In the recent years, historians of economics have researched more carefully the apparent consistency, the institutionalization and the reasons for the success of this community, highlithing the contested influence of neocon foundations and societies, the importance of the Business and the Law schools, the ties with the institutionalism of the NBER, the role of scholars such as Theodore Schultz, Jacob Mincer, Aaron Director.

Much is yet to be done before we come to a broad and rich understanding of how economics at Chicago was constructed, bargained and spread. Ross Emmett has laid out a “research program” at the end of a r ecent review article, and I particularly endorse the need for a greater focus on Chicago empirical economics fashioned by Gregg Lewis, D. Gale Johnson, Zvi Griliches and Harry Johnson, and the importance of studying the impact of Chicago economics on governmental (and non-governmental) offices and agencies around the world. Yet, it is another limit of the current historigraphy that annoys me the most lately: the inability to document the relations between the department of economics and the Cowles Commission (today called the Cowles Foundation).

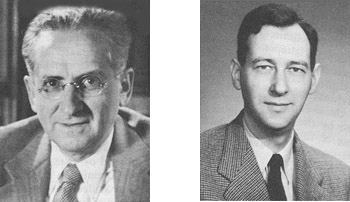

The Cowles Commission was located at Chicago between 1939 and 1955. Unusually concerned with their own history, its members have provided several historical accounts of their institution. From these, we get the picture of a changing group led by influential research directors, Ted Yntema (1939-1942), Jacob Marschak (1943-1947) and Tjalling Koopmans, and whose research interests evolved from the study of consumer and producer behavior during the war to the structural estimation econometric programs, with a rising concern for the theory of decision under uncertainty and general equilibrium in the early fifties. The Cowles has often been described by historians as a refuge for European mathematical economists and other scientists émigrés, who often carried with then a strong bent for rigourous formalization, walrasian theory, planning, and an unabashed hope that science could provide rational policy making and social engineering. A stream of visiting researchers and PhD students kept flowing in and out the commission, including Theodore Anderson, Kenneth Arrow, Herman Chernoff, Carl Christ, Evsey Domar, Trygve Haavelmo, Leonid Hurwicz, Lauwrence Klein, Don Patinkin, Herman Rubin, Sam Schurr, Franco Modigliani, Herbert Simon.

Marschak on the left, Koopmans on the right

The year the Cowles crowd arrived at Chicago, the department of economics was a small and multifaceted community which included (again see Emmett’s review) price theorist and international economist Jacob Viner, socialist capitalism thinker Oskar Lange, production and labor economist Paul Douglas, historians John Nef, Chester Wright and Frank Knight, and public finance theorist Simeon Leland, then head of the department. When the Cowles left to Yale in 1955, the department, chaired by agricultural economist T. W. Schultz since 1946, was undergoing significant changes. Its research, ranging from price theory to agricultural economics, consumer theory, labor economics and monetary economics was in the process of being structured by a variety of workshops, on the model of Friedman’s famous workshop on Money and Banking, initiated informally in 1951, then formally established in 1953 with a grant from the Ford Foundation. Its graduate program was also being aligned on the emerging conception of economic science fostered by members of the department: the numerous students enrolling in the graduate program had to pass a set of preliminary exams in price theory and monetary theory (the “core” exams), before they were allowed to apply the “toolbox” transmitted in these courses to various area of economics. Since his recruitment at the department in 1946 to replace Viner as a price theorist, it was Friedman who was teaching both the price theory course and the money course in these years.

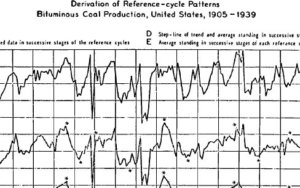

According to Emmett, the department of economics was located in the social sciences building, the “Eleven Twenty Six,” on the second floor, with the statistical laboratories on the fourth floor, down the hall from the Cowles Commission offices. The department also contributed to the funding of some Cowles research programs, and it was the biweekly workshop that Marschak instigated in 1943 that was the inspiration for the department workshop system. As has been often pointed out by historians, Friedman sometimes attended those workshops, and, whether because of the NBER tradition of econometrics he belonged to or his underlying scepticism toward social engineering, he often took this opportunity to deride Cowles econometricians’ ambitions.

And that’s it. That all we have.

Although my previous interests in Friedman and Marschak probably entail too narrow a focus of these two characters, I’d venture the conclusion that this is close to all we know on the relationships between the department of economics and the Cowles. It is indeed customary to write the history of such and such theoretical or empirical development by simply disregarding that a counterpart was being fashioned at the same moment two floors above or under, or, at best, by juxtaposing the two strands of research without assessing their interdependance and/or opposition. For instance, the history of Chicago price theory, from Viner to Friedman, is largely told without reference to its walrasian doppelgänger, beginning with Mosak and Lange and extending to Arrow and Debreu. In Epstein’s history of econometrics, the Cowles and NBER research in econometrics (Epstein calls the second “monetarist econometrics”) are confronted, but it’s not clear to what extent the two sides were involved in open debates or concealed power fights ( it is now known that Friedman participated to the Koopmans-Vining “measurement without theory” controversy through the advice he gave Rutledge Vining ).I hope I underestimate the number of historical pieces when contribution from Chicago and Cowles men are discussed together, and I take any reference along these lines.

Even when I restrict myself to my two favorite characters, Friedman and Marschak, the scope of my ignorance is distressing. As for their research, they shared more than is usually remembered, with intellectual trajectories crossing each other in these years. After years of work on budget studies, demand theory and monetary theory and its relationship to assets and liquidity, by the end of the forties Marschak was increasingly concentrating on the theory of decision under uncertainty, along the lines defined by Von Neuman and Morgenstern in their 1944 opus. Friedman had also written early on demand theories and experiments (with Allen Wallis in 1942), then completed a PhD on the income of independent professional practices at Columbia under the leadership of Kuznets and spent the war working as a statistician in various public agencies. Then, after writing down an analysis of gambling and insurance behavior within the framework set by VN&M with Jimmy Savage, he had spent the summer of 1948 reading material on the Great depression, money as an asset and the strange behavior of the velocity of money and was about to start a study of these elements at the NBER. Between uncertainty and monetary concerns, they thus had many common interests, as exemplified by their participation to the “colloque international sur le risque” organized by Alphonse Allais in Paris during the summer 1952.

But reasons to expect interactions, maybe oppositions, went beyond this. As remarked by Emmett, Marschak was the first formal link between Cowles and the department, being simulatenously named research director of the former and professor in the latter. Indeed, my record show that Marschak taught “Money, Banking and Business Cycles” until 1945 at least, then “Income, employment, and the Price level”(Ec 335) between 1848 and 1950 (a course in which he showed how agregate demand and supply interact and how they are “can themselves be derived from more basic relations, ie, the behavior patterns of single firms and households” and where different agregation methods are studied). He then switched to Ec303 “Economics of Uncertainty” in the fifties. Emmett makes it clear that during the fifties, the teaching of price theory and the theory of money would become the “core” whereby doctoral students became socialized into the Chicago way of doing economics. In this context, it would be interesting to know how the teaching of a stauch walrasian who advised his students to read Keynes, Lerner and Lange was perceived by this other group of economists seeking to advance what they labelled Marshallian price theory and, gradually, a revamped quantity theory of money.

Yet I have no clue on what Marschak and Friedman thought of each other, nor on their interaction during department meetings. Nor do I know more largely how many Cowles economists taught at the department, whether they had any decision power on the repartition of funds, the evolution of curicula, the recruting policy. I don’t know what the status of Cowles PhD students was, whether they had to attend the graduate courses proposed by the department. I know little on the theoretical and epistemological battles that took place in the corridors of the Eleven Twenty Six building and nothing of the institutional fights of the forties and fifties. Yet, tensions were strong enough for Arrow to state in later recollections that “Cowles was kind of a persecuted sect. The mathematical and quantitative emphasis was exceptional and distrusted.”

To be exhaustive, furthermore, an analysis of economics at Chicago in the poswtar era should also consider the relationships with other bodies, such as the Law School where Aaron Director was heading the Free Market study, the Committee on Social Thought, of which Hayek became a member in 1950, and the Graduate School of Business and Administration. Finally, the coexistence of Cowles and the department of economics at Chicago meant that two of the biggest journals in the profession were administered within the same building: the Journal of Political Economy and Econometrica, to which both department and Cowles economists contributed. How did they chose to submitt to one journal rather than the other, were the editorial lines biased in favour of such and such subject or technique? A huge number of theoretical advances, empirical studies, and tools of methods were produced at Chicago in the forties and early fifties. As long as we overlook one key element of the intellectual climate pervasive in that place in these years, we will fall short of a comprehensive understanding of these contributions.