Originally published on Democracy

Why does the IMF keep badly missing its global growth forecast? And what does that have to do with the 2016 presidential election?

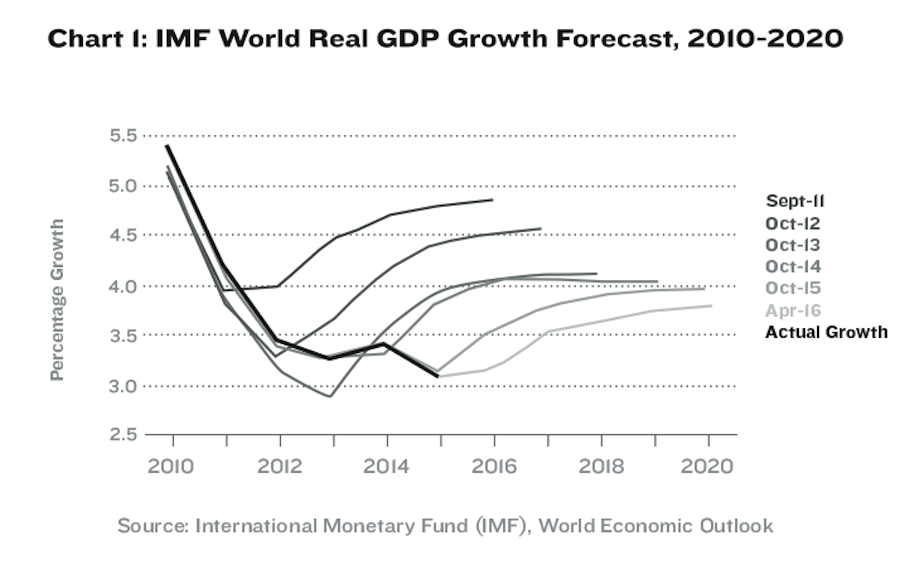

In the years since the 2008 global crisis, when the world’s growth rates tumbled, the IMF has dutifully printed forecast after forecast predicting rebounding growth rates. But in reality, rates have fallen well short of these predictions, as seen in Chart 1.

One of the key and largely overlooked reasons for this disappointing growth is hiding in plain sight: the increasing global burden of private debt—the combination of business debt and household debt. Even though government debt grabs all the headlines, private debt is larger than government debt and has more impact on economic outcomes. In the United States, total nonfinancial private debt is $27 trillion and public debt is $19 trillion. More telling, since 1950, U.S. private debt has almost tripled from 55 percent of GDP to 150 percent of GDP, and most other major economies have shown a similar trend. [See Chart 2.] Since GDP is largely the sum of all the spending, and thus income, of households and businesses in an economy, if aggregate private debt to GDP has tripled, that means that average businesses and households have three times more debt in relation to their income. Both private debt and government debt matter, and both will be discussed here, but of these two, it is private debt that has the larger and more direct impact on economic outcomes, and addressing the issues associated with private debt is the more productive path to economic revival.

Stagnant incomes, underemployment, and job insecurity are key reasons so many voters in Europe and America are now willing to embrace candidates outside of the mainstream. But the now stultifying level of private debt, and the accompanying impact on growth, is an equally important reason.

Private debt is a beneficial and essential part of any economy. However, as it increases, it can bring two problems. The first is dramatic. Very rapid or “runaway” private debt growth often brings financial crises. Runaway private debt growth brought the 2008 crisis in the United States, the 1991 crisis in Japan, and the 1997 crisis across Asia, to name just three. And just as runaway debt for a country as a whole is predictive of calamity for that country, runaway debt for a subcategory of debt, such as oil and gas or commercial real estate, is predictive of problems within that subcategory.

The second problem it brings is much more subtle and insidious: When too high, private debt becomes a drag on economic growth. It chips away at the margin of growth trends. Though different researchers cite different levels, a growing body of research suggests that when private debt enters the range of 100 to 150 percent of GDP, it impedes economic growth.

When private debt is high, consumers and businesses have to divert an increased portion of their income to paying interest and principal on that debt—and they spend and invest less as a result. That’s a very real part of what’s weighing on economic growth. After private debt reaches these high levels, it suppresses demand.

Because interest rates are low, some economists have dismissed this impact. However, most middle- and lower-income households (which is where the highest rate of debt growth has been), as well as most small- and medium-size businesses, pay interest rates much higher than money market rates. In the case of low-income households and small businesses, the rates for some types of debt can be very high, often an APR of 20 to 30 percent or more. And in addition to interest, all these borrowers have to pay down the principal balance of the loan. High debt makes these borrowers more reluctant to spend or take on more debt. Further, an estimated 6.4 million of the 56 million mortgages held in the United States are still severely underwater. Millions more are less severely underwater or just barely “above.” Many of these mortgages were underwritten at the height of the boom. Since then, the home values, and in many cases the incomes, of these borrowers have fallen. Lower rates may help but do not solve their financial stress. Though their rates may be lower, all of these borrowers are now in a world where increases in income and revenue are harder to come by.

This all takes a bite out of the spending and investing that drives growth.

The unprecedented amount of our global debt glut is underscored by the creeping presence of negative interest rates—a situation where the borrower, unbelievably enough, gets paid for borrowing. An estimated 15 percent of European corporate debt issued now has a negative interest rate. If the massive $150 trillion glut of debt is the culprit that is curbing demand, then perhaps this European Central Bank experiment with negative rates is the inevitable response to this glut. High private debt contributes to lower rates by reducing demand for credit—since highly leveraged borrowers have less ability to borrow more and are often understandably wary of further borrowing. But these negative rates are not generally available to low- and middle-income borrowers.

Despite the popular perception, consumers carry 13 percent more debt as a percent of GDP than in 2000.

U.S. private debt growth has disproportionately affected the least well-off Americans. In fact, since 1989 (the year the Fed started a survey of this statistic), the debt level of the 20 percent of U.S. households with the lowest net worth has grown two and a half times faster than all other households. And though consumers have deleveraged since the crisis, and the popular perception is that consumers are in much better shape today, consumers are in fact carrying 13 percent more debt as a percent of GDP than they were in 2000, the moment before the ill-fated private debt boom that led to the 2008 crisis began.

As mentioned, GDP roughly equates to the aggregate spending and income of the businesses and households in a country, and the private debt of a country is the sum of household and business loans. So to speak about the “private debt to GDP ratio” of a country is essentially the same as speaking about the “private loan to income ratio” of that country. You’ll recognize that ratio, because it is the same one that lenders have long used to help make loan decisions for individuals and businesses. Whether you are applying for a loan as an individual or for your business, if your loan-to-income ratio is low, the lender is likely to conclude that you have capacity for more debt, and if it is high, the lender will likely conclude that you will struggle to pay your existing loan, much less qualify to take on additional debt.

It follows directly that if a country’s private debt to GDP ratio is low, let’s say 50 percent, then the households and businesses in that country generally have low loan-to-income ratios and are well positioned to power growth through increased leverage. And if a country’s private debt to GDP ratio is high, let’s say 200 percent, then the households and businesses in that country are generally overleveraged, with, on average, very high debt ratios. They are much less likely to be able to boost growth through more borrowing.

Chart 2 showed that private debt to GDP in major economies has been growing rapidly since World War II. However, it has been growing in size relative to GDP for a lot longer than that. It’s part of a process often described by economists as “financialization” or “financial deepening,” an increase in the size of a country’s debt and equity markets usually explained as simply the maturation of a market. But as we have seen, when it comes to debt, it is much more than that—it is the path from low leverage to overleverage for the participants in that economy. The benefit of increasing leverage from low levels has played a central role in the miraculous gains in incomes over the 200-plus years since the Industrial Revolution. You can see this clearly in Chart 3. I have made a concerted effort to reconstruct more than 200 years of private debt history for the six countries in this chart—China, Japan, Germany, Britain, France, and the United States—because collectively, they have accounted for roughly 50 percent or more of global GDP since the Industrial Revolution. So studying the data of these six countries during this period gives us a fairly solid proxy for the world during the most important era of economic history. (This chart is a work-in-progress which will be augmented and refined in preparation for an upcoming book on this same subject.)

All six countries show more moderate levels of private debt in the early years of this period and much higher levels today, punctuated by crescendos of private debt at pivotal moments—the French Revolution, the crisis of 1914 that began immediately prior to World War I, the Crash of 1929, Japan’s crisis in the early 1990s, and the Great Recession. These crescendos are often followed by periods of rapid and painful private debt deleveraging, such as during the Great Depression. Notwithstanding the peaks and valleys along the way—all instructive and worthy of deeper study—the general trend is toward higher levels of debt. And the world has now reached a point where combined global government and private debt to GDP is the highest by far in history.

As mentioned, short bursts of runaway growth in private debt have often led to crisis—the United States in 2008 and Japan in 1991 to name just two. That is because so much lending occurs that it results in overcapacity: Far too much of something is built or produced—housing and office buildings are two examples—and too many bad loans are made. In fact, so many bad loans are made that they approach or exceed the amount of bank capital in the system. So, inevitably, the economies of these countries need to slow to a crawl to allow demand to catch up to this overcapacity, and the banks need to be propped up or rescued because of the extraordinary amount of bad debt.

Some economists maintain that this buildup in private debt is not a concern, because for every borrower there is a lender and therefore it all balances out. This view ignores the fact that the vast majority of lending is made by a very small handful of large institutions whose increased consumption is unlikely to match the decreased consumption of overburdened borrowers, especially in the same period as that decreased consumption. Instead, their consumption is more likely to appear as retained earnings for those institutions. Further, this view ignores the disproportionate burden of this debt on middle- and lower-income groups, the very ones we depend on to power growth.

Importantly, the role and importance of private debt has been marginalized in the two leading economic policy camps. That’s why they both failed to forecast the crash of 2008. The “doves,” who favor government management of the economy through interest rates and deficit spending, were confident the future held a continuation of the supposedly benign economic era they had termed the “Great Moderation,” which ran from the mid-1980s to the mid-2000s and was characterized by low inflation, steady expansion, and decreased business-cycle volatility. The “hawks,” who prefer a hands-off policy on the part of government and strongly oppose government deficits, made dire forecasts of much higher inflation because of the high levels of government debt. But neither focused much on private debt, and the predictions of both were far off the mark.

What greater indictment can be made of an economic theory than that it failed to forecast the greatest economic calamity in 70 years? Yet both schools of thought remain largely unchanged and unrepentant. Both schools minimize the importance of private debt because public debt seems inherently and more appropriately to be our collective responsibility, while private debt seems more the responsibility of free enterprise and the marketplace. Further, the primary locus for training and influence on economists has long been the Federal Reserve, which is one step removed from private sector loans and primarily deals with government debt and bank reserves, and therefore thinks of the world in those terms.

The Global Impact of Chinese Debt

Because this current private debt burden suppresses spending and investment, growth rates in the United States, Europe, and Japan—which have private debt-to-GDP ratios of 150 percent, 162 percent, and 167 percent ,and 2015 real growth rates of 2.4 percent, 1.9 percent, and 0.5 percent, respectively—will continue to lag. Real U.S. growth rates were 1 to 2 percentage points higher for most of the post-World War II period. Even a 1 percent higher growth rate in the eight years since the crisis would have resulted in $1.2 trillion more in GDP today. And now China is on the verge of joining this mediocre-growth club.

As I forecasted in this journal in early 2015 [see “The Coming China Crisis,” Issue #36], China is now beginning to suffer the consequences of its recent private debt binge. Since 2008, it has poured on $18 trillion in new private (or nongovernment) loans. The proverbial chickens have begun to come home to roost. In the summer of 2015, China’s stock market collapsed by 45 percent. Its economy is decelerating. Its skyrocketing private debt ratio has now reached 231 percent, bringing a level of overcapacity that makes a continued slowdown in its growth inevitable in order for demand to catch up to a now-staggering oversupply of housing, commodities, and other items.

As recently as 2011, China’s growth rate was 15 percent, but is declining and is now reported by Chinese authorities as 6.7 percent, though many prominent analysts believe it is 4 percent or less. In its rush to grow, China has simply built far too many buildings—witness the many ghost towns—and produced far too much steel, iron, and other commodities—and made far too many bad loans in the process. Its overcapacity is so pronounced that it will take years for true demand to catch up with this oversupply. That’s a central part of the reason the IMF keeps overforecasting global growth. The IMF is having difficulty accepting the amount of correction that will be required.

There is, however, a major complication in all this: In spite of all rhetoric to the contrary from its leaders, China is compounding the problem by fully continuing to overlend and overproduce, albeit with diminishing returns. China’s nongovernment loans have grown almost a trillion dollars in the most recently reported period alone, and they are still producing 40 percent more steel than the world needs. In continuing this trend, the Chinese are taking a problem whose size and scope is unprecedented and making it all that much bigger.

Because China is still pouring it on, it continues to boost some growth and provide some support to commodity prices. However, in so doing, its eventual problem will be both worse and longer lived. While there are differences between China and Japan, it is worth noting that Japan’s crisis of the 1990s took eight years to unfold. After very high GDP growth in the 1980s, fueled primarily by runaway lending, Japan suffered a stock market crash in 1990, then a real estate collapse in 1991, and finally a bank rescue in 1998. And Japan has posted almost 20 years of near-zero growth since that rescue.

The IMF keeps overforecasting global growth because it can’t accept the correction needed in Chinese supply and demand.

China’s ultimate problem is twofold. First, its growth rate will continue to slow to very low levels, perhaps, similar to Japan, for as long as a generation. Second, the oversupply will continue to mean downward long-term pressure on major nonagricultural commodity prices—in an ugly word, deflation.

This slowdown in growth will spill over to the rest of the world—contributing to the continued mixed growth results in the United States and Europe. China’s unfolding crisis will not lead to something like the 2008 meltdown, since that event stemmed from runaway private debt growth in countries representing more than half of the world’s GDP. But it won’t be small either, since China and other runaway lending countries that are economically intertwined with China such as Australia and South Korea together constitute more than a quarter of the world’s GDP.

The most immediate impact of China’s slowdown will be a dampening of the economy in other parts of the Asia Pacific region, such as South Korea, Australia, Thailand, Vietnam, Singapore, and even Japan.

Africa and South America will continue to be profoundly impacted too, because both continents are disproportionately dependent on commodity exports. Take South America, where real GDP growth has collapsed in the last five years from more than 5 percent to less than 1 percent, due as much to reduced demand from China as from any other factor.

The United States, Europe, Japan, and China—the big four—together constitute almost 65 percent of world GDP. These four have collectively been the engines that have powered global growth in the post-World War II era. But of these four, only China has shown rapid growth in recent years. China’s growth is now decelerating and will trend much lower in coming years. All four are now overleveraged and as a result will find it very hard to return to high growth. So what will be the next source of global growth? The growth of most of the rest of the world, largely Africa, South America, Southeast Asia, and the Middle East (which are collectively much smaller than the big four in economic terms) is driven in large measure by exports of raw materials, component parts, and commodities to these big four. So their growth will be muted as well. India is sometimes mentioned as a potential driver of economic growth, but it is only 3 percent of world GDP, so even if it has high growth, the impact globally will be small.

Given this high global leverage, it is not unreasonable to think that the world’s combined real growth rate will stay moderate or low for a generation. Welcome to the new era of subpar growth.

How to Solve the Problem

So how does a country deal with the problem of too much private debt—a task often referred to as deleveraging? This question does not currently appear on any policymaker’s agenda. However, as is easy to see from Chart 4, this will be one of the defining questions of the upcoming age.

Although I believe public debt deleveraging is a less pressing issue than private debt deleveraging—after all, governments can always resort to printing money, while households and businesses can’t—they will both be a very big part of what defines the economic era ahead. Let’s briefly examine them both.

The first thing to understand, however, is that in developed countries over any sustained period, total debt grows at a rate roughly commensurate with or greater than GDP. In fact, private debt alone usually outgrows GDP. As I will discuss below, the exceptions to this are when there is very high inflation, a high level of net exports, or a calamity such as depression or financial crisis.

Debt grows as much or more than GDP because it is a necessary and causal factor in GDP growth. It’s one of the axioms that must be understood to grasp the modern world. For example, during the “Great Moderation” period from 1985 to 2002, the GDP grew by $6.6 trillion, but total debt grew by $14.9 trillion, taking America’s total debt ratio from 155 percent to 198 percent. Private debt alone grew by $10.7 trillion. Moderation indeed!

In fact, the most benign period of U.S. debt growth since the aftermath of World War II was 1958 to 1968, when total debt declined on a percentage basis from 130 percent of GDP to 126 percent—a trivial amount of deleveraging. Even then, however, absolute debt outgrew GDP. But given even these rare moments of slight deleveraging, the path of debt in that overall postwar period has consistently been toward dramatically higher levels—doubling from 127 percent in 1951 to 255 percent today.

Some economists assert that establishing causality from debt to economic growth is difficult. That may well be so. Nevertheless, in my everyday experience over 40 years in business, as the CEO of three businesses and then as a private investor, the majority of the companies I am familiar with depend on debt for growth and expansion. In fact, without debt, most economic activity would grind to a halt. If you want to buy an office building or a house, it usually requires a loan. If you want to open a new store or expand a factory, it usually requires a loan. In a recent example, the installation of solar panels on residential homes was a small business propped up by government subsidies, until the financial industry figured out a way to offer homeowners a 20-year lease on those solar panels and the business took off. The list of examples is endless. Finance—the making of loans—is as central as any factor in driving economic growth.

Debt, especially private debt, is vital to powering growth. Yet when it gets too high it begins to impede growth, a phenomenon I refer to as the “paradox of debt.” Debt is necessary for growth, and countries with low levels of private debt to GDP are well-positioned for strong growth, by using increased private debt for things like new factories and housing. It is only when debt has piled up to levels that are too high (often after years of runaway or profligate lending), that debt becomes a burden. So when debt gets too high, how does a country deleverage—decrease the amount of debt relative to its GDP—without putting a dent in economic growth?

Politicians, when confronted with the problem of government debt that is too high, often respond by saying that we will simply grow our way out of the problem. Unfortunately, it’s not that simple. Let’s look at the historical data to see how both public and private deleveraging has actually been accomplished.

Start with public debt deleveraging, since it is the type of debt that garners the most attention. Economists and politicians often cite the post-World War II period as a triumph of government debt deleveraging. In the 30 years from 1951, a point just beyond the wind-down of World War II, to 1980, the beginning of the Reagan era, federal debt to GDP declined from 73 percent to 32 percent (it is now back to 105 percent). What these experts generally either don’t notice or neglect to mention is that private debt increased dramatically during this period, from 54 percent to 101 percent, entirely offsetting the decline in government debt. It was that offsetting leveraging that allowed the public debt ratio to come down. Otherwise we would have had massive GDP contraction just like in the Great Depression. From 1951 to 1980, a huge $2.7 trillion increase in private debt powered a $2.5 trillion increase in GDP, such that even though public debt grew by $653 billion, it declined in ratio to GDP. But total debt increased in ratio to GDP. The GDP growth resulting from that private debt growth is what allowed the federal debt ratio to decline without causing a contraction in GDP.

In fact, offsetting private leveraging is usually the mechanism that enables the ratio of public debt to come down. So, for example, we may find that a given country’s GDP grew by $30 billion, but public debt grew by only $10 billion, thereby improving that country’s public debt ratio. When we examine countries comprehensively, what we will generally find in a situation like this is that private debt will have increased by $20 billion or more in the same period, filling the “gap” left by slower public debt growth. In this example, it took a full $30 billion in total debt growth—$10 billion public and $20 billion private—to obtain this $30 billion in GDP growth. The exceptions to this are when there is very high inflation or a large net export position.

To understand this more fully, I examined a database that includes available data from 1945 onward for 47 of the largest 71 countries, including the 20 largest. (Historical private debt data is missing for certain countries, underscoring the lack of attention to this subject.) These countries together constitute 91 percent of world GDP. For these countries, since World War II, there have been a total of 42 cases where public debt to GDP (and not also private debt) has declined by at least 10 percentage points in a five-year period.

By my reckoning, in 33 of these cases, this deleveraging was due largely or wholly to increasing private debt leverage—not the most desirable way to achieve that end. Stated differently, on a ratio basis, private debt increased as much or more than public debt decreased, and therefore overall debt stayed high. In the next eight cases, the deleveraging was due to high inflation. Inflation does work, but it is a painful path to deleveraging. In the one remaining case, Saudi Arabia from 1999 to 2014, the deleveraging was due to massive positive net oil exports. In no case was the deleveraging accomplished without one of these three factors—rapid private debt leveraging (which in many cases led to a financial crisis), high inflation, or a very large net export position. None. Both private debt leveraging and high inflation are steep prices to pay for public deleveraging. A high net export level is a better path, but it is the very thing that contributes to the global imbalances that economists have so heavily criticized. It generally only occurs in smaller countries, and is very difficult for larger countries to sustain without political repercussions, as with China in the 2000s or Germany in the current, contentious EU. In any event, in its entire history, the United States has never had a sustained export surplus of the size required for meaningful public debt deleveraging.

The story is similar for private debt. Private debt deleveraging has usually only been possible because of offsetting public debt increases. Japan’s private debt ratio reached a whopping 221 percent in the lead up to its 1990s crisis. But luckily for Japan, its public debt ratio at that time was only 86 percent. In the two decades following Japan’s crisis, private debt has deleveraged from 221 percent to 170 percent (which is still too high), but that deleveraging was enabled by a massive increase in the public debt ratio from 86 percent to 246 percent. Private debt declined by ¥260 trillion, but public debt grew by ¥810 trillion, and the combined impact of this debt increase was growth of zero in nominal GDP.

Again, just one example, but I have surveyed all the available data for these same 47 countries, and since World War II, there have been a total of 40 cases in which private debt to GDP (and not also public debt) has declined by at least 10 percentage points in a five-year period. By my reckoning, in 24 of these cases, the deleveraging was due largely or wholly to increased public debt leverage. In eight more cases, the deleveraging was due to high inflation. In the eight remaining cases, the deleveraging was due to a large, positive net export position. In no case was the deleveraging accomplished without one of these three factors—rapid public debt leveraging, high inflation, or a very large net export advantage.

There are only ten cases since World War II in which both public and private debt deleveraged by 10 percentage points or more in a five-year period. Six of these were due to high inflation. Four of these were in large measure due to a high export surplus position, or more broadly speaking, a high current account surplus. One of these, Israel in 2003, comes the closest of any case I examined to deleveraging through growth, but even there, total debt outgrew GDP.

Deleveraging is difficult.

Absent the methods described above, if the total debt ratio were to be meaningfully reduced, either through an absolute decline in debt outstanding, or through a decline in the ratio, it would force significant, damaging downward pressure on GDP. The Great Depression saw such a deleveraging, and that’s why those years were so tremendously painful. By contrast, in the years after 2008, the U.S. government and the Federal Reserve acted to prevent deleveraging. We were saved from another Great Depression, but we were left with a massive pile of debt.

We are not at some ordinary moment in history. Instead, we are at an unprecedented, era-defining crossroads. Debt to GDP is the highest it has ever been in history. Politicians are unlikely to address this since it has proven easy to sidestep and the associated issues are highly difficult, so we will almost certainly continue down this debt path, increasingly burdened by high levels of private and public debt, ignoring what is in front of us, and wondering why global growth remains so mixed.

Part of our debt dilemma is that political leaders haven’t even squarely acknowledged the issue, let alone addressed the problem. But the more vexing part of our dilemma is that, as an examination of these past cases shows, deleveraging is a highly difficult proposition. It’s hard to expect any major economy to deleverage with only the tools of painful inflation, growth in other debt, or unrealistic trade account surpluses.

We need another tool in our deleveraging toolkit.

What About Restructuring?

The good news is that history suggests a fourth way. The process of elimination in the preceding paragraphs leads one to consider an obvious but largely overlooked way: private debt restructuring. It is the primary mechanism through which the absolute level of private debt can be reduced without directly and negatively affecting GDP. The easiest and most direct way to increase consumer spending (or demand) is to cut consumer debt. The easiest and most direct way to increase business investing is to cut business debt.

But it is a solution fraught with controversy.

Take the United States after the 2008 crisis. A rapid rise in mortgage debt was the proximate cause of the crisis—it rose from $5.3 trillion in 2001 to $10.6 trillion in 2007, an avalanche of new mortgage lending in the space of a mere six years. And yet even though we spent billions to bail out most of the lenders pursuant to this crisis (and largely without meaningful consequence to the management of those lending institutions), the amount of help provided to homeowners has been negligible in comparison. In the wake of the crisis, 15 million of 52 million mortgages in the United States were seriously underwater, with a loan-to-value ratio above 125 percent. When coupled with the diminished incomes of many of these households, their spending became highly constrained, leaving them far less able to buy new cars, take vacations, and make the many purchases that power an economy forward. If, during the crisis, we had provided meaningful, systemic relief to these mortgage-holders, the trajectory of our recovery would have been far stronger and our growth rates today would be far higher.

Here’s an example of a program that could have been employed in the 2008 to 2010 time period to address this issue—and could well be employed in the future. It would have been a one-time program whereby if a borrower, because of the collapse brought on by the crisis, had, for example, a $400,000 mortgage on a $300,000 house, the lender would be given a regulatory dispensation to write the mortgage down to, say, $250,000 and spread their loss over an extended period, perhaps 30 years. In exchange, the borrower would provide the lender a certificate that gives them half or more of the upside upon the sale of the house—a type of debt for equity swap.

That’s just one example of the type of program that could have been deployed, as relates to the U.S. mortgage-driven crisis of 2008. Other crises have primarily involved other types of loans—for example, commercial real estate in Japan in the 1990s—so they would require different types of programs. This type of debt restructuring approach has ample precedents, from England in the 1700s to the Latin American debt crisis in the 1980s, to “Jubilee,” the strategy in ancient civilizations whereby debts were forgiven. The imagination of policymakers would need to be guided by the facts of a given situation. The requirement would be that the program or programs be sufficiently broad to meaningfully address the full scope of the problem.

We have now unmistakably entered a new age of slow growth. The ongoing situation in Japan is as sobering as it is instructive. In the generation since its private debt eruption, its nominal GDP growth has been zero. During that time, it has fallen from 18 percent of the world’s GDP to only 6 percent, and still, its burden of private debt is both high and largely ignored.

Governments are working earnestly to revive global growth, but the tools they are looking to are inadequate for the task. They cannot simply continue their attempts to boost growth by constantly increasing our aggregate debt load. Instead, they need to deflate the dangers of private sector debt load in a way that does not undermine the economy. The most responsible course for that is the private debt restructuring that has been suggested here. Private debt restructuring by itself will dramatically boost demand—as much or more than any other policy or approach.

But leave this burden unaddressed, and the world will slowly suffocate.