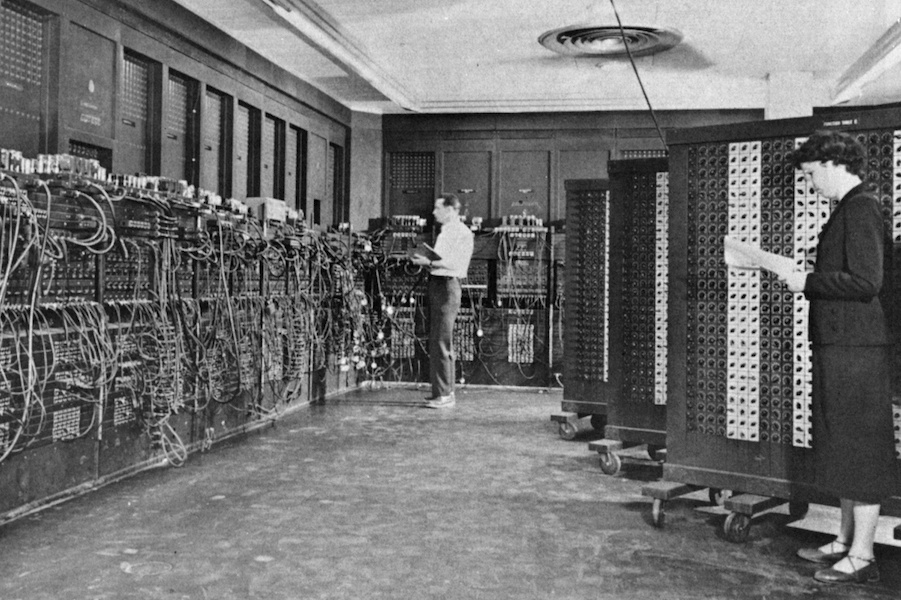

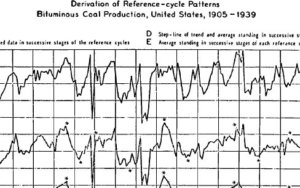

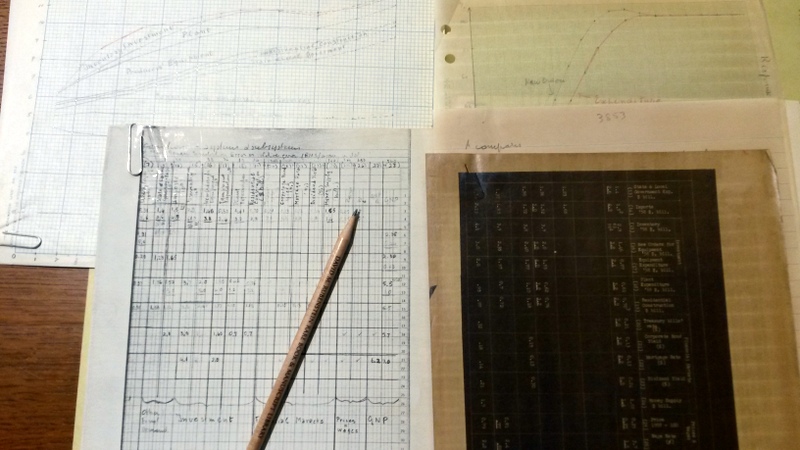

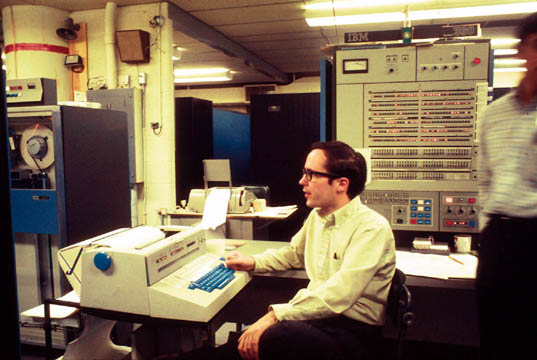

Below is a picture of what the desktop of MIT macroeconomist Franco Modigliani may have looked like in 1970, when he was working on the large macroeconometric model he was building for the Fed with Penn colleague Albert Ando. The material is taken from his archives. The second picture is a screen capture by data wizard

@freakonometrics, dated a week ago.

The immediate conclusion one is tempted to draw from such juxtaposition is that the development of computers dramatically affected economics. Computers radically transformed the practices of economics. Hand or desk calculator computation gave way to code writing, card punching and data inputing, waiting hours for mainframe machines to execute programs, then reel reading and hand-drawing results in the 1970s, all things now done by software on PCs in a matter of seconds. It also provided economists with techniques they had only dreamed of (multinomial probit, Full Information Maximum Likelihood …) and some they hadn’t even thought of (simulations, machine learning, matching algorithms). For these reasons, many commentators, including Betsey Stevenson and Justin Wolfers or more recently Justin Fox, have been prone to explain that computerization resulted in a “booming business” in empirical economics, or a trend “from theory to data.”

Though this bears unmistakable element of truth, the idea that computerization fostered the rise of applied economics seems somewhat simplistic. While macroeconometricians like Modigliani had yearned for more computational power, better storage, convenient software, the leap done by the computer industry at the turn of the 1980s did not prevent the marginalization of Keynesian type of econometrics in the wake of the Lucas critique, nor that of the other computationally-intensive field of the 1970s, computational general equilibrium. The former was replaced with calibration, often viewed as a second best. And paradoxically, the hot methodological debate pervading microeconometrics in the early 1980s ended up in the rise of quasi-experiments, a method minimally demanding in terms of computational power.

Tying the purported rise of economics with the spread of computers also overlooks the possible transformative effects of computers on theory. In mathematics, physics and biology, automated-theorem proving, numerical or algorithmic proofs, and simulations have become well-accepted scientific practices. In economics, by contrast, that proofs are demonstrated with the help of a computer is carefully concealed in published papers. In spite of a long tradition dating back to Guy Orcutt and Jay Forrester, simulation is merely acceptable as an empirical illustration, or when analytical proofs are impossible to reach. Complaints that economists have been unable to change their idea of what a “proof” should be, that they had stick to the Hilbertian paradigm instead of jumping on the algorithmic bandwagon, or shun numerical methods in their most prestigious publications abound. If a few computer-based approaches, like mechanism design and experimental economics, have become mainstream, a galaxy of new approaches, from agent-based modeling to automated theorem proving, computational game theory or computational social choice have hitherto wandered on the margins of the discipline, though there are hints that the situation is slowing evolving.

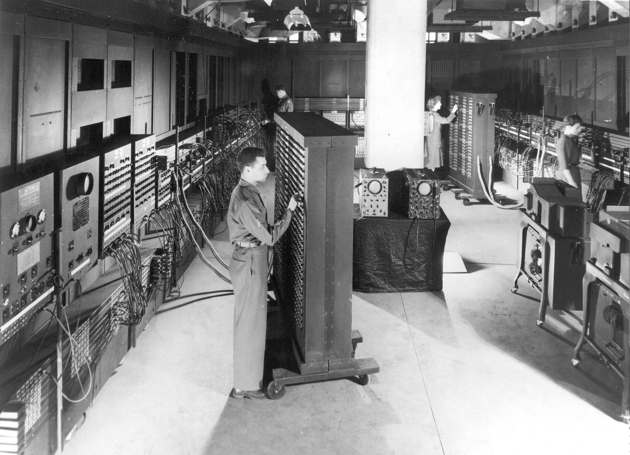

In a recent paper, Roger Backhouse and I therefore argue that what computers did to economics, and in particular to theoretical and applied economics requires closer historical examination. It is obvious that computers were important: take away computers and much modern applied economics would be impossible. But the fact that computers were important does not explain how they changed economics. One idea we put forward is that computers did not just promote applied work at the expense of theory.They challenged the demarcation between theory and applied work: running an agent-based simulation, or writing down a matching algorithm in mechanism design does not seem to belong in either of these categories. The scope and speed of economists’ accommodation of this transformation in the past and the future is not merely influenced by the hardware econ labs and research departments are equipped with. The history of computerization in economics has been riven with giant leaps, but also utopian hopes and over-optimistic predictions. In 1948, Wassily Leontief, the brain behind input-ouput analysis, thought the ENIAC could soon “tell you what kind and amount of public works were needed to pump-prime your way out of a depression.” In 1962, econometrician Daniel Suit wrote that with the aid of the IBM 1620, “we can use models of indefinite size, limited only by the available data.” In 1971, RAND alumni Charles Wolf and John Enns explained that “computers have provided the bridge between […] formal theory and […] databases.” The next challenge, they argued, was to use computer not merely for “hypothesis-testing,” but also for “hypothesis-formulation.” And Francis Diebold has recently unearthed 1989 lecture notes in which Jerome Friedman claimed that statisticians are “substituting computer power for unverifiable assumptions about the data.” All thing that have either not happened, or much more slowly than predicted

ENIAC (1946); IBM 1620 (1959); IBM 360 (1965), IBM PC (this one, 1991)

The spread of various computerized approaches to economics has been conditioned by the development of software (think Stata, Autobox, MUDA, Dynare), the ability of young researchers to acquire coding skills or collaborate with other scientists, the availability of business and governmental data, salesmanship to policy-makers, and how epistemologically acceptable these approaches were made to other economists. Experimental economists and mechanism designers were successful on all fronts, recent histories have shown. On the other hand, why Guy Orcutt’s, then Santa Fe’s simulations proved “a hard sell,” to use Robert Axelrod’s words, is still unclear. In all cases, unpacking the exact influence computers had on economics requires more attention by historians, but also more testimonies by those who lived through these events. A few publications have strived to record protagonists’ reminiscences, but much of the material needed for a more comprehensive history is still buried in economists’ mind.

Full paper here.