Ugly inflation not seen in four decades, fuel prices spreading pain through the rest of the economy, the invasion of Ukraine roiling energy markets, and long-term climate goals thwarted by the need to contain price spirals. It’s enough to make your head spin. Muayyad Al-Chalabi, an industry researcher, shares his perspective with the Institute for New Economic Thinking on the fuel woes and energy challenges that have everyone worried.

Lynn Parramore: Let’s start with a general picture of the fuel market. We had some ups and downs over the course of the pandemic, but nothing too alarming. Now, suddenly, everyone everywhere is facing spiraling costs of oil and gas. What’s going on? How much of it is about Russia’s invasion of Ukraine?

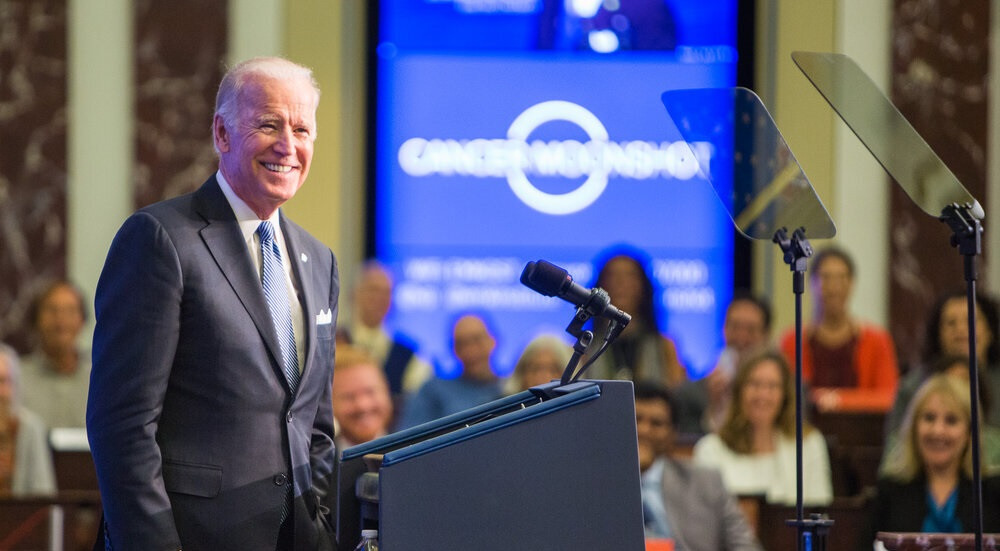

Muayyad Al-Chalabi: Some of this goes back before Russia. With all the public policies and agreements we’ve seen, the idea was to convert to renewables and cut down on emissions. So investments in oil infrastructure have been declining. In terms of production of natural gas and oil and so on, there hasn’t been a disruption – the U.S. is still producing 11.5 million barrels of oil a day. But investments in new exploration for oil, new leases, and such, whether in the U.S. or everywhere else, along with capital expenditures, are down. What you have is the market saying, ok, there’s no investment in this new infrastructure and the demand is growing, so investors anticipate the gap, at least from a futures perspective, and see that renewables may not fill it. The first phase of rising costs really started with the administration change and Biden’s focus on green energy. Prices were going up even before we got the situation in Ukraine.

Now we’re into the second phase of rising prices with the Ukraine conflict, which has the possibility of taking 10 million barrels of oil away from the market – that’s almost 10% of the entire market. We went from $100 to $115, $120 per barrel, but then it came down a little bit. We are also seeing a rebound in demand now from the pandemic, but it’s not as significant as many think. It’s true that there’s more demand for oil than there was in 2020, but it’s really not much different from 2019 – actually about 5% less.

LP: All of this puts the Biden administration in quite a bind. First, they were talking about a green future, now it’s drill, baby, drill because fuel got so expensive.

MA: A lot of the green guys would like the price of fossil fuels to go up because then the differentials will not be as bad. But yes, it’s awkward for Biden to be asking the Saudis or the Venezuelans or the Iranians to pump more!

LP: What about this idea that the U.S. could supply liquified natural gas (LNG) to help Europe break its energy links with Russia? How viable is that, given the need for infrastructure, ships, etc.?

MA: Well, let’s look at the numbers. Nord Stream 1, the natural gas pipeline running from Russia to Germany, has about 55 billion cubic meters of gas capacity per year. Nord Stream 2 [under construction and almost finished, but awaiting regulatory approval] would have doubled that capacity to 110, but that’s on the shelf for now. Currently, I think there are only about 300 ships that can do LNG, and of those, only about half are operational at any given time. The largest ship that the Koreans have built can carry somewhere around 250,000 cubic meters of LNG [gas converted to liquid]. It won’t be enough. You would need a lot more ships. On top of that, ports in the U.S. are mostly on the Gulf Coast and it’s a long trip to go to Europe. Then, when you get to Europe, you need specialized terminals. It’s not like a ship docks and you’re ready to go – you have to convert the liquid back into natural gas. The only practical ports available are in Holland and the U.K. So Germany has to build LNG ports on the North Sea or on the Baltic to take these big ships.

In Germany, the big energy development was decommissioning the nuclear power plants, at least for electricity generation. I think they might be putting that on hold now. In the U.K., there’s a huge price increase in LNG or natural gas that’s already happened. Even in the U.S., our prices have gone up considerably. I can see it in my bill in New Jersey, especially the delivery charge.

LP: Sounds like the plan for the U.S. to provide LNG to Europe is not going to go very far in the short term because of all these issues you mentioned. Which means that high prices in Europe will be around for a while, right? And what about the U.S.?

MA: Yes, prices will likely stay high in Europe, and the U.S. doesn’t really have excess capacity to ship outside anyway. Here, LNG is about 40% of power generation right now, or a little bit higher, so if you start exporting and you haven’t invested in building new stuff, the supply/demand ratio in the U.S. will go up, which means our prices will go up. That means inflation will go up. I’m not sure how they’re going to solve that problem. If you say on the one hand, no more new stuff, no capital investments and so on, or you discourage them, but on the other hand, you want to export LNG, you’ve got quite a dilemma.

LP: Let’s discuss to what degree oil futures markets or commodity futures markets are impacting prices. In the U.S., prior to 2006, we had rules limiting the trading and who could do it. You could have futures contracts — farmers needed them to sell crops at a set price and so on — but producers and users dominated the market rather than Wall Street players, who were constrained in how much they could buy. But in 2006, the U.S. removed rules on position limits. Now Wall Street has piled into futures on fuel – private equity, hedge funds, and so on. Is this a problem?

MA: There is no doubt that hedgers and speculators have an impact by just looking at the volume of contracts. I think about a billion barrels of oil a day get traded, or change hands, and the actual production is only around 90 to 100 million barrels. So there’s a ten to one ratio of futures barrels v. actual physical barrels.

The market has two types of participants. Hedgers engage with the spot market, in which delivery is immediate. Speculators deal with the futures market, in which delivery is due at a future date.

The spot market is influenced by traders – the big ones in oil are Glencore and Vitol. They are the middle guys who take the oil from the oil producers and they do have a huge influence.

Speculators like private equity folks influence the forward contracts and do not participate in the spot market. The price of the crude oil futures market has an effect in the international crude oil spot market. Crude oil futures prices are affected by supply and demand fundamentals and external factors such as emergencies, policy uncertainty, and war.

The futures really come into play in two cases. One is called “contango,” in which the futures you buy are usually higher than the stock price. That’s because people account for storage, insurance, and so on. There’s a premium for the future above the current stock price. Then you have the opposite case, called “backwardation,” where you have a lot of things on your hands and the future price is lower than the stock price. Most of the time the futures market is in contango, but sometimes, if storage is full, for example, you might get backwardation. The whole chain goes from the oil producers, to the middle guys, and then the users—the refineries or the power producers.

Interestingly, in 2020, the price of oil crashed and actually became negative because a lot of people who had the contracts couldn’t unload them because the storage was near capacity. They had to take delivery and there was no place to store it and they got caught. The contracts were due and they had to pay people to take it off their hands.

Commodities markets that can impact prices of fuel are not just oil, but also metals. Green energy is metals-based – it’s steel, aluminum, rare earth metals, etc. We’re trying to shift from hydrocarbons to metals, but the extraction of these metals requires hydrocarbons – fossil fuels.

China has around 80% of the rare earth market today by production, so in a green energy scenario, we might be increasing our dependency on China. Then there’s lithium [needed for batteries for everything from electric cars to cell phones], which comes from Bolivia, Argentina, and Chile. But 70% of batteries are made in China, and China has bought most of the lithium already. There’s also cobalt from the Democratic Republic of Congo, which has a monopoly on mining, production, and processing. So you’ve got storage of electricity and batteries dependent on China. And the production of green energy, whether it’s windmills or even solar, is also heavily dependent on China. Electric vehicles are especially dependent on rare earth elements – China again.

LP: Do we need rules put back into place that would halt some of the speculation, like those we had before 2006?

MA: Regulation might need to be global, not Wall Street only. Some people claim that speculation doesn’t make a lot of difference in the prices. I don’t believe that. If there’s a ten to one ratio between trades and physical, there must be an impact. People like Southwest Airlines are pretty good at hedging because jet fuel is 15-20% of their costs, But the current price rises threaten to blow out fuel costs to a greater proportion of overall operating costs. They always buy these futures contracts so that they don’t get hit with price increases. This is a good thing. These are the users. But when you have speculators buying contracts, you could possibly get problems similar to what we had in 2008 with AIG – that whole problem with [credit default] swaps which played a large role in the financial crisis. A borrower bought the swaps from the lender, but others who had nothing to do with the deal were betting that the borrower couldn’t pay, a kind of speculation. It was a big blow-up.

LP: The future is always uncertain, but what can you say about where we’re headed? Is there anything to be optimistic about regarding prices and inflation? What about sustainable energy?

MA: Well, do we go from $100 a barrel to $80, or back to $40? I don’t believe we’re going back to $40. I think we may be stuck with where we are now for a while (trading range of +-20% influenced by geopolitics and speculation). It will impact electricity prices, and of course energy is needed to produce almost anything – so much stuff is made from plastics. People also forget about ammonia and its relationship to natural gas. Ammonia that goes into fertilizers is made from natural gas, and Russia is a big producer of it. Between Russia and Ukraine, they produce a lot of wheat for the developing world. Here again, we have this difficulty of transitioning away from hydrocarbons. We need better innovation in sustainable energy than we have today. It could be small nuclear power plants, but they are very expensive. The other idea, which you’ve started hearing about from BP, is hydrogen. But hydrogen comes in different colors. The colors are green hydrogen, which is made by using clean electricity from surplus renewable energy sources, such as solar or wind power, to electrolyze water. There’s also blue hydrogen (with carbon capture), which is somewhat ecologically friendly and produced mainly from natural gas but requires heat and hydrocarbons to separate it from other elements. And there’s gray, the least renewable form without greenhouse gases capture, which is derived from natural gas or methane.

I’m hoping we might get more innovation on sustainable energy, but there’s a hard road ahead. The best scenario is a hybrid model — maybe we can eventually get from 90% fossil fuels and 10% green energy to 30% fossil fuels and 70% green energy. But it’s still a hybrid. Fossil fuels don’t disappear from the picture.