Moritz Schularick is a Fellow at the Institute for New Economic Thinking (INET) and professor of economics at the University of Bonn. He was previously a professor at the John F. Kennedy Institute of the Free University of Berlin, Germany, a visiting scholar at Cambridge University, and worked in the financial industry for several years. His current work focuses on credit cycles, the determinants of financial crises, and the international monetary system. Together with Niall Ferguson, he coined the term “Chimerica” to describe the intimate financial relations between the United States and China. Working at the crossroads of monetary and international economics as well as economic history, his contributions can be found in the American Economic Review, the Quarterly Journal of Economics, the Journal of Monetary Economics, the Journal of International Economics, the Journal of Economic History, and several other journals.

Moritz Schularick

- Leader of Private Debt

- Leader of Finance and the Welfare of Nations: The View from Economic History

By this expert

Rates of Return on Everything: A New Database

Returns on wealth exceed growth for more countries, more years, and more dramatically than Piketty has found

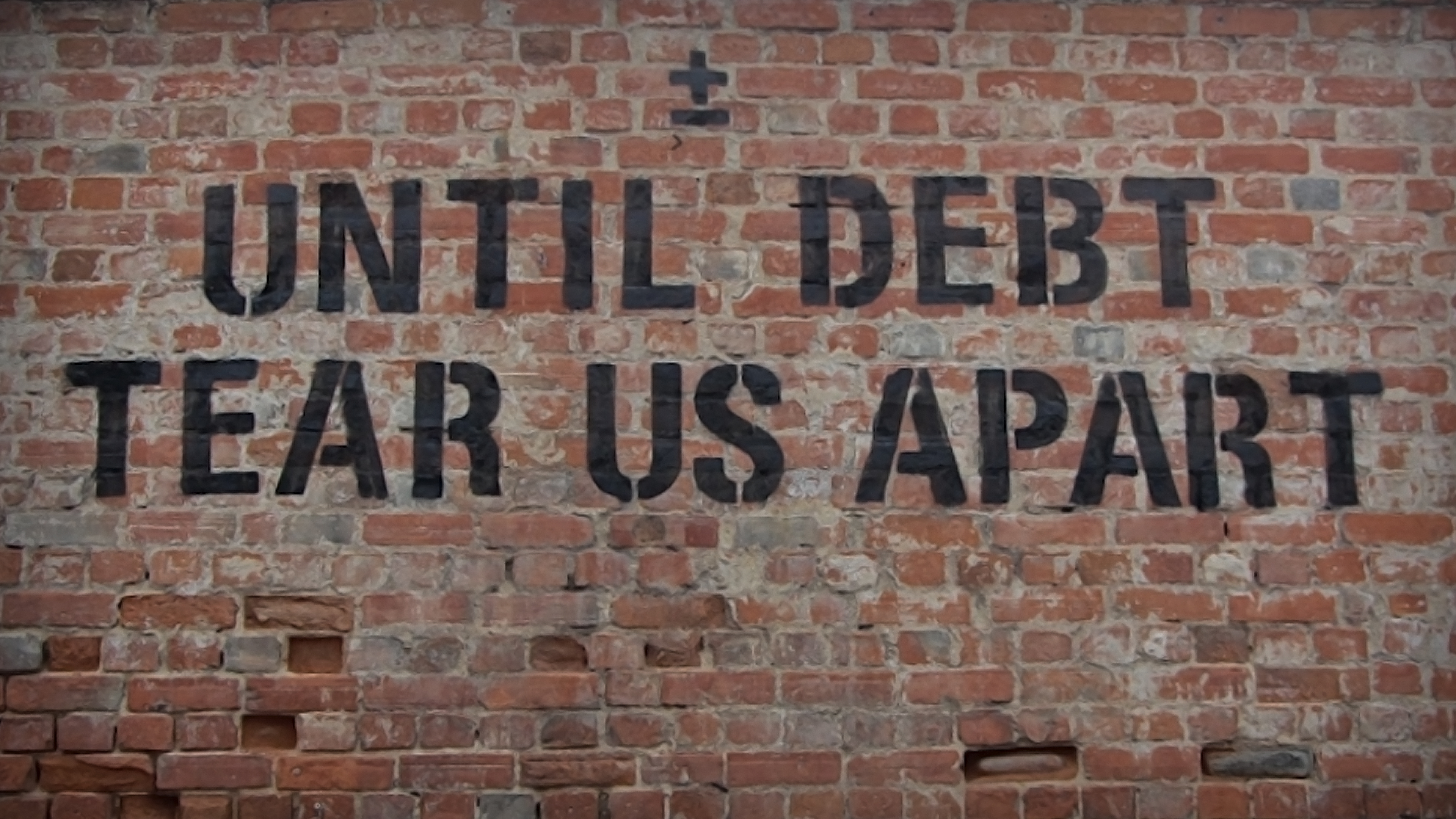

When the Middle Class Lost Its Wealth

Until 2008, rising home values gave the middle class a cushion amid growing income inequality. But following the financial crisis, that wealth has failed to return.

The Rate of Return on Everything, 1870–2015

This paper answers fundamental questions that have preoccupied modern economic thought since the 18th century.

Inside the Great Leveraging

This paper discusses what we have learned about the debt build-up in advanced societies over the past century. It shows that the extraordinary growth of aggregate debt in the past century was driven by the private sector.

Featuring this expert

Debt Talks Episode 7 | The Case for Household Debt Relief with Erica Jiang, Johnna Montgomerie, and Jialan Wang; moderated by Moritz Schularick

Large-sale debt relief for indebted households could be a game changer.

Schularick, Taylor & Jorda’s INET funded research is featured in the FT

“The economists Òscar Jordà, Moritz Schularick, and Alan Taylor studied the sensitivity of house prices to interest rates across 14 countries and 140 years of history. They found that a 1 per cent rise in interest rates reduces the ratio of house prices to incomes by about 4 per cent. In New Zealand, for example, that ratio has risen by about half in a decade, implying a double-digit rise in interest rates to stabilise it.” — Robin Harding, FT

Schularick, Taylor, & Jorda’s INET funded research is cited in Bloomberg on the most stable investments

“The issue is important because it tends to conflict with a hugely influential study published in 2017, called The Rate of Return on Everything, by Oscar Jorda, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. This was a mightily ambitious piece of financial archaeology covering 17 countries, and it rendered the startling result that housing performed virtually as well as equities over time, but with much less volatility. The result held true for every country that Jorda and his colleagues examined.” — John Authers, Bloomberg

INET funded research articles are cited in The Conversation

Two separate INET funded research articles are cited; first from Schularick, Jordà, & Taylor on leveraged bubbles followed by Bao, Hommes, & Makarewicz on bubble formation. “Since their inception, financial markets, and to a lesser extent some real markets, have been subject to bubbles. … More recently, stock prices, but also credit, real estate, commodities, bond markets, and famously, bitcoin, are all assets that have experienced bubble episodes. Regarding cryptocurrencies, many economists also defend a permanent bubble, their fundamental value being theoretically non-existent.” …. In fact, the presence of bubbles in the markets (financial and real) seems to stem from the persistent behavior of economic agents. Experimental studies, controlling exactly the actual value, showed that participants tended to set up a bubble-like operation, with price surges and collapses very similar to real economy situations, and in no way related to a change in the market.