Why to Be Wary of Another Volcker-Type Monetary Tightening

For a long time, stagflation was thought to be a thing of the past. But now there is a real risk of it coming back, warns the Bank for International Settlements (BIS 2022), the ‘central bank’ for the world’s central banks. High inflation is expected to be around for a prolonged period of time—as a result of the recurring reinstatements of lockdowns in China, the surge in global energy and commodity prices following Russia’s war in Ukraine, global warming, and the breakdown of global supply chains due to geopolitical tensions.

High inflation, wars in key commodity-producing regions, slowing economic growth, tightening monetary policy and turbulence in commodity stock markets resemble the dominant features of the global economy in the 1970s (UNCTAD 2022; World Bank 2022). “That period ended in the early 1980s,” as Martin Wolf (2022) reminds us, “with a brutal monetary tightening in the U.S., a sharp reduction in inflation, and a wave of debt crises in developing countries, especially in those of Latin America.” This much is true: the collateral damage to the world economy of monetary tightening by the Fed included a lost decade for development in most Latin American and African economies.

No one wants a repeat of this disastrous episode—more so now, right after the worst global recession in 90 years, in which more than 114 million jobs were lost, the cumulative (confirmed) global death toll due to COVID-19 is more than 6.5 million persons (and counting), and about 120 million people were thrown back into extreme poverty. The COVID-19 recession affected the most vulnerable segments of societies disproportionately hard, as the highly uneven fiscal response to the pandemic widened already yawning disparities and inequities within and between countries (United Nations 2021). Higher spending on social protection and pandemic relief and lower revenues from taxation led to higher public budget deficits everywhere, and public debts rose significantly. The average public debt to GDP ratio for emerging economies in 2020 was 64% in 2020, up from an average value of 52% during 2015-19. IMF (2022a) forecasts suggest that the public debt to GDP ratio in emerging countries will rise even further—to 74% in 2026. The higher indebtedness comes with greater vulnerabilities to financial shocks, including higher interest rates.

Soft versus hard landing

Nevertheless, support for a drastic monetary tightening in response to the rise in inflation during 2021-22 is growing in the U.S. and Europe. The most outspoken advocate of Volcker-like monetary tightening is Lawrence Summers (2022) who argues that “The US may need as severe monetary tightening as Paul Volcker pushed through in the late 1970s early 1980s.” Summers claims that the Federal Reserve may have to hike interest rates above 5% to beat back inflation, warning that if the Fed eases up in its inflation fight, this would be a “prescription for much higher interest rates and a sustained and very difficult stagflation that would have serious global consequences.”

No one doubts that further monetary tightening by the Fed will push the U.S. and the global economy into a recession. But opinions are divided over how deep and long-lasting the unavoidable recession will be. Establishment opinion is that “the time to throttle an inflationary upsurge is at its beginning, when expectations are still on the policymakers’ side,” as Wolf (2022) puts it. That is, the sooner and the more aggressive central bankers act, the lower will be the collateral damage to the (global) economy and the more likely the (global) economy will experience a ‘soft landing’.

The Bank for International Settlements (BIS 2022, p. 24) similarly warns, in its Annual Economic Report of 2022, that “the most pressing challenge for central banks is to restore low and stable inflation without, if possible, inflicting serious damage to the economy”, adding that “calibrating the response naturally involves a trade-off. Tightening too much and too quickly could inflict unnecessary damage. But doing too little would raise the prospect of a larger and more costly tightening down the road.” Establishment opinion firmly holds that it will be better to err on the ‘safe’ side—meaning that it is preferable to pre-emptively raise interest rates sooner and more aggressively, at the cost of a temporary and limited recession now, than to act more cautiously and risk inflation spiraling out of control, which would need much more strongly tightening later on and, hence, lead to a deeper and more prolonged recession (or worse).

This establishment opinion is urged upon central bankers in emerging and developing economies (EMDEs). For example, “a key lesson from the 1970s is,” according to World Bank (2022, p. 64), “that central banks need to act in a pre-emptive manner to avoid a loss of confidence in their commitment to maintaining low inflation [….] and to prevent a de-anchoring of inflation expectations.” For BIS (2022, p. 26), the task for central bankers is equally clear:

“The new inflationary environment has changed the balance of risks. Gradually raising policy rates at a pace that falls short of inflation increases means falling real interest rates. This is hard to reconcile with the need to keep inflation risks in check. Given the extent of the inflationary pressure unleashed over the past year, real policy rates will need to increase significantly in order to moderate demand. Delaying the necessary adjustment heightens the likelihood that even larger and more costly future policy rate increases will be required, particularly if inflation becomes entrenched in household and firm behavior and inflation expectations.” (Italics added).

One big problem with the establishment view is that it narrows down the public debate on policy responses to the rise in global inflation to a choice from a reductionist menu of only two options: (1) a fast and aggressive hike in interest rates, which is argued to lead to an unavoidable but mild and temporary recession (the soft-landing option) versus (2) a slower and more cautious monetary tightening that arguably can only end in tears (the hard-landing option). Framed in this way, the policy choice for central bankers is straightforward—but in my opinion, the above reductionist framing is wrong, as I argue in a new INET Working Paper, which served as a background paper for UNCTAD’s Trade and Development Report 2022.

First, there is a real risk that the global recession triggered by a fast and aggressive hike in interest rates in the U.S. and the E.U. (option 1) will permanently scar the process of economic growth and development in the EMDEs, leading to another ‘lost decade’. One reason why this may happen is the very high ‘sacrifice ratio’ of monetary policy, which reflects the collateral damage, defined in terms of the decline in real GDP, that is associated with the degree of monetary tightening needed to reduce the inflation rate by one percentage point as I argue below. A second reason concerns the negative distributional consequences of higher interest rates (in combination with austerity), which by hurting domestic demand growth and capital accumulation will not just lower potential growth in the EMDEs, but also reduce the size of serviceable debt in the economy. Finally, excessive monetary tightening may well lead to financial instability and crises in the EMDEs, given the already high public and private debts in many of these economies (Chowdhury and Jomo 2022). Simplistic calls to ‘bring back Volcker’ are dangerous and wrong because drastic monetary tightening is likely to bring about the exact stagflation that it is arguably intended to avoid. This would represent an epic failure of macroeconomic policymaking—even against its already highly checkered history.

There is a second reason why the reductionist framing is wrong: the policy choice is not a binary one and also does not just concern monetary policy. Establishment macroeconomics exclusively prioritizes monetary policy as the means to manage demand and the economy, downgrading all other policy tools (including fiscal policy instruments) to useless paraphernalia (Storm 2021). But drastically higher interest rates cannot and will not succeed in lowering current inflation, the origins of which lie mostly on the supply side (Storm 2022), at a bearable societal cost. In other words, a single-minded reliance on monetary tightening must end in tears, squeezing demand and lowering (potential) output, but failing to reduce inflation.

The good news is that governments have other policy instruments at their disposal which can be used to fight inflation and effectively manage its (distributional) consequences at lower economic and social cost than that associated with monetary tightening. Hence, to avoid another era of stagflation, it is now time to bring monetary policy down from its high pedestal, while the roles of fiscal policy (including income support), strategic price policy and stricter (financial) market regulation are in urgent need of a re-appreciation.

Key lessons

This article presents key insights from the Working Paper, which center around the huge, and avoidable, economic and social, cost of an uncoordinated global monetary tightening led by the Federal Reserve, and point to the importance of trying out alternative interventions to bring down and manage (global) inflation. The Working Paper focuses on 11 major EMDEs (Argentina, Brazil, Chile, China, Egypt, India, Indonesia, Mexico, Nigeria, South Africa, and Türkiye)—and highlights the risks of non-coordinated interest rate hikes in these EMDEs in the context of monetary and fiscal policy tightening in the OECD.

No doubt, a drastic tightening of U.S. monetary policy will lead to currency depreciations, sudden financial outflows, higher risk premia, weaker credit positions, and more difficult access to global dollar credit and liquidity (necessary for exports and investment) in most EMDEs. Higher interest rates in the U.S. will thus stymie growth in emerging economies and further constrain their macroeconomic policy space (UNCTAD 2022), which was already compromised by rising commodity prices and the pandemic (Bortz et al. 2021). The ability of central banks in generally highly-indebted emerging economies to manage the fall-out of monetary tightening by the Federal Reserve will critically depend on their access to U.S. dollars—and this will depend on the Fed. A global recession, in turn, will hurt the US economy. Hence, clockwise or counter-clockwise, the Federal Reserve will have to balance its de jure national mandate and its de facto global function. The Fed cannot, therefore, act in ‘splendid isolation,’ also if it is narrowly considering the interests of the U.S. economy.

UNCTAD (2022, p. 22) is right in sounding the alarm that “it is not obvious [….] that tighter monetary and fiscal policies [in developed countries] are the correct response to inflation driven by supply-side bottlenecks”, because these policies “may have disastrous repercussions for developing countries if it triggers appreciation of the dollar.” With rising inflation, tightening monetary and financial conditions, and elevated debt levels considerably limiting policy space, emerging economies are facing increasingly stronger stagflationary headwinds (World Bank 2022). However, drawing historical parallels between the current inflation and the stagflation of the 1970s is not helpful: the differences are more important than the similarities.

There is no wage-price spiral in the EMDEs

Unlike in the 1970s, after decades of labor market deregulation and union bashing, workers across the globe are relatively powerless and incapable of protecting their real wages in this inflationary era (ILO 2021). This shows up in the secular decline in the labor income share and in declining real wages in the EMDEs (UNCTAD 2022). I must note that, in the EMDEs, the decline in worker power in the developing world has gone hand in hand with the growth and deepening of global supply chains, largely under the control of globe-spanning multinational corporations—usually headquartered in the triad (United States, Western Europe, and Japan). These multinationals have the power to impose strict cost and delivery conditions and often unreasonable demands for flexibility upon their suppliers, through which they have managed to exploit the workforce, disempower governments, undermine regulation, and to extract maximum value through a process of unequal exchange (Suwandi 2019).

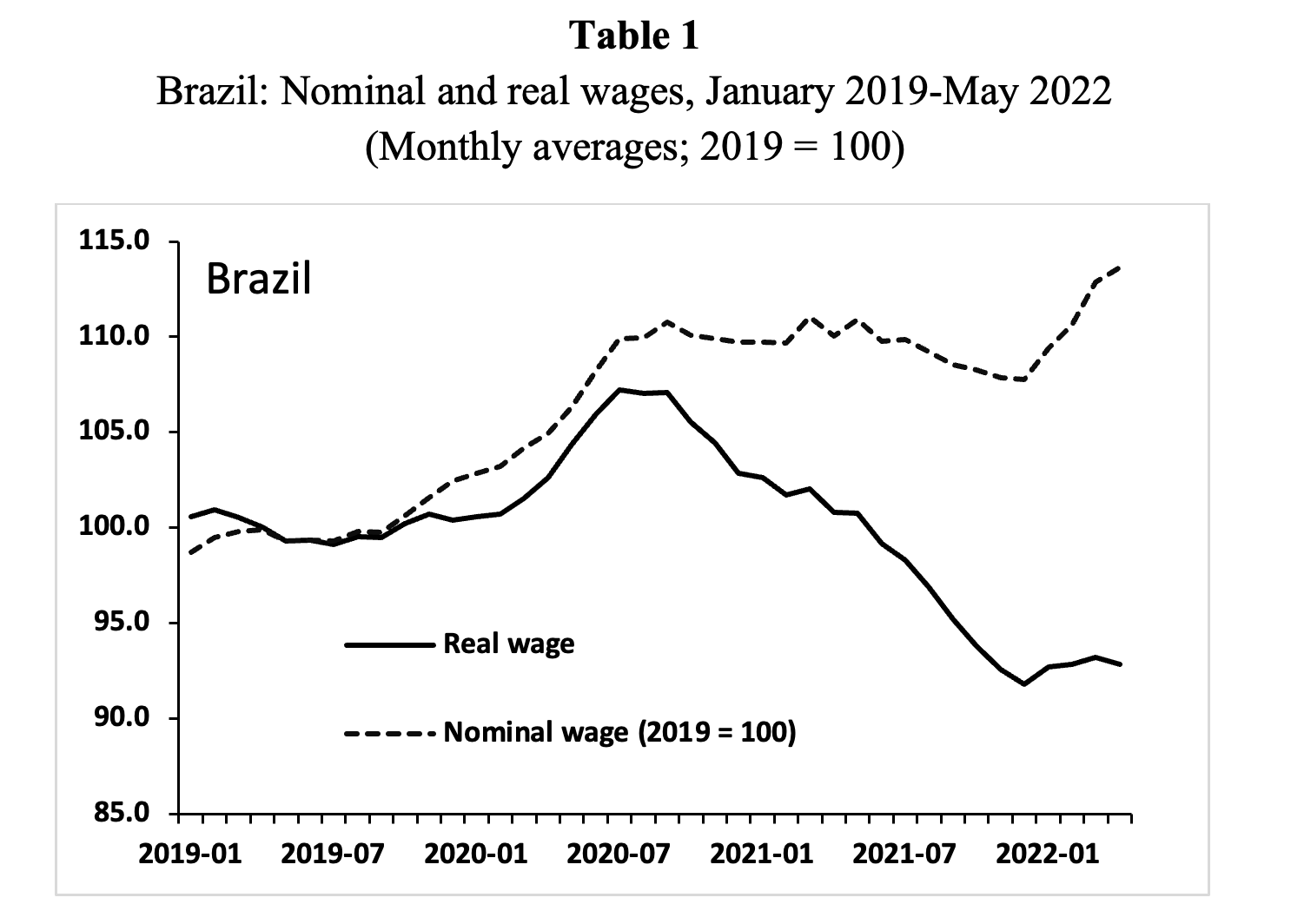

As is shown in Figure 1, real wages in Brazil declined by more than 13% between September 2020 and April 2022, even if nominal wages rose by 3.3%. The drastic fall in real wages, which is observed for other EMDEs as well, shows that workers are bearing the brunt of the higher prices. Global inflation, fuelled by higher prices for food and energy, is eroding wages and pushing millions of people into poverty and hunger.

Sources: Monthly earnings: Instituto Brasileiro de Geografia e Estatística (IBGE); CPI: FRED database (series BRACPIALLMINMEI). Note: Monthly nominal wages are deflated using the monthly CPI.

It is evident that inflation in the EMDEs is not being driven by a wage-price spiral. World Bank (2022) and BIS (2022) are nevertheless calling for monetary tightening and fiscal retrenchment. These ‘medicines’ will be worse than the ‘disease’ (inflation), because they will lower employment and economic growth, and thus further increase the misery of workers, many of whom will become unemployed. “The misery of being exploited by capitalists is nothing compared to the misery of not being exploited all,” is how Joan Robinson (1962, p. 45) summarized the problem.

High sacrifice ratios

Implicit in the analyses of the World Bank (2022) and BIS (2022) is the assumption that interest rate increases will be effective in bringing accelerating inflation down to its target rate. As a truism, this assumption is correct: if central banks raise interest rates brutally enough, aggregate demand will be asphyxiated, the economy concerned will go into recession and inflation will be brought down. But the collateral damage of this kind of inflation control will be large, both in the short run in terms of higher unemployment and increased poverty and in the long run, because the damage done in the short run will spill over into permanent, long-run damage: the monetary policy error may cause business investment and, hence, the growth rate of potential output to decline (Kahn 1972).

Hence, the real question is whether monetary tightening can safely bring down inflation, i.e., without generating prohibitively high economic and social damages. The empirical evidence for emerging economies suggests that a soft landing is unlikely to be possible. Table 1 summarizes published evidence, mostly provided by central bank economists, on the responses of the inflation rate and real GDP to a one-percentage-point hike in the policy interest rate in Brazil, China, India, Mexico, Nigeria, and South Africa. The evidence is summarized in terms of the cumulative impacts after four quarters (one year) and eight quarters (two years).

It can be seen that the estimated impact of a one-percentage-point increase in the interest rate on the inflation rate is relatively small after four quarters—inflation in India, Nigeria, and South Africa is estimated to decline by just 0.1 percentage point; in Mexico, inflation declines by 0.5 percentage points in China and by 0.8 percentage points in Brazil.

The cumulative impacts on inflation are larger after two years, which indicates that monetary tightening works with considerable time lags. However, even after eight quarters, the cumulative effects of higher interest rates are estimated to be small relative to the current surge in inflation. Consider the case of South Africa where the CPI inflation rate (on a year-to-year basis) rose to 6.5% in May 2022. South Africa’s central bank sets the inflation target at 4.5% (with a tolerance margin of 1.5 percentage points on either side). Suppose we assume that the South African central bank decides to raise the interest rate in order to lower inflation by 2 percentage points from 6.5% to 4.5% over the next two years. To do so, it has to increase the interest rate by 4 percentage points—from 4.75% in May 2022 to 8.75%.

Table 1

Cumulative impacts of a 1 percentage point increase in the interest rate

|

|

Brazil |

China |

India |

Mexico |

Nigeria | South Africa |

Inflation rate (% pts) |

|

|

|

|

|

| |

| After 4 quarters | -0.8 | -0.5 | -0.1 | -0.2 | -0.1 | -0.1 |

| After 8 quarters | -2.1 | -0.8 | -0.2 | -0.6 |

| -0.5 |

Real GDP (% change) |

|

|

|

|

|

| |

| After 4 quarters |

| -1.2 | -0.2 | -0.7 | -0.4 | -0.5 |

| After 8 quarters |

| -1.7 | -1.1 | -1.5 |

| -0.9 |

Sacrifice ratio (After 8 quarters) |

|

2.1 |

5.5 |

2.5 |

|

1.8 |

Sources: See Working Paper. Note: The ‘sacrifice ratio’ reflects the collateral damage, defined in terms of the decline in real GDP, that is associated with the degree of monetary tightening that is needed to reduce the inflation rate by one percentage point.

In sum, small increases in interest rates will not do enough to bring down demand and rising inflation in emerging economies in a significant way. Much higher increases in interest rate may work, but still take two years or more to make a dent in inflation—while also doing damage to real GDP.

The cumulative impact of a one-percentage-point increase in the interest rate on real GDP is considerably larger (in absolute terms) than on inflation (Table 1). The collateral damage of inflation control, which comes in the form of a recession and higher unemployment, is non-negligible. For example, an increase in the interest rate by 4 percentage points (as in the example for South Africa, mentioned earlier) will lower South Africa’s real GDP by 3.6 percentage points after two years, while Mexico’s real GDP will be depressed by 4 percentage points.

The cost of monetary tightening can be defined in terms of the ‘sacrifice ratio’, which gives the decline in real GDP that is associated with the degree of monetary tightening that is needed to reduce the inflation rate by one percentage point. The sacrifice ratio is around 2 for China, Mexico, and South Africa—meaning that a one-percentage-point reduction in the inflation rate comes at a social cost of (more than) a two-percentage-point decrease in real GDP. The ‘sacrifice ratio’ for India is estimated to equal 5.5.

Because bringing down inflation will require large increases in interest rates and since this will significantly depress real GDP, it follows that central banks in emerging countries cannot safely bring down inflation by means of monetary tightening. This outcome becomes even more likely in case of a simultaneous and uncoordinated monetary tightening by central banks in many emerging economies—Keynes’ fallacy of composition applies in this case, at a huge social cost to the populations of the EMDEs.

EMDEs have much higher debts today

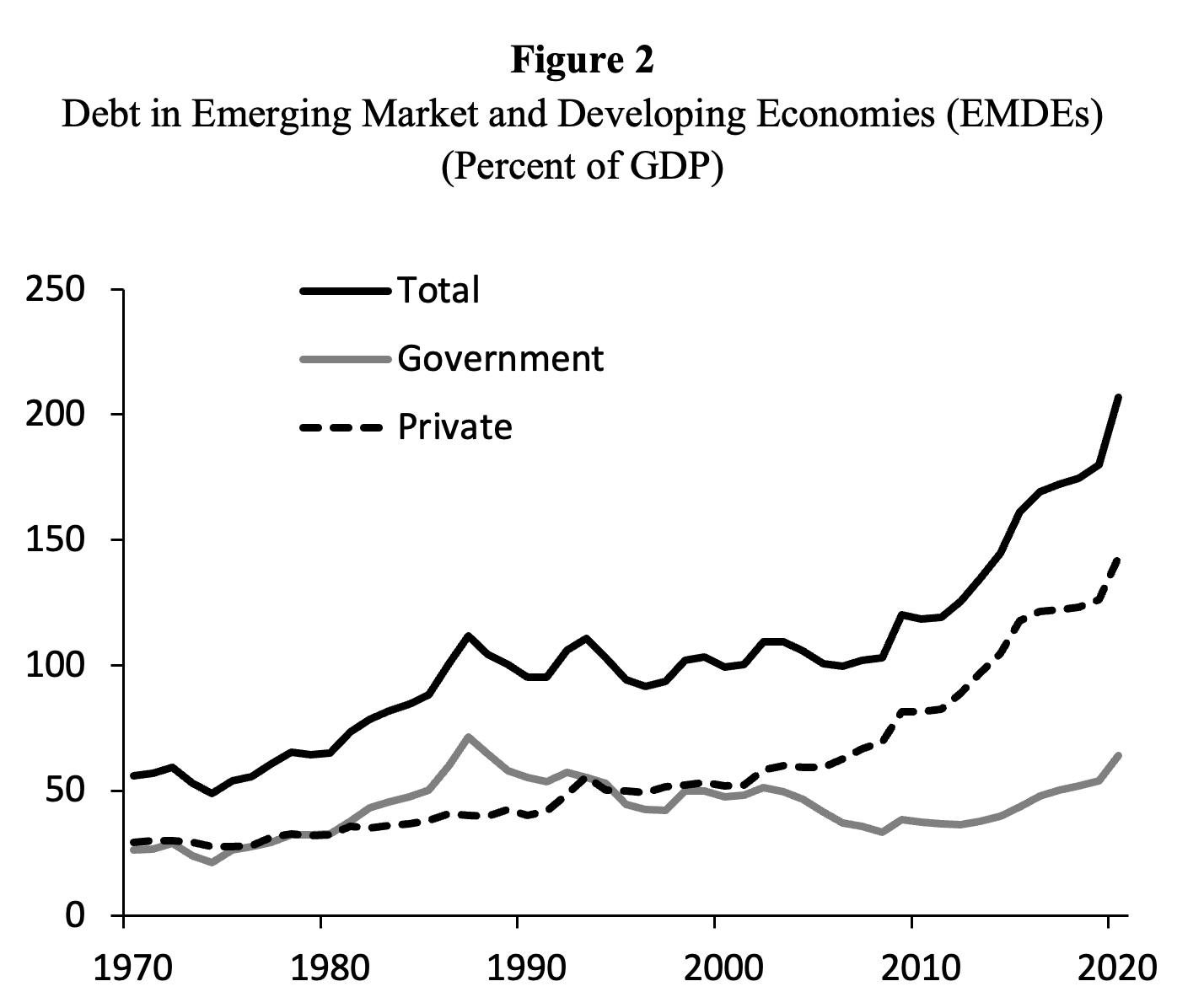

Another structural difference between the 1970s and the current conjuncture concerns the significantly higher indebtedness of emerging economies (Figure 2). In 1980, the total debt of the emerging market and developing economies (EMDEs) stood at 65% of their GDP, and half of this debt was sovereign debt and the other half was private-sector debt. When the U.S. Federal Reserve brutally tightened monetary policy in the late 1970s and early 1980s in response to rising inflationary pressures in the US, it triggered the ‘Third World’ debt crisis of the 1980s.

However, as Figure 2 illustrates, the initial conditions today are worse than in the 1980s with respect to external indebtedness. In 2020, after the largest, fastest, and most broad-based increase in indebtedness by the EMDEs in the past 50 years, total debt of the EMDEs amounted to 207% of their GDP. More than two-thirds of these debts are private-sector liabilities, while the share of public debt in total debt is 31%. Low global real interest rates during the 2010s encouraged a surge in EMDE debt, especially in Latin America and Sub-Saharan African countries. Much of these debts are denominated in foreign currency and are commercial and short-term. Many emerging economies are facing tighter financial conditions against a backdrop of high debt, and seventeen emerging and developing countries already experienced a downgrading of their sovereign debts in the first five months of 2022. Monetary tightening by the Federal Reserve thus carries a considerable risk of triggering a new domino chain of financial crises in the EMDEs (World Bank 2022).

Source: World Bank (2022), Figure SF1.5.A. Note: GDP-weighted averages based on a sample of up to 153 emerging market and developing economies.

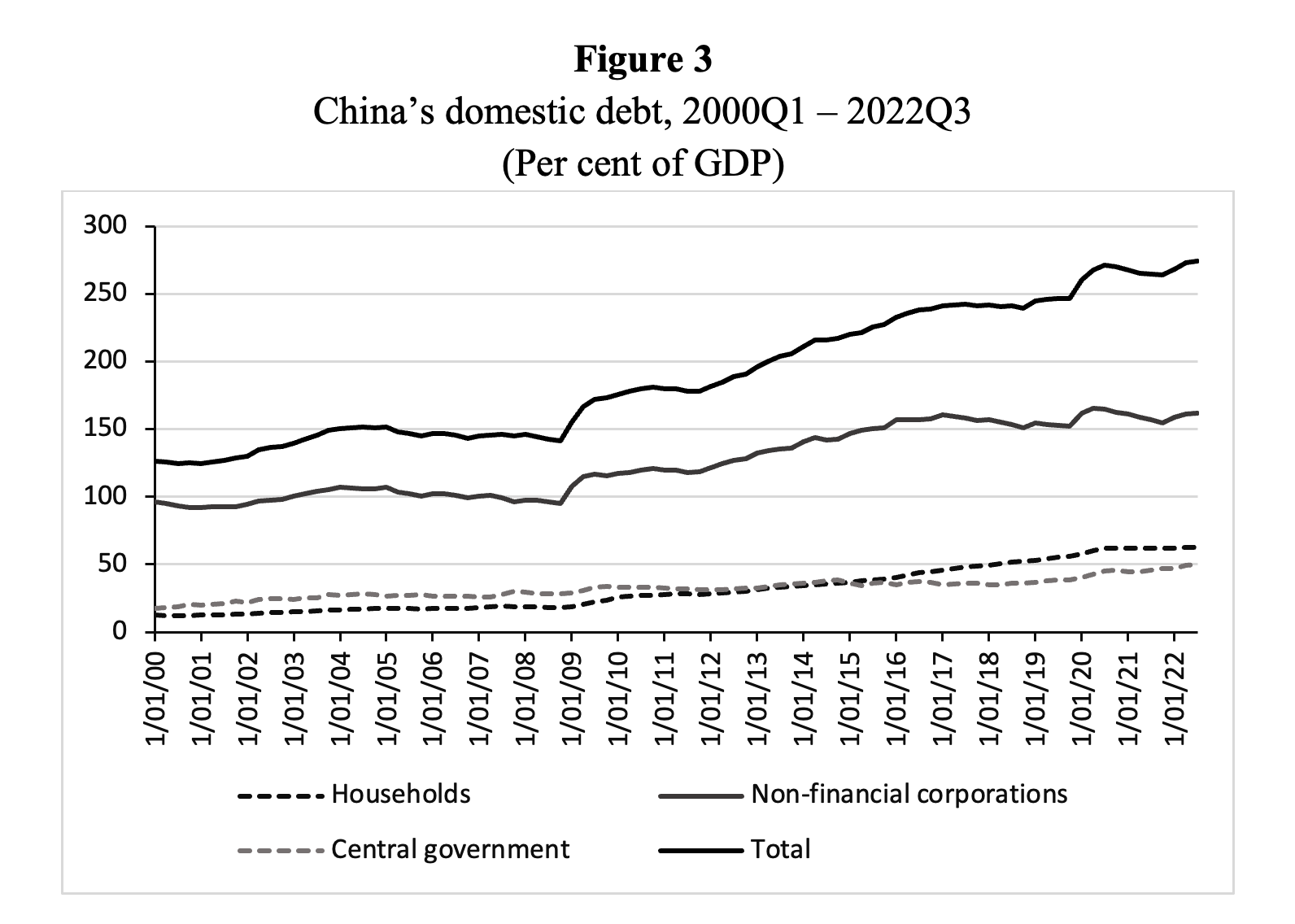

China’s domestic debt warrants separate consideration for two reasons. Firstly, because total non-financial sector debt has almost doubled between 2008 and 2022Q3 (Figure 3); China’s total debt-to-GDP ratio increased from around 140% in 2008 to 274% in 2022Q3. Secondly, because the high debts of households and local governments are becoming increasingly difficult to service and a Chinese debt crisis is becoming more likely.

Let us first look at Chinese household debt which has more than doubled (as a percentage of GDP) since 2012. Servicing these household debts is eating up disposal income that could otherwise be used to buy goods and services, and, hence, high household indebtedness, combined with rising interest rates, is undermining consumer demand and economic growth. Chinese households increased borrowing mainly to purchase houses (apartments), mostly in presale transactions—purchases of properties not yet built. Rising house prices and low interest rates made this possible during 2010-2020. But in 2020, the Chinese government began to slow down the property sector, whose ballooning levels of debt were worrying officials.

China’s property sector has been cooling down rapidly in 2022, following the corona lockdowns and Zero-COVID policies, economic stagnation, and rising interest rates. The Chinese property market went into freefall, and developers slashed purchases of land. All this has resulted in a liquidity crunch for Chinese property developers, as presale receipts plummeted and access to bank financing became increasingly difficult (IMF 2022b). The near-default of China Evergrande Group, one of China’s largest property developers, in Spring 2021 is all too well known. In effect, prices for new homes are falling in 70 major cities, some 2 million off-plan homes, presold to Chinese households, remain unfinished across the country, and Xi Jinping’s government is forced to bail out the property market in an attempt to prevent a financial-sector crisis (Farrer 2022).

Source: National Institution for Finance & Development; http://www.nifd.cn/Home/IndexEn

Chinese central government debt has increased from 28% of GDP in 2008 to almost 50% of GDP in 2022Q3. But the Chinese state has a far larger debt burden than this, because hidden local government debt, which is included in the debt of the non-financial corporate sector (in Figure 3), has increased to more than 50% of GDP by 2021. Worryingly, most of China’s local government debt is held by off-balance-sheet state-owned or state-controlled financial institutions, called local government financing vehicles (LGFVs).

Many of these borrowings by LGFVs, which are estimated to amount to $8 trillion, are not recorded and transparency is weak when it comes to how the funds are used. The LGFVs financed their investment in local government debts by issuing bonds, which are now at risk of defaulting amid the building crash in China’s residential property market (Farrer 2022).

The problem is that local governments are heavily reliant on the revenues from land sales to balance their books, but Chinese property developers drastically lowered their purchases of land. As local government revenues began to dry up, the ability to service LGFV debt weakened. The housing bubble and the land market boom threaten to spill over into a public debt crisis. It is, as yet, unclear how Xi’s government will tackle the unavoidable LGFV debt crisis.

Macroeconomically, a total (consolidated) debt of the Chinese state is around 100% of Chinese GDP, and higher interest rates will hurt China’s public finances—as in Brazil and India. Fiscal austerity will augment the insufficiency of aggregate demand and slow down economic growth. The resulting economic stagnation, in turn, will make a (public and/or private) debt crisis more likely.

Alternatives to monetary tightening

The Working Paper discusses the likelihood of contractionary devaluations in the developing world—and argues, based on a review of the empirical evidence on the effectiveness of monetary policy in lowering inflation in the EMDEs, that central banks cannot bring down current inflation without engendering considerable damage to their economies. A ‘soft landing’ is an impossibility, so the economic policy discussion should focus on the issue of whether a ‘hard landing’—a deep and prolonged recession caused by monetary tightening—is a social cost worth suffering in order to bring down inflation.

In my view, given the significant (and avoidable) collateral damage caused by monetary tightening (measured in terms of output losses, increased unemployment, much higher inequality, and significantly greater and deeper poverty), hiking up interest rates is not a rational policy response to the recent surge in inflation—and this conclusion becomes even more weighty when one considers the risk that excessive monetary tightening leads to ‘super-hysteresis’, i.e., permanent damage to the level and the growth rate of an economy’s potential output.

Lord Kahn (1972, p. 139) issued this prophetic warning against restrictive monetary policy in his evidence given to the Radcliffe Committee on Monetary Reform in 1958:

“The economic waste in such a policy is particularly great if demand is regulated by restricting productive investment, as will be the main result of relying on monetary policy. Not only is there a loss of potential investment. But the growth of productivity is thereby curtailed, thus narrowing the limit on the permissible rate of rise in wages and increasing the amount of unemployment required to secure observance of the limit.” (Italics added).

Kahn warned against regulating aggregate demand, and business investment in particular, by means of monetary policy. The reason is that monetary tightening will raise the ‘steady-inflation’ rate of unemployment and, therefore, the unemployment gap—the difference between the (lowered) actual and the (heightened) ‘steady-inflation’ unemployment rate—rises as well. Higher interest rates are hurting potential real GDP by lowering endogenous demand-led productivity growth and by raising the inflation barrier, defined in terms of the ‘steady-inflation’ rate of unemployment.

If further monetary tightening in the US during 2022-23 triggers a worse global recession than the one occurring during the early 1980s, the potential growth rate in the developing economies will take a hit—and the permanent damage to economic development in these countries will be large. This permanent scarring of potential growth, in turn, will have dire implications for developing countries’ indebtedness: the volume of supportable (or serviceable) debt must decrease. The risk of another, avoidable, round of EMDE’s debt crises increases—and another ‘decade lost to economic development’ is in the cards, if the current phase of monetary tightening goes too far.

It is, therefore, critically important to consider alternative ways to bring inflation down. The final section of the Working Paper discusses a few such options, including the much-maligned strategic price controls, a tightening of position limits and an increase in margin requirements to eliminate commodity-market speculation, and fiscal interventions to shield vulnerable households and firms from the negative impacts of high inflation.

Finally, I discuss the importance of (external) debt relief measures and of reforms to improve the access of developing economies to global U.S. dollar liquidity. These alternatives, in turn, have to be embedded in a larger, more ambitious reform of the global financial system that supports stable exchange rates, long-run ‘committed’ finance, steered toward productive economic activities (rather than toward speculative returns), and open, but managed and sustainable international trade, while ensuring sufficient (fiscal) policy autonomy for developing nations to raise living standards and expand life opportunities for their citizens in low-carbon and socially-inclusive ways (Gallagher and Kozul-Wright 2022).

References

Bortz, P.G., G. Michelena and F. Toledo (2020) ‘A gathering of storms: The impact of COVID-19 pandemic on the balance of payments of emerging markets and developing economies (EMDEs).’ International Journal of Political Economy 49 (4): 318-335. https://www.tandfonline.com/do…

Chowdhury, A. and Jomo K.S. (2022) ‘Stop worshipping central banks.’ Substack, available at: Challenging Development+ https://jomodevplus.substack.c…

Farrer, M. (2022) ‘A Ponzi scheme by any other name: the bursting of China’s property bubble.’ The Guardian, September 25. Link: https://www.theguardian.com/bu…

Galagher, K. and R. Kozul-Wright (2022) The Case for a New Bretton Woods. Cambridge: Polity Press.

ILO (2021) Global Wage Report 2020-21. Geneva: International Labour Office.

IMF (2022a) Global Financial Stability Report: Shockwaves from the War in Ukraine Test the Financial System’s Resilience. April. Washington, DC: International Monetary Fund.

IMF (2022b) World Economic Outlook, Chapter 1. October. Washington, DC: International Monetary Fund.

Kahn, R. (1972) ‘Memorandum of evidence submitted to the Radcliffe Committee (1958)’. In Selected Essays on Employment and Growth. Cambridge: Cambridge University Press, pp. 124-152.

Robinson, J. (1962) Economic Philosophy. London: Penguin Books.

Storm, S. (2021) ‘Cordon of conformity: Why DSGE Models are not the future of macroeconomics.’ International Journal of Political Economy 50 (2): 77-98. DOI: 10.1080/08911916.2021.1929582

Storm, S. (2022) ‘Inflation in the time of corona and war.’ INET Working Paper No. 158. New York: Institute for New Economic Thinking. Link: https://www.ineteconomics.org/…

Summers, L.H. (2022) ‘The Fed is charting a course to stagflation and recession.’ The Washington Post, March 15.

Suwandi, I. (2019) Value Chains: The New Economic Imperialism. New York: Monthly Review Press.

United Nations (2021) Financing for Sustainable Development Report 2021. New York: United Nations.

UNCTAD (2022) Trade and Development Report 2022: Development Prospects in a Fractured World. Geneva: UNCTAD. Link: https://unctad.org/tdr2022

Wolf, M. (2022) ‘Policy errors of the 1970s echo in our times.’ The Financial Times, June 14. Link: https://www.ft.com/content/d5d…

World Bank (2022) Global Economic Prospects. June 2022. Washington, DC: The World Bank Group.