Electricity is an essential commodity, but the structure of the electricity market has inflated revenues and exacerbated consumer hardship at a time of national crisis.

The energy crisis hugely increased the price of wholesale electricity in 2022, where the price is set mainly by the most expensive generator required to meet demand. Wholesale prices dominate the revenues of most generators, but the variety of contracts in the market and their confidential nature make it impossible to calculate revenues precisely. Our new working paper, published jointly by INET and the UCL Institute for Sustainable Resources, tries to sort out where the revenues went. Our best estimate, based on a ‘representative’ average contract structures for different technologies, is that revenues to GB electricity generators in 2022 increased by almost £30bn, compared to pre-COVID levels (£49.5bn compared to £20.5bn over 2018-19). The paper examines the structure of revenues to different types of generators (see table) along with brief consideration of how this relates to likely changes in input costs.

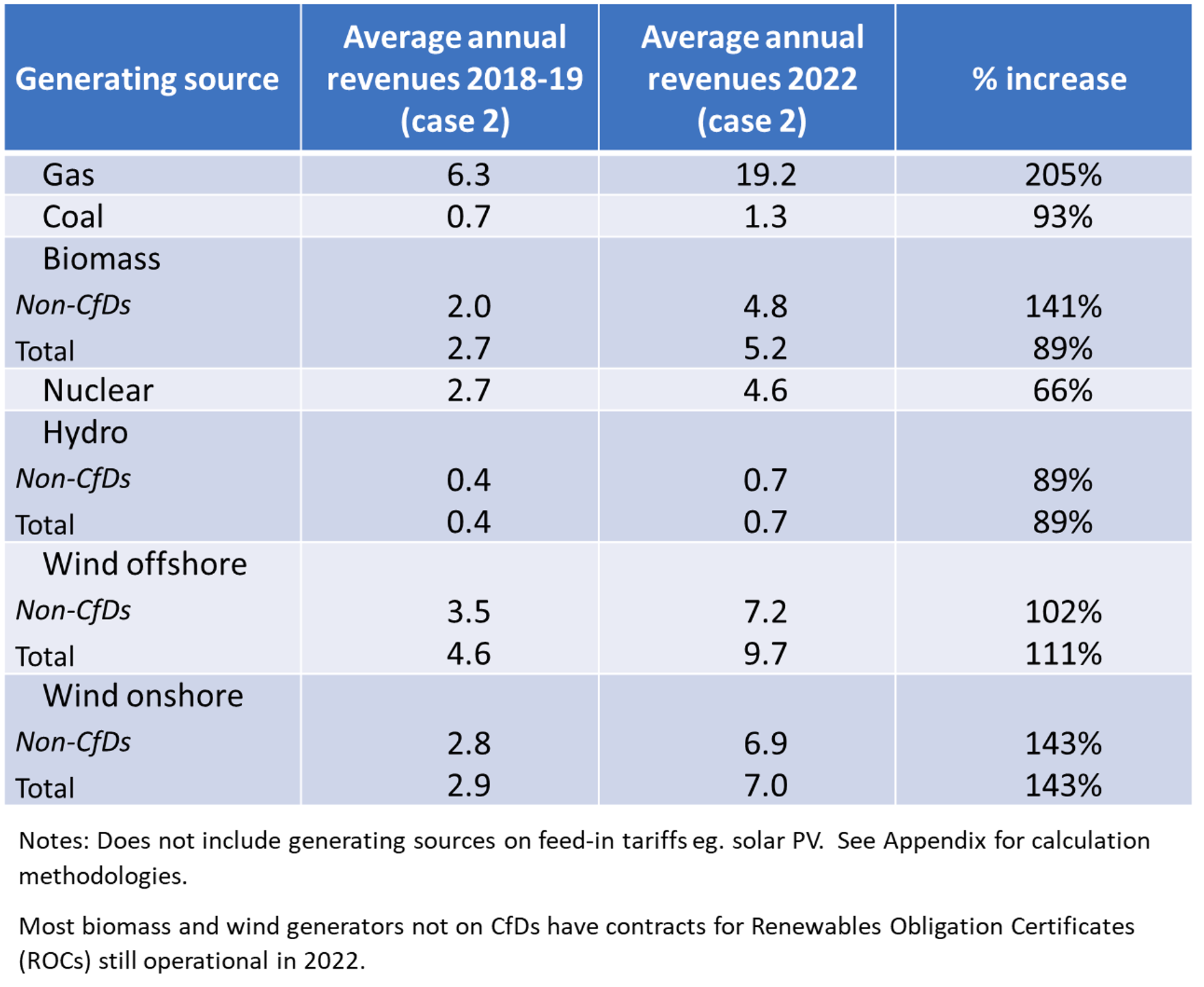

Changes in revenues for the technologies included in our analysis.

Gas generation and nuclear

Revenues associated with gas generation in 2022 rose by about £13bn (200%) compared to the pre-Covid (2018-2019) average, from about £6bn/yr to £19bn.

There are various indications that this increase in revenues exceeded the rise in input costs. The strongest single indicator is that the published direct measure of the margins earned by gas generators (the ‘spark spread’) rose from about £5/MWh to average around £40/MWh over the year. Gas generators also gained from the ‘balancing mechanism’, which pays generators to correct short-term imbalances between offered supply and demand: these revenues increased by 250% from 0.4 to almost £1bn. Our estimates (albeit uncertain) of the increased cost of gas inputs to power generation also suggest that profits, as well as revenues of gas generators, increased substantially.

In formal legal terms, the GB market is highly competitive, but in reality there is little competition between gas and other GB-generating sources. Up until at least 2020, a major factor constraining higher prices in the wholesale market was imports through interconnectors from mainland Europe. We infer that a largely unrecognized impact of the past few years is on the competition facing GB generators: multiple factors, exacerbated by the energy crisis, impeded the inflows of competitive electricity from continental Europe. GB generators were thus more able to raise prices further above input costs.

The higher GB wholesale prices increased revenues for all generators (except those on fixed-price contracts). Revenues to nuclear generators in 2022 rose proportionately less than gas (we estimate, revenues rose by about two-thirds, to £4.6bn ) because nuclear mostly sells its electricity on forward contracts, reflecting pre-crisis prices. The revenues of nuclear and other generators with extensive forward contracts may rise during 2023 if those contracts reflect the 2022 price increases.

Generators with Renewable Obligation Certificates (ROCs)

The majority of renewables output in 2022 was from generators with Renewable Obligation Certificates. We estimate that revenues to generators on ROCs increased by £7.7bn (100%) compared to the pre-Covid average (2018-2019), from £7.7bn to £15.5bn. Unlike gas, there would have been no significant increase in operating costs, though, like gas, they argue that for several years previously, wholesale prices had been lower than expected.

Onshore Wind. Through to 2020, total revenues for onshore wind were divided roughly equally between selling electricity and the value of the ROCs: by 2020 the former almost quadrupled whilst ROCs value remains unchanged.

Offshore wind. Through to 2020, the revenue for the early offshore windfarms was dominated by selling ROCs; by 2021 this was matched by revenue from selling electricity, which doubled again in 2022.

Biomass & Hydro. The revenues to biomass and hydro benefit from being able to schedule output to meet peak wholesale prices; the revenues to biomass on ROCs overall is comparable to nuclear power, at over £4bn in 2022.

Due to concern about the level of profits implied, the government introduced the Electricity Generator Levy (EGL) on nuclear and renewables with ROCs, which took effect from 1st January 2023. We estimate that, had this been in operation in 2022, it would have reduced the revenues to generators by 12% (nuclear and hydro) to 14/15% (biomass/ wind). The impact of the EGL in practice, for 2023, will depend on the evolution of electricity prices but is likely to be lower. The EGL does not apply to gas generators, partly on the grounds that the gas industry (fuel production) itself is subject to the Energy Profits Levy applied to oil and gas companies. However, unlike that profits levy, the EGL does not allow tax offset against new investment.

Renewable generators and Contracts-for-Difference (CfD)

The CfD system introduced in 2013 offers nominally fixed ‘strike prices’ to renewable generators, which since Jan 2014 have competitively bid for contracts through auctions. This has become the main mechanism for securing competitive investment in new renewables, particularly offshore wind.

Technically, the CfD generators still sell into the wholesale market, but if the price received exceeds their strike price, the excess imputed revenue is returned to electricity suppliers. Consequently, CfD generators made little or no additional revenue from the energy crisis, except insofar as the output itself increased due to the rapid expansion, particularly of offshore wind.

The return of excess revenues from these CfD generators marginally helped to temper the impact of the energy crisis on consumers. However, due to the complexity of the revenue recycling mechanism, it is not clear that all the returned revenues resulted in lower consumer prices, except insofar as these were included in the Ofgem price cap on standard tariffs.

A modest but growing volume of renewable generators outside of CfDs and ROC supports also benefited from the general rise in wholesale prices.

Conclusions

The way the wholesale electricity market operates exacerbated the impact of the energy crisis on electricity consumers. In total, the associated bill to electricity consumers rose by £29bn in 2022, compared to pre-Covid levels. Most of this additional revenue was associated with gas generation, and renewable generators supported by Renewables Obligation Certificates, which between them accounted for about 70% of the increased revenues. There is evidence that the revenues to gas generators substantially exceeded the increase in their costs, and there is no reason to believe that the cost of those renewable generators increased significantly.

Other major beneficiaries were nuclear and biomass generation, and coal generation where revenues increased from negligible levels to over £1bn. The remainder of gross revenue change reflects the expansion of CfD generation on fixed-priced contracts (where ‘excess’ revenues were returned to energy suppliers).

We find that the Electricity Generator Levy would have made a modest difference if it had existed in 2022, and its impact in 2023 is likely to be lower.

The complexity and confidential nature of contracts in the system means that these are estimates; the fact that many electricity contracts are hedged and traded means that consumer prices also reflect revenues accruing to financial intermediaries.

Electricity is an essential commodity, but the structure of the electricity market has inflated revenues to most generators and exacerbated consumer hardship at a time of national crisis. Reforms should seek to reduce the wholesale dependence on fossil fuel price volatility, enhance transparency, and better reflect the known and more stable economics of a rapidly growing volume of renewable generation.