Like master illusionists, bank accountants conceal losses from federal regulators, putting the whole economy at risk

Accountants portray themselves as truth-tellers, but especially when they work for a dangerously undercapitalized bank, their jobs are far more complicated than that. In INET Working Paper 136, I compare skilled bank accountants to master illusionists such as Siegfried and Roy. Much as these famed magicians made audiences think that they could make large wild animals disappear, some bank accountants enhance their income by convincing client banks that they have the power to make losses disappear. But in both kinds of illusion, items we no longer see have not actually vanished. They have been moved surreptitiously to places for which outsiders have no sightline.

This relocation process occurs under the cover of one or another cloaking device. The paper identifies some of the devices that bankers use to cloak losses. The simplest of these involves under-reserving for known or anticipated loan losses by deliberately overestimating distressed borrowers’ ability to repay.

The research reported on here develops and supports the related hypothesis that what looks like an energetic effort by bank regulators and self-regulatory organizations to control loss concealment is at least partly a sham. In practice, details of banking reforms are worked out between bankers and regulators and confirmed by elected politicians. If successive banking reforms were not shaped to serve these parties’ joint interests, the wave after wave of counterfeit reform we observe would not be allowed to work so poorly or would at least be designed to work better for a longer time.

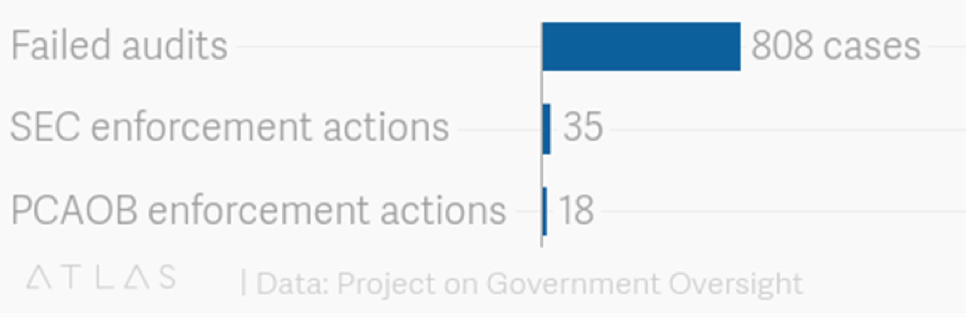

My INET paper develops circumstantial evidence that supports the narrower hypothesis that politicians and policymakers find it is in their joint interest to tolerate substantial loopholes in bank accounting rules and standards. Negotiating and enacting opportunities to hide bank losses serves the interests of politicians, bankers, and incumbent regulators alike, but does so in different and in subtle ways. Accountants know that this system could not continue to function unless regulatory forbearance extended to their work as well. Figure 1 shows that the Securities and Exchange Commission disciplined accounting firms in less than four and a half percent of the cases its investigators uncovered. The accounting industry’s self-regulatory arm –The Public Company Accounting Oversight Board—imposed penalties at roughly half that rate.

Financial stability is an explicit goal of modern central banking and every bank and central bank regards secrecy as an important tool. Elected and appointed officials make informational evasions and falsehoods available to insolvent bankers because their evasions and falsehoods help officials to minimize their own exposure to blame and let them block and reshape the flow of adverse information at critical times. Although many forms of government secrecy are openly embraced, loss concealment is an unacknowledged instrument. Its purpose is to discourage disorderly bank runs in periods of financial stress. Especially in the short run, authorities find it politically and reputationally less dangerous to suppress adverse accounting information than handing the taxpaying public an immediate and accurate accounting of the bill that is coming their way.

In view of the severity of the Covid-19 crisis, regulators have decided to be less sneaky this time around. They have openly advised examiners and bank accountants to help troubled bankers to make loan losses disappear from their firms’ balance sheets and income statements. Allowing too-big-to-fail banks to misrepresent the depth of their accumulating losses is one leg of a conscious strategy through which bankers and regulators hope to lessen the threat of destructive Covid-driven systemic runs on the world’s banking systems. The second leg of the strategy rests on another fiction. Prudential regulators around the world are telling us that they can and do maintain financial stability by assuring the adequacy of what they call “bank capital.” But the statistical measures of bank capital on which regulators focus their efforts are nothing more than repurposed variants of a bank’s accounting net worth. With accountants able to conceal the impact of losses on accounting net worth, until and unless unsophisticated household depositors begin to fear that a bank may have let itself become deeply insolvent, the effectiveness of this control framework is being badly oversold.

In an industry crisis, this disposition toward supervisory informational deception and regulatory forbearance creates a risk-hungry herd of what economists now characterize as “zombie” banks. A zombie bank is a financial institution whose economic net worth is less than zero, but which can continue to operate because its ability to repay its debts is credibly backed up by a combination of implicit and explicit government credit support.

A zombie’s managers can not only keep themselves in business, they can grow their assets massively. But they can only do this when and as long as creditors are confident that government officials somewhere are ready and able to force their country’s taxpayers to make good on any missed payments. Almost no matter what interest rate a central bank or deposit insurer charges a zombie for its emergency credit support, the funding is almost always being offered at what is de facto a subsidized rate. In providing this subsidy, taxpayers accept a poorly compensated equity stake in the survival of the zombie enterprise.

To treat taxpayers more fairly, it would be appropriate for authorities to presume that each and every bank threatened by a run is almost certainly undercapitalized. Because it is costly all around for depositors to close their accounts suddenly, it is reasonable to assume that at least the early wave of “runners” have seen something concrete to worry about. This line of thinking leads me to recommend that authorities should be required either to freeze the positions of uninsured creditors whenever a bank suffers a statutorily defined “abrupt and rapid shrinkage” in its liabilities or, in the event of a bank’s sudden failure, to have the right to reverse transactions by uninsured creditors whose ability to exit would not have been possible in the absence of the emergency funding supplied by the central bank or other government agency.

This blog seeks to explain that teams of financial illusionists stand ready to conceal developing losses and other forms of dishonest behavior. Bankers’ and regulators’ capacities for deception make it self-defeating for taxpayers to accept a social contract that turns on accounting measures of capital and self-administered stress tests. I believe that the world’s system for penalizing accounting misrepresentation at government-insured financial institutions desperately needs to include the possibility of imposing criminal as well as civil penalties on violators. The processes through which bankers extract benefits from the safety net closely resemble those of embezzlement and the rewards bankers garner usually rise to the level of grand larceny. The difference between street crime and safety-net abuse lies mainly in the class and clout of the criminal and the subtlety of the crime.

FIGURE 1 BIG 4 ACCOUNTING FIRMS WERE PUNISHED FOR ONLY A FRACTION OF FAILED AUDITS BETWEEN 2009 AND 2017 Source: ATLAS Data Project on Government Oversight