Prof. Tahoun is a Full Professor at London Business School. He was named one of the Top 40 Professors under 40. Tahoun has been a research scholar at the University of Chicago Booth School of Business and the Wharton School, a faculty member at the London School of Economics, a research fellow at the University of Valencia, and a banker at HSBC.

The current focus of Tahoun’s research is on “Text as Data.” Specifically, he develops methodologies to convert raw text into actionable data. These methods can predict the impact of systemic shocks, such as political events or global pandemics, and create firm-level metrics for various issues like cybersecurity risk, inflation, and climate change. He adapts techniques from computational linguistics to construct datasets valuable for policymakers, which can be used to monitor country risk and sentiment, analyze risk transmission during crises, measure the risks, costs, and opportunities firms associate with specific shocks and policies, and compare impacts attributed to different sources.

Tahoun’s research also addresses important societal questions, ranging from the quid-pro-quo relations between politicians and the corporate world, the economic consequences of revolutions, and the global development of securities law in response to corporate scandals over the past 200 years. In addition, he has been engaged in comparative international work on executive compensation, investigating the roots of cross-country differences in pay packages. Furthermore, Tahoun researches and publishes on the economic outcomes of transparency, aiming to understand the impact of information provision and dissemination and questioning whether more information always leads to better outcomes.

Tahoun has published his research in the Quarterly Journal of Economics, the Review of Economic Studies, the Journal of Finance, the Review of Financial Studies, the Journal of Financial Economics, the Journal of Accounting Research, the Journal of Accounting and Economics, the Accounting Review, and the Review of Finance. His work has been covered by The Economist, the New York Times, the Wall Street Journal, and the Financial Times.

Ahmed Tahoun

By this expert

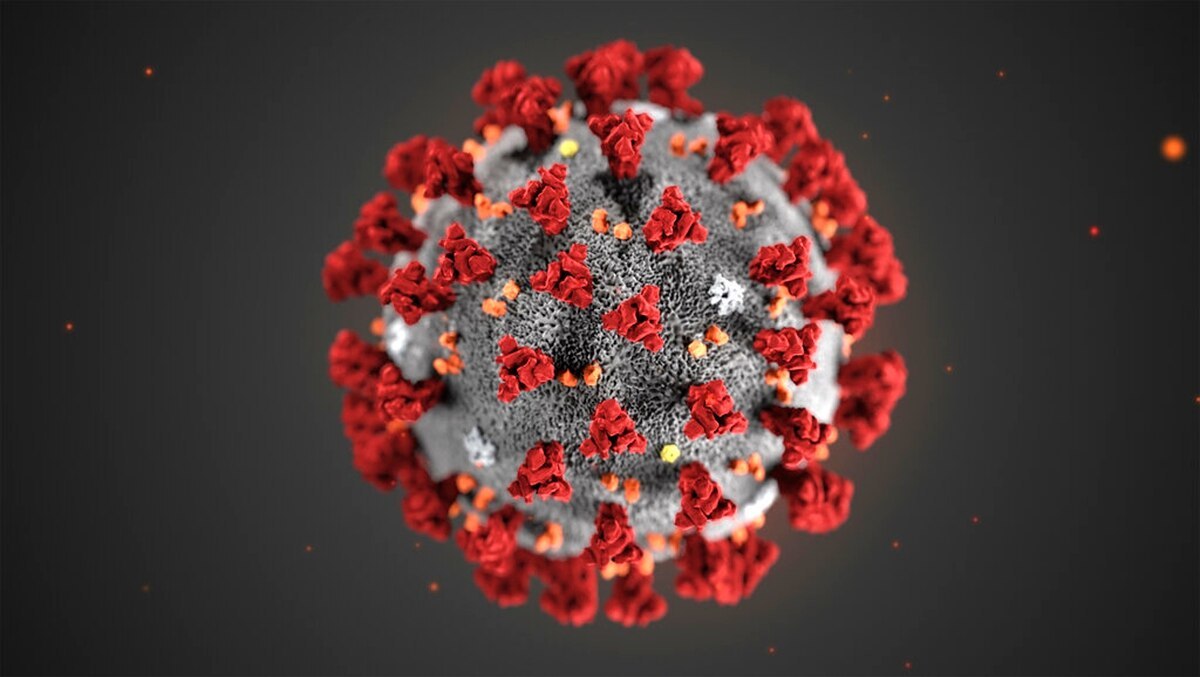

Which Businesses Will Covid-19 Disrupt and Why? An Assessment Based on Firm-Level Data

The scale of firm exposure to the coronavirus is unprecedented by earlier outbreaks, spans all major economies and is pervasive across all industries

Firm-Level Exposure to Epidemic Diseases: Covid-19, SARS, and H1N1

As Covid-19 spreads globally in the first quarter of 2020, this paper finds that firms’ primary concerns relate to the collapse of demand, increased uncertainty, and disruption in supply chains

The Global Impact of Brexit Uncertainty

Using tools from computational linguistics, we construct new measures of the impact of Brexit on listed firms in the United States and around the world