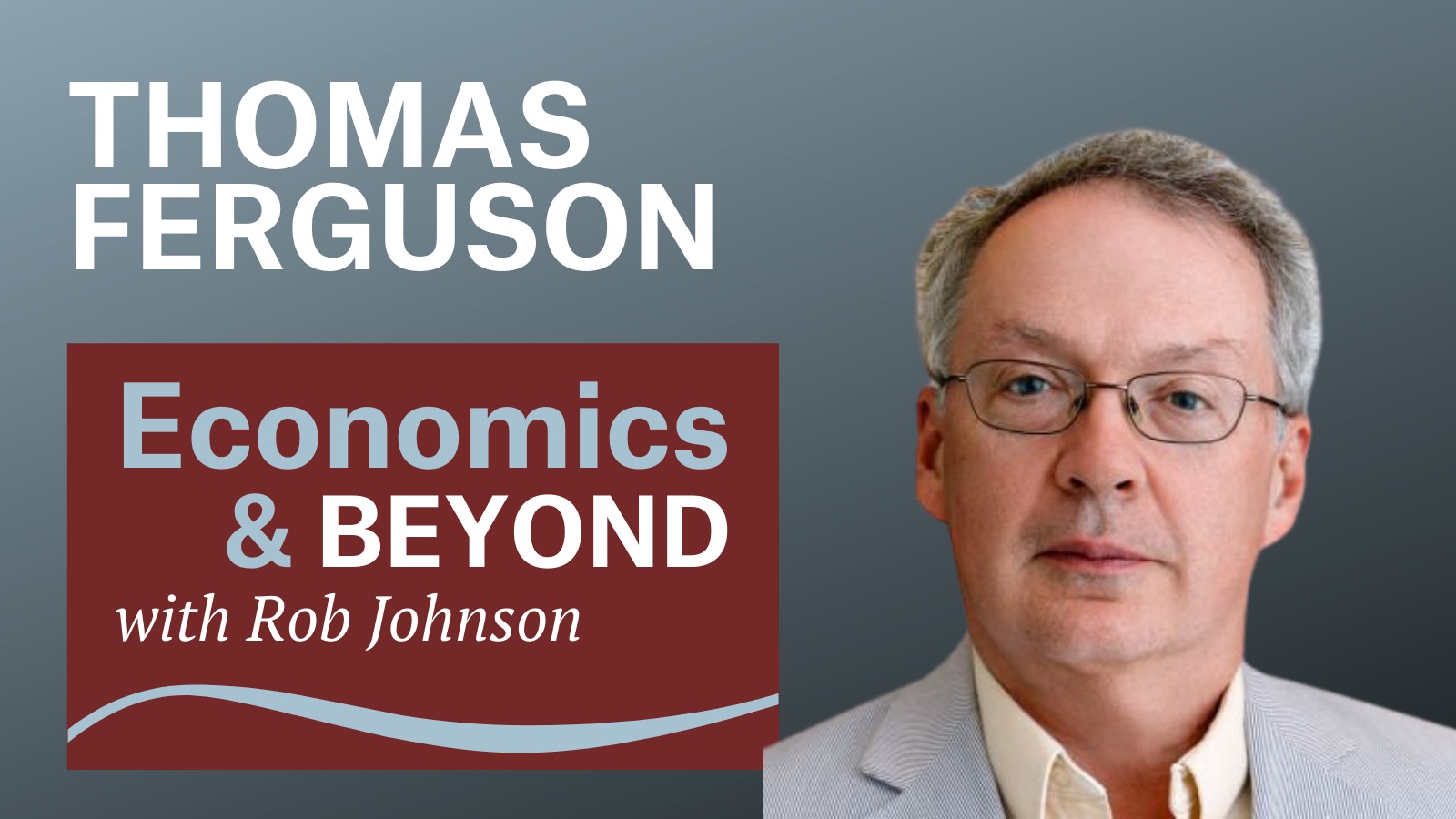

Thomas Ferguson is the Research Director at the Institute for New Economic Thinking. He is Professor Emeritus at the University of Massachusetts, Boston and Senior Fellow at Better Markets. He received his Ph.D. from Princeton University and taught formerly at MIT and the University of Texas, Austin. He is the author or coauthor of several books, including Golden Rule (University of Chicago Press, 1995) and Right Turn (Hill & Wang, 1986). His articles have appeared in many scholarly journals, including the Quarterly Journal of Economics, International Organization, International Studies Quarterly, and the Journal of Economic History. He is a member of the editorial board of the International Journal of Political Economy and a longtime Contributing Editor at The Nation.

Thomas Ferguson

By this expert

How Money Drives US Congressional Elections

Social scientists have stubbornly held that money and election outcomes are at most weakly linked. New research provides clear evidence to the contrary.

Trump, Populism, and the Republican Establishment: Two Graphs From New Hampshire

This year’s New Hampshire primary testifies to the disintegration of the Republican Party

The Origins of the Investment Theory of Party Competition

Preface to the Japanese Edition of Golden Rule

Central Banks, Green Finance, and the Climate Crisis

The tough policy choices ahead for confronting the climate crisis

Featuring this expert

Stark New Evidence on How Money Shapes America’s Elections

Oversights of two generations of social scientists have weakened democracy.

The Lehman Disaster and Why It Matters Today

On September 15, 2008, Lehman Brothers, a giant investment bank with a storied history, filed for bankruptcy. The shock was profound; world markets melted down.

The Lehman Disaster and Why It Matters Today

On September 15, 2008, Lehman Brothers, a giant investment bank with a storied history, filed for bankruptcy. The shock was profound; world markets melted down.

YSI Conference on Debt Sustainability

Discussions on the key conceptual and policy themes for sovereign debt sustainability with a view to proposing possible policy reforms.