The explanation of systematic breakdowns in supervisory oversight over time must include the shift in Federal Reserve culture during and after the 1990s

The closing of Silicon Valley Bank (SVB) on March 17 began a series of extraordinary steps taken by key supervisors of the global financial system (United States, United Kingdom, and Switzerland), all of which tell us that we are not living in normal times. From the US Treasury’s approval of a “systemic risk exception” for SVB, thus allowing a blanket government guarantee of all its deposits, to the precedent-setting rescue of all deposits at Credit Suisse, ordinary understandings of the law were stretched to and probably beyond their limits.

The factors contributing to the demise of SVB have been detailed in numerous press accounts and editorial commentaries. Increasingly, the focus of these articles has shifted from the massive interest-rate and liquidity bets taken by SVB, coupled with its rapid growth, to questions regarding why the Federal Reserve failed to supervise this bank adequately. There is nothing new or exotic about the risks on SVB’s balance sheet. In fact, the financial posture of SVB (large uninsured deposits funding purchases of long-term bonds) was similar to the bad bet of First Pennsylvania Bank during a similar high-inflation period in 1980 that resulted in a financial rescue by the Federal Deposit Insurance Corporation (FDIC).

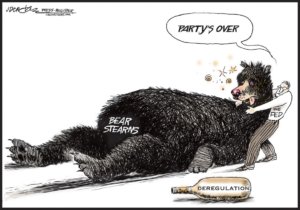

In the emerging debate about how the 2018 roll-back of some banking restrictions enacted as part of the 2010 Dodd-Frank Act figured in the demise of SVB, numerous writers have pointed to the need to address the failures of bank supervision before new supervisory statutes and regulations are enacted. So why is it that the Federal Reserve, the principal supervisor of SVB, seemed to have fallen asleep at the switch? The question is important because SVB’s failure illustrated that financial system supervisors are not comfortable allowing market discipline arising from uninsured deposits to work, which reinforces the skeptic’s presumption of implicit guarantees for large depositors in even mid-sized banks.

We spent more than 20 years each in the Federal Reserve System. We have written extensively on issues related to financial markets and institutions, and we worked closely with the banking supervisors at our respective Federal Reserve Banks (Cleveland and New York). We agree that the explanation of systematic breakdowns in supervisory oversight over time must include the shift in Federal Reserve culture during and after the 1990s. In the late 1970s and throughout the 1980s, William Taylor, a tough-minded supervisor, rose through the ranks to become the director of the Division of Banking Supervision and Regulation (BS&R) at the Fed’s Board of Governors. Taylor was a dominant figure, and under Taylor, BS&R was a force to be reckoned with in internal Board politics.

The exit of Taylor from the Board, following his appointments by President George H.W. Bush as the first head of the Resolution Trust Corporation in 1990 and as FDIC Chair in 1991, left a power vacuum in BS&R and shifted supervisory policymaking power at the Board from BS&R to the Division of Research and Statistics (Research), home of most of the Board’s staff economists. Under the leadership of Fed Chair Alan Greenspan during the comparatively stable banking environment of the 1990s, the Fed’s supervisory culture moved from an audit/compliance model toward a more consultative approach. This consultative approach became known internally as “value-added supervision.”

The growing influence of Research at the Fed occurred while innovations in computing and information technology were transforming risk management in large financial firms. By 1997 supervision of what eventually become known as Systemically Important Financial Institutions (SIFIs) began to use a more model-based approach focused on leveraging the SIFI’s own risk modeling to supervise them, using data submitted by the SIFIs. Traditional on-site field examinations were curtailed. The problems with this approach are that the institutions’ own models might be easy to influence or alter, important institutional structural details might be ignored, and over time institutional knowledge would be lost.

The Basel II international capital standards for bank supervision (2004) were a heavily model-based system of risk assessment. Those standards reinforced an ongoing trend for using model-based supervisory judgment as a substitute for institutional knowledge-based judgment, rather than as a complement in bank examinations. By its very construction, an international capital standard fitted to banks across different legal and cultural traditions necessarily deemphasizes institutional structural characteristics in the risk modeling. The new consultative approach to supervision drew on a best practices mentality. Unintentionally, that worldview increased the frequency of homogenous risk models among the SIFIs, further increasing the likelihood that all the supposedly independent risk models would break down simultaneously and become their own source of systemic risk.

The financial crisis of 2007-2009 challenged policymakers as data/model-based decisions of financial market participants, including SIFIs and financial system supervisors, failed catastrophically, producing the sharpest economic downturn since the 1930s. The responses of financial system supervisors internationally through the Basel III capital standards and of the US Congress in drafting of Dodd-Frank (both climaxing in 2010) were to double down on model-based supervision with the adoption of DFAST and CCAR. DFAST is the application of stress tests devised by the federal bank supervisory agencies (primarily the Federal Reserve) to the largest financial institutions, projecting their overall financial condition forward over nine calendar quarters in conditions of increasing financial stress. CCAR is “comprehensive capital analysis and review,” aimed at determining the adequacy of capital over time in conditions of varying financial stress.

The evolution of the Board’s supervisory policy culture away from the Bill Taylor model was completed by the appointment of an MIT-trained Ph.D. economist who emphasized quantitative modeling as director of BS&R in 2012. Economists of a similar viewpoint also were tapped to lead the new Division of Financial Stability at the Board following the Great Financial Crisis. In the mid-2000s, one of the visiting scholars in macroeconomics at the Cleveland Fed told us that macroeconomics today is like SciFi movies: It is mostly special effects. Sadly, the same can be said for the model-based financial supervision of today that is abstracted from institutional details and fundamental financial structures.