, those ideas are difficult and disruptive to change. This is a particular problem for economics. For it emphasizes technical mastery, far more than critical scrutiny of the ideas behind the techniques and the reformulation of those ideas as experience unfolds. This essay provides just one example of the costs of this unhappy arrangement.

One way economists describe their discipline to themselves has proven beguilingly seductive since it was codified by Lionel Robbins 90 years ago — that economics is the science of scarcity and that it is, therefore, paradigmatically about trade-offs. So ingrained is this approach that my questioning it may come as a shock. But that is my purpose here. As Mark Twain apparently didn’t say, “it’s not what you don’t know that gets you into trouble, but what you know for sure that just ain’t so.” Indeed, I show this approach has become a kind of counterfeit metaphysics — a means by which practice becomes increasingly thoughtless and alienated from economic reality whilst practitioners affect rigor and insightfulness.

Here’s an introductory example of the way in which trade-offs are assumed as necessary when they are anything but. In the 1970s, manufacturers presumed there was a necessary trade-off between cost and quality. Quality improved as one increased spending on tighter tolerances and more inspectors to catch production errors. But Toyota developed a profoundly different approach in which meticulous attention to getting it “right first time” in the production chain dramatically improved quality and lowered cost. Moreover, this set the stage for future productivity growth as production teams strategized and bug-fixed their way to endless design and workflow optimizations. Astonishingly, within two decades Toyota’s labor productivity was four times that of its American rivals. By the mid-1980s, the two car models with the highest build quality were luxury Mercedes Sports (assembled with more inspectors per car than any other) and the Toyota Corolla (assembled without any inspectors at all)!

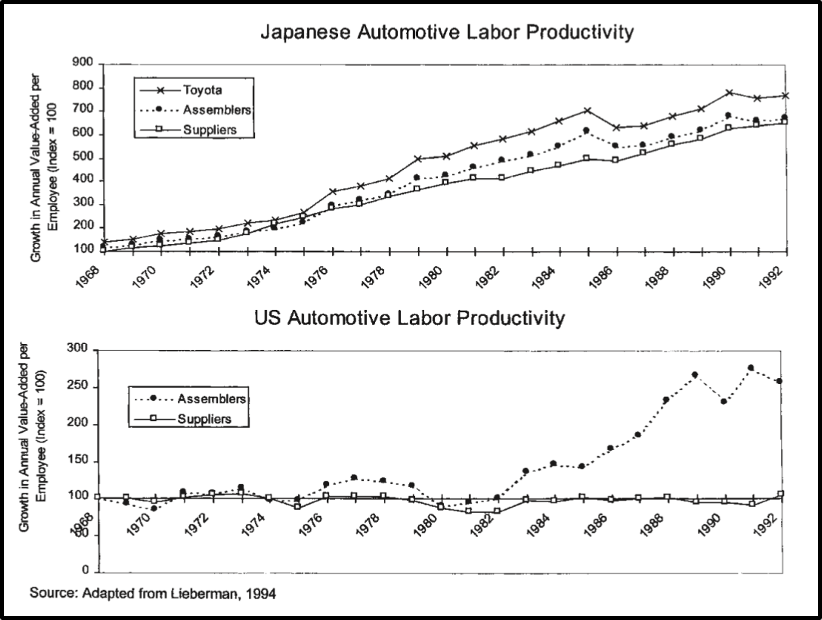

Figure 1: Japanese and US labor productivity (1968-1992). Credit: Jeffrey H. Dyer, Kentaro Nobeoka, 2000. “Creating and managing a high-performance knowledge-sharing network: the Toyota case” Strategic Management Journal, March 21, 2000

Is it too much to expect that economics might be fascinated with such phenomena, and obsessed with finding and exploring such “free lunches” and bringing more of them into being? Alas, economics’ all-purpose method discourages curiosity about such things when it’s not altogether assuming them away. Numerous sub-disciplines of economics have emerged in the last generation, but they’ve all emerged from the internal imperatives of the discipline — from innovations in economic theory, econometric method, or data availability. None of these, of any professional significance, has taken its cue from emerging phenomena in the economy itself despite some remarkable developments that have shown us new forms of economic relations. Peer production and the collective debt obligations behind microcredit are some examples. Toyota’s production system is another example.

Toyota wrought far-reaching and subtle transformations to a whole socio-technical system. After a decade of denial, American firms spent the next decade trying to copy Toyota’s method. We can see this in the chart above as we can also see the Americans’ failure. As Edwards Deming (the American process control engineer who’d helped develop the Toyota system) put it mischievously, “American management thinks that they can just copy from Japan—but they don’t know what to copy!” Put differently, the methods of American management rendered how Toyota achieved its miracle invisible. By a similar means, the miracle remains invisible also to neoclassical economics, a subject on which we expand in what follows.

Economics Strives to Become a Science

Particularly since the late 1800s, economics has famously striven to become a science. It was rebuilt around the mathematics of classical physics. It was also given a singular focus — as the science of scarcity. But this method became the master rather than the servant of economic inquiry. Economic life as experienced was increasingly pushed out of view to make the chosen methods work.

Alfred Marshall was an early architect of the transformation. But he sought a methodological fusion, between formal economic theory and deep familiarity with economic life. The echoes of these disciplinary values survived through to the late 1930s. Thus, as they contributed to the edifice of neoclassical economic theory, theorists like John Hicks closely considered the compromises they made between the simplifying assumptions necessary to get the mathematics to come out and the extent to which this falsified economic reality.

By contrast, the leader of the post-war generation of economists, Paul Samuelson, regarded Marshall’s attempts to bridge the divide between economic theory and economic life as hopelessly confused. He was right that they were “fudges,” but matching thought to life is like that. And the new approach solved Marshall’s problem by essentially ignoring it. Those discussions carefully explained why the theorists’ choice of tools was the best solution to the specific intellectual dilemmas at hand became increasingly perfunctory. In the upshot, as Paul Krugman has noted, it became both normal and acceptable for major economic phenomena that couldn’t be easily captured in formal models to become invisible to professional economists, a pattern repeated again and again, including, Krugman admits — with remarkably little unease — in his own work.

By a strange alchemy, economists’ new method was projected back into economists’ presumptions about the nature of economic reality itself. Philosopher E. A. Burtt identified the phenomenon a century ago:

[If a man be] engaged in any important inquiry, he must have a method, and he will be under a strong and constant temptation to make a metaphysics out of his method, that is, to suppose the universe ultimately of such a sort that his method must be appropriate and successful… But inasmuch as the positivist mind has failed to school itself in careful metaphysical thinking, its ventures at such points will be apt to appear pitiful, inadequate, or even fantastic.[1]

Samuelson understood the economic world to be so constituted that it would yield its secrets to his method. He had expected the new approach to “accumulate a convergent body of econometric findings convergent on a testable truth.” Forty years on he confessed that his expectation “has not worked out.”

Trade-offs As a Paradigm

Compared with other objectives, how much should we value economic efficiency — the effort in inputs like labor and capital required to produce a given output of goods and services. How much should we value equality? How important is people’s health compared with these other objectives? These are difficult questions of values with which economists rarely grapple directly. On the other hand, economists are more confident in their assertions about the relationship between these values in the wider world: They must be traded off against each other. Thus Arthur Okun titled his 1975 landmark work for the Brookings Institution Equality and Efficiency: The Big trade-off. His point is straightforward enough. Writing when America’s economy was suffering from overcommitment to various objectives — from the war in Vietnam to the war on poverty — Okun made the timely but obvious point that, taken too far, the promotion of equality can harm efficiency.

As he put it, governments redistribute income via “leaky buckets.” Both subsidies and the tax necessary to fund them impose costs both in administration and by changing incentives, and thus behavior. As redistribution increases, the leaks grow and policy effectiveness diminishes. At the limit, absolute income equality shears away all material incentives to work and invest.

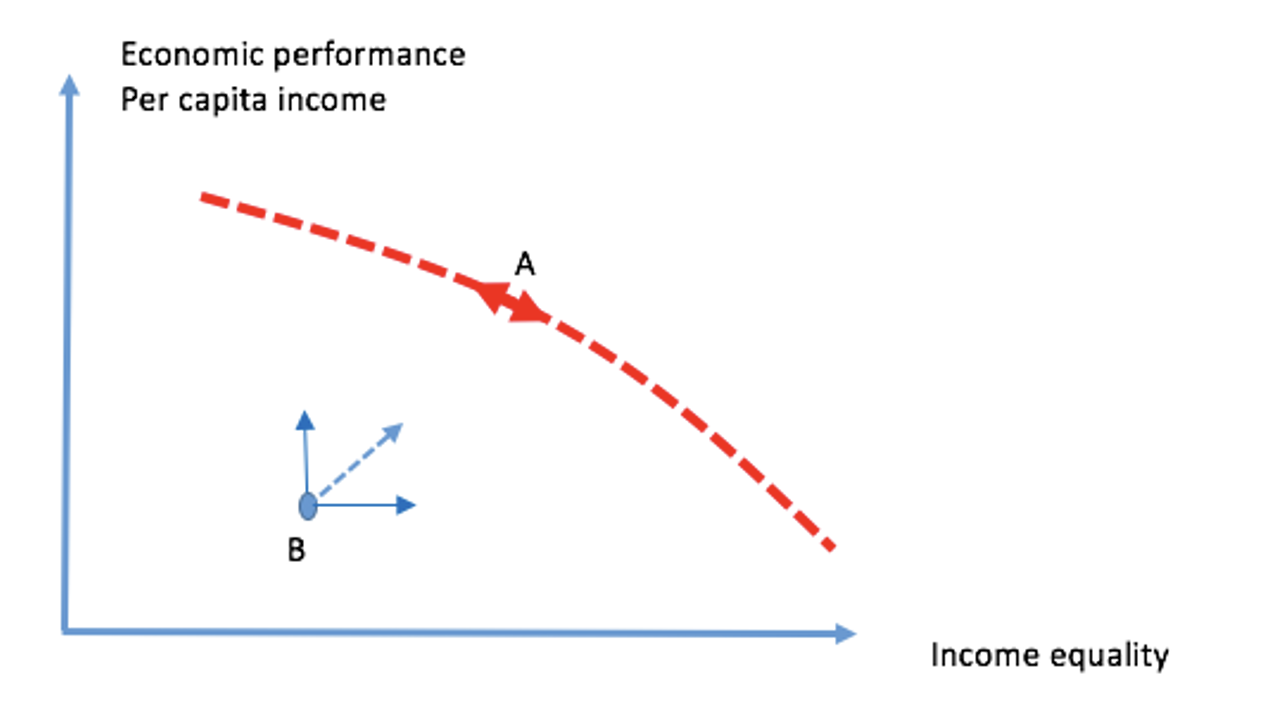

However, except somewhere near the limit, it’s far from clear where the trade-offs between efficiency and equality become substantial. And, as I’ll argue below, efficiency and equality can also complement each other as much as productivity and quality complement one another in a Toyota factory. But economics is impatient with such complications, teaching its students that efficiency and equality are paradigmatically competing values — as in this 2016 explanation and the accompanying diagram:

Policies like taxes and transfers can contribute to ensure a more equal distribution of income. However, this comes at the cost of distorting incentives for work, education, investment and so on, which in turn leads to a worse economic performance.

It’s almost as if these two abstract entities “efficiency” and “equality” were two products an economy could produce. Oh, wait …. It’s exactly like that. This is the same diagram you’d get to illustrate your choice of how many apples or oranges you want to produce — or consume. Like so many things in neoclassical economics, a particular way of thinking — legitimate enough in its domain — is then totalized. The result is a discipline that’s rendered strangely incurious and emptied of empirical content.

The reason for the tradeoff relationship between equality and efficiency is the empty one that equality is not efficiency. In this schema, there’s a trade-off between efficiency (or the production of apples or anything else) and the production of anything that’s not efficiency (or not apples — like oranges). There’d be a trade-off between spelling performance and efficiency. Just change the x-axis to good spelling and the more effort you put into it (you know, with spelling bees in schools and old people’s homes, TV quiz shows, cruise ships, and so on) well it’s all at the expense of how far you can get on the Y-axis of efficiency.

This structuring of entire bodies of thought around the empty observation that one thing is not another thing is replicated endlessly. Thus this Health Economics textbook tells us of a health ‘trilemma’ constructed out of nothing more than three different abstract values embodied in health policy — health, wealth (or the efficiency of delivery), and (health) equity.

Figure 15.1 depicts the three-pronged trade-off inherent in health policy. In an ideal world, all three goals would be attainable at once: people would live long, healthy lives; pay very little for health care; and this happy state of affairs would be available to everyone in society.

In practice, though, it is impossible to have everything. Any attempt by a nation to move closer to one of these three goals necessarily involves a trade-off that moves that nation further away from some other goal. Any hypothetical policy X that effectively combats adverse selection and increases equity, for example, would either increase costs or lower health at least for some. That there are trade-offs between these three goals should not be surprising. If all three goals could be met simultaneously, health policy would not be a source of endless political acrimony – nor would it be interesting or important to study. (Emphasis added)

And yet, as was obvious from the get-go and made even more so by the COVID pandemic, a community’s health is a fundamental input to its economy.

An alternative (institutional) framing

Here’s a very different but equally general analysis. The queue above forms spontaneously between complete strangers. It’s simple, a little like an economist’s model, but its role in the analysis is not to produce mathematical tractability. Rather, it takes queuing — a simple and often spontaneous social phenomenon — as a paradigm of something more general that the philosopher William James expresses as follows:

A social organism of any sort whatever, whether large or small, is what it is because each member proceeds to his own duty with a trust that the other members will simultaneously do theirs. Wherever a desired result is achieved by the co-operation of many independent persons, its existence as a fact is a pure consequence of the … faith in one another of those immediately concerned. A government, an army, a commercial system, a ship, a college, an athletic team, all exist on this condition, without which not only is nothing achieved, but nothing is even attempted.

The idea can be given a more modern point of departure via the scholarly consensus that has arisen since the late 1970s,[3] that humans’ extraordinary and unique capacity for shared intentionality is the foundation of our astounding productivity. The most fundamental means by which this is done is via what I have called generative orders — language and culture being preeminent examples, though markets and money are others. Within these generative orders, our cognition of the world, our intentions, and our mutual expectations of each other are entangled. This foundation enables us to build other special-purpose institutions such as those mentioned by James above.

The spontaneous queue illustrated above is an instant, informal, special-purpose institution — a mini-world within a wider world. As such it provides the seed for a “theory” of institutions. It is built from each member’s understanding that:

- It helps them achieve something with others they couldn’t otherwise achieve individually; and

- Members assume reciprocal obligations towards each other.

Our queue works well when people understand and honor those obligations. It breaks down if individuals exploit others’ goodwill for their own private gain. So there is an integral relationship between efficiency and equality of treatment in such cases. But as much as we can distinguish them in our minds as abstract concepts, they’re not to be experienced as such in economic life — where they only occur fused together, inseparable. Just as quality was made fundamental to efficiency on Toyota’s production line, fairness is fundamental to the efficiency with which we cooperate within and through institutions.

Conclusion

Does any of this prove that greater equality necessarily improves efficiency? Obviously not. My point has simply been to show one theoretical framing of the relationship between efficiency and equality that proceeds from careful, critical observation of and abstraction from reality. If this is well-judged, our understanding of reality improves as do our prospects of improving it. The textbook approach couldn’t be more different. Turns out that it is metaphysical fairy-floss. The “efficiency-equality” trade-off exists as a particular case of the general one that if you wish to achieve one thing, doing something else could get in your way. That applies whether the things in question are apples, oranges, efficiency, spelling prowess, bananas, Nobel Prizes, stop signs, or fortune cookies. Oh — I nearly forgot — and equality. Who knew?

Disciplines like economics can be worse than useless without proper attention to what Mary Midgely called their ‘philosophical plumbing’ — the way their organizing ideas are brought into relation to get us closer to reality — like the philosophical plumbing I’ve offered in this essay. Without it, the ideas and techniques economists use are unmoored from any wider accountability for actually helping us understand the world. Yet that kind of close-grained reflectiveness about the way ideas are used in situ is completely absent, both from learned journal literature and from the core economics curriculum. (Indeed, in my experience, it barely makes its way into the “philosophy/methodology of economics” literature and pedagogy preoccupied as they have been with various more ponderous set pieces — for instance, Popper’s falsificationism and Milton Friedman’s call to judge theory by the quality of its predictions rather than the realism of its assumptions).

Finally, note how frequently the kind of thinking I’ve been critiquing in this essay perpetrates the fallacy of the excluded middle — and how much damage this has done to the fabric of economic and political debate, and therefore to our economy and polity. Thus, Friedrich Hayek compellingly demonstrated the impracticability of managing a complex economy entirely from the center. But he took this demonstration of the impracticality of one extreme to justify a lurch towards the other and the general principle that less government was in principle preferable to more. This piece of motivated impatience in going from arguments to practical conclusions — so typical of intellectuals — was a spectacular non-sequitur from which many economists have still not freed themselves and from which the world has still not recovered.

Notes

[1] E. A. Burtt, 1925. The Metaphysical Foundations of Modern Science, Kegan Paul et al, p. 226.

[2] Samuelson, P. A., 1986. “My Life Philosophy”, in Crowley, K. (ed), The Collected Scientific Papers of Paul A. Samuelson, Volume 5, Massachusetts Institute of Technology, Boston. p. 793.

[3] Nicholas Humphrey’s 1976 paper “The social function of intellect” has pride of place as a kind of ‘ground zero’ in this story.

Thanks to Steve Roth, Gene Tunny, Peyton Bowman, Reuben Finighan and Martin Wolf for comments on earlier drafts and/or encouragement.