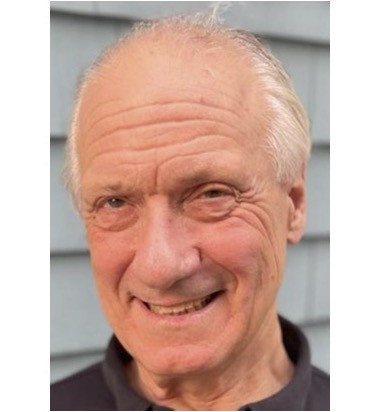

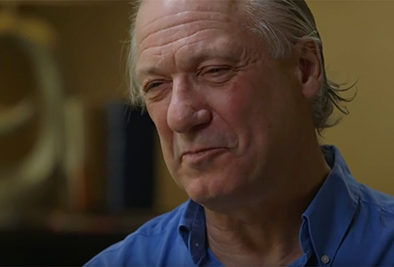

William Lazonick, professor emeritus of economics at University of Massachusetts, is co-founder and president of the Academic-Industry Research Network, a 501(c)(3) non-profit research organization, based in Cambridge, Massachusetts. He is an Open Society Fellow and a Canadian Institute for Advanced Research Fellow.Over the past decade, the Institute for New Economic Thinking has funded a number of his research projects.

He has professorial affiliations with SOAS University of London and Institut Mines-Télécom in Paris. Previously, Lazonick was assistant and associate professor of economics at Harvard University, professor of economics at Barnard College of Columbia University, and distinguished research professor at INSEAD in France. Lazonick earned his B.Com. at the University of Toronto, M.Sc. in Economics at London School of Economics, and Ph.D. in Economics at Harvard University. He holds honorary doctorates from Uppsala University and the University of Ljubljana.

His research focuses on the social conditions of innovation and economic development in advanced and emerging economies. His book Sustainable Prosperity in the New Economy? Business Organization and High-Tech Employment in the United States (Upjohn Institute 2009) won the 2010 Schumpeter Prize. He has twice—in 1983 and 2010—had the award from Harvard Business School for best article of the year in Business History Review. In 2014, he received the HBR McKinsey Award for outstanding article in Harvard Business Review for “Profits Without Prosperity: Stock Buybacks Manipulate the Market and Leave Most Americans Worse Off.” In January 2020, Oxford University Press published his book, co-authored with Jang-Sup Shin, Predatory Value Extraction: How the Looting of the Business Corporation Became the U.S. Norm and How Sustainable Prosperity Can Be Restored.