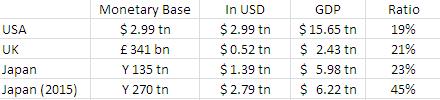

Grabbing our trusty GDP yardstick, we grabbed some quick monetary base numbers from the US, UK and Japan, doubled today’s Japanese figure, picked up the exchange rate from Google, and projected a 2% growth rate on the Japanese GDP figures. And the answer is yes, it is a big deal:

Just looking at some basic numbers, the suggestion is that the Japanese monetary base will be 45% of GDP in 2015. Compared to the US current situation of 19% and the UK’s position of 21% (of narrow money) that seems like a lot. Can’t tell you what it will mean, but it looks important.

———————————————————————————————————————————————————————————————————-

Sources: US monetary base St. Louis Fed, UK Monetary base (narrow money) Bank of England, Japan monetary base, Financial Times 5 April 2013, Exchange rates (from Google on 5 April 2013), JPY/USD 0.0103, GBP/USD 1.53, GDP from IMF 2012 forecast as listed on Wikipedia.