In thinking about China’s future, economists need to break the shackles of standard analysis and consider poliical information as well as economic data. Looking only at economic data risks having findings distorted by well-known biases. The more data economists have and the more complex their models, the more likely they are to cherry-pick the data and tweak model specifications to generate results they instinctively prefer for whatever reason. Adding political observations does not eliminate this risk, but rather adds an additional perspective that is external to the economists’ data and models, and contains the views of thousands of surveyed people—and in many instances, millions of voters. Political data contains a kind of “wisdom of crowds” that, if handled well, should be able to improve economic analysis and forecasting.

The limits of economic data and standard modeling have been pointed out by academics from mathematician David Orrell in The Science of Prediction and the Future of Everything[1] to New York University Professor of Engineering Nassim Taleb in The Black Swan.[2] They conclude that economic systems are too complex to be predictable and human thinking is too biased to build proper predictive models. International Monetary Fund (IMF) economists Giovanni Dell’Ariccia, Deniz Igan, Luc Laeven, and Hui Tong in “Credit booms and macrofinancial stability” support these findings. They note that only one third of credit booms end in crisis, and even in hindsight they saw no clear warning signs to determine whether a crisis will follow a boom.[3]

The National People’s Congress decision to remove the term limit on Xi Jinping’s service as President is a major piece of political information. Can it help tell us anything about the persistent concern that China is facing a financial crisis? This move toward authoritarianism is troubling because history suggests that a shift to more autocratic rule is a sign of national distress.

When nations feel economically and geopolitically insecure they lean toward authoritarianism. Conversely, when conditions are trending favorably, they lean toward democracy. During the Great Depression and World War II, for example, the United States tolerated a presidency lasting beyond the two-term precedent set by the first president, George Washington. Immediately after victory and emergence as the world’s leading economic and military power, the United States amended the Constitution to strictly limit presidential service to two terms in office.

Whether times are good or bad, economic forecasting is uncertain. There are many reasons, but the most important and most subtle are behavioral. Like everyone else, economists’ thinking is plagued by systematic biases such as “anchoring” and “confirmation.” Anchoring is the bias that causes us to tend to focus our thinking around the first fact or analysis we hear. Confirmation bias is our tendency to interpret information in ways that confirm our already-held conclusions. Australian researcher Thomas Stanley at the School of Business and Law at Deakin University showed in “The Power of Bias in Economics Research”[4] that “over half of economic research results are reported to be twice as large as they actually are, and one-third are exaggerated to be four times too big.”[5]

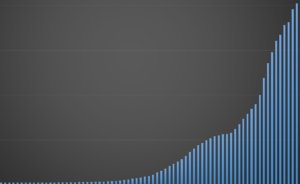

Forecasts about China may suffer from biases. For example, China optimist Chi Lo of BNP Paribas Asset Management identified and examined an example of anchoring bias in an April 2017 Barron’s article on the Bank of International Settlements’ (BIS) widely cited indicator of a financial crisis, the “credit gap.” The credit gap is the difference between the private non-financial credit-to-GDP ratio and its long-run trend.[6] The BIS says a credit gap above 10% of GDP indicates a strong possibility of an impending financial crisis.[7] China’s gap has exceeded 10% of GDP since 2012. Relevant data allowing for the calculation of the gap was released in 2013.[8][9] Thereafter we saw an explosion of research and news articles warning of China’s impending financial crisis. A Google inquiry only including pre-2013 search results of the words “China” or “Chinese,” and key terms such as “financial crisis,” “credit gap,” and/or “debt growth exceeding GDP” yielded just a couple dozen relevant articles and research reports. The same search including only post-January of 2013 results yielded thousands of articles and research reports.

Chi argues that the research and news commentary was anchored by the BIS view, which biased analyst thinking and led them to broadly forecast crisis. The BIS warning level, he claims, is misleading. He points out that many countries “fell into a financial crisis with a credit gap of less than 10% of GDP, such as the UK and South Korea.” And “some economies avoided a financial crisis with a credit gap of more than 10% of GDP, such as Australia in the years around 2006 and Hong Kong around 2011.”[10]

Looking back on their work, BIS economists admit in their March 2018 Quarterly Review that the prediction rate for their “credit gap” indicator is only 66%, and they expect their indicator to perform worse in forecasting future crises. The reason they give is that the “credit gap” and other early warning indicators “have been calibrated based on past experience, and cannot take account of broader institutional and economic changes that have taken place since previous crises.”[11] Despite all this evidence showing the limitations of the gap indicator, analysts and researchers remain anchored in the older perspective and still prominently mention this indicator in their analysis. The first paragraph, for example, of a January 2018 IMF report warns that China’s “credit gap” is above 10% of GDP.[12]

The possibility of anchoring bias leads Chi to discount “credit gap” arguments. A counter example, is China pessimist Kyle Bass, founder of Hayman Capital Management. Bass argues that China’s non-performing loans (NPLs) greatly exceeded the 1.7% official rate in a June 15, 2017 interview with Reuters. Bass estimates that NPLs account for 20% of bank loans, net of mortgages.[13] This analysis is part of Bass’s forecast that the yuan will fall 30% against the dollar as China uses its FX reserves to recapitalize its banking system.

Bass’s forecast, however, may suffer from confirmation bias. Inclined to expecting the worst, he ignores that the People’s Bank of China (PBoC) can do what the Bank of Japan has been doing since its asset bubble burst in 1990, and the European Central Bank and the Federal Reserve have done since the Great Recession – support asset markets with quantitative easing and even NPLs purchases. There may be an inflection point in regards to how much debt the PBoC can buy before the currency collapses. Still, as long as China has current account surpluses comparable to those of Japan and Europe, it is reasonable to conclude that China should be able to monetize troubled debt a long time without depreciating its currency as much as Bass suggests.

Nevertheless, Bass may be correct for a reason that Chi overlooks. Chi writes that “the problem with analysing China’s corporate debt (the major driver of China’s debt growth) is that many analysts have confused its private-sector obligations with public-sector debt.” According to Chi, “In China, a large share of company borrowing that is often counted as private sector, including by the BIS statisticians, is actually lending to the SOEs (state owned enterprises) and their affiliates that enjoy implicit guarantees. These are not really private debt.” Chi argues further that SOE debt is not a concern because the government has such a “strong balance sheet.”

Here Chi’s thinking may be biased by his wanting a positive outlook. Ten years ago, two of the largest SOE’s on Earth failed and brought down the world’s largest economy. The SOEs were Fannie Mae and Freddie Mac, and the economy was the United States. To put this in perspective, BIS data reports U.S. government debt at 58% of GDP at the time of the 2008 Crisis. Fannie and Freddie’s debts and obligations amounted to 37% of GDP.[14] Together the U.S. government debt and contingent “SOE” debt were 95% of U.S. GDP in 2008.

China’s government debt ratio is 46%. This is lower than the U.S.’s was in 2008, but China’s SOE debt is much larger.[15] Chi estimates 60% of “Chinese corporate bank loans are extended to the SOE sector,” and the BIS estimates China’s corporate debt at just north of 160% of Chinese GDP.[16] This would make China’s contingent SOE debt equal to about 96% of GDP — more than two and a half times larger than the U.S. contingent Fannie and Freddie debt to GDP ratio at the time of the U.S. crisis.[17] All-in, China’s government debt and contingent SOE debt amounts to about 142% of GDP.

Is Chi wrong and Bass right? How do we see through the clouds of differences between Chinese and U.S. economic reporting? How do we weigh the fact that China is running a current account surplus and the U.S. is not? How can we be sure we’re not picking numbers and models that affirm our prior expectations? We can’t, and that’s the reason we need to include the “wisdom of crowds” information contained in large-scale political preferences. Political information isn’t easy to interpret. History, culture, psychology, and even anthropology matter. But given the success of narrow mainstream economic forecasting, including different perspectives will likely only improve performance.

The highest priority of Chinese political leaders is to stay in power. Their decisions are shaped by conditions from the smallest, most remote villages to the highest levels of business and government. Their decisions reflect economic activity throughout China. In an important sense, election results and politicians’ actions are comprehensive indicators of economic and social wellbeing.

The role of political preferences has long been recognized by economists. James Buchanan received a Nobel Prize for his work in public choice theory in economics. IMF economists Ari Aisen and Francisco José Veiga show how political instability reduces per capita GDP growth rates in “How does political instability affect economic growth?”[18]

Are Chinese leaders sensing increasing grass-roots level dissatisfaction with economic and social trends? The decision to eliminate the limit on President Xi’s time in office suggests they might be. Xi seems to be embracing and encouraging this resurgence in strongman rule. State sponsored propaganda is even calling him “lingxiu” — the same title that was given to Mao.[19] The seeming renewed popularity or acceptance of Maoist authoritarianism may be another sign of Chinese stress. These possibilities strongly suggest that researchers should carefully study the economic and political relationships that led to the term limit decision. Doing so will require investigations into past turns away from and toward authoritarianism in China and elsewhere.

Following Mao’s example, Xi has instituted his own official political doctrine called “Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era.” According to Chris Buckley of the New York Times the doctrine is a “blueprint for consolidating and strengthening power at three levels: the nation, the party and Mr. Xi.”[20] The lack of pushback to these actions is a clear sign of the Chinese public and ruling class’s willingness to move to more autocratic rule, and of Xi and the government’s increasing popularity.

This popularity also may be a warning. Researchers Helios Herrera, Guillermo Ordonez and Christoph Trebesch find in their groundbreaking paper “Political Booms, Financial Crises” that in emerging markets, “political booms, measured by the rise in governments’ popularity, predict financial crises above and beyond better-known early warning indicators, such as credit booms.” They surmise this is due to governments riding “unsound credit booms in order to boost their popularity, rather than implementing corrective policies that could prevent crises but are politically costly.”[21]

The degree to which strongman rule is associated with a kind of economic stress that foretells crisis will differ from country to country and culture to culture, and change over time. Despite this indeterminacy, the additional guidance provided by extracting information about and understanding past political events, will provide better understandings of current economic conditions.

As an item of forecasting information, the designation of Xi as president for life should lead us to pay less attention to NPLs, debt/GDP ratios, GDP growth rates and other economic and financial ratios as these numbers do not immediately affect the political sentiments of average Chinese citizens. Instead, a study of the political/economic history of the ebb and flow of authoritarian power will lead us to evaluate the life conditions of average Chinese and the options they have for expressing discontent or satisfaction. We’ll be led to ask: Is there is anything or maybe several things that are causing concerns among Chinese citizens and by extension China’s leadership?

Distress is clear in many developing countries where authoritarianism is rising. Poor economic conditions together with weak political institutions appear to be the contributing factors to political turmoil and authoritarianism. A case in point is Venezuela. Other examples include Thailand and Turkey as well as Egypt and other countries affected by the Arab Spring. These countries’ weak political institutions are insufficient to deal with their ongoing Islamic extremist and separatist insurgencies.

A clear example of authoritarianism caused by economic distress may be Russia following the breakup of the Soviet Union and its sovereign debt default and insurgencies. The trend toward authoritarianism has been strengthened by the uncertainty and economic fallout from foreign wars, sanctions, and an unstable economy heavily dependent on volatile oil prices.

We just don’t see this kind of instability or turmoil in China. The government’s apparent decision to accept lower GDP growth-rate targets could, in time, negatively impact citizen well-being. The indicators of a population’s economic well-being such as employment, loan delinquency, poverty and consumer confidence rates do not show distress yet. If growth is lower but of higher quality, that is, it comes with less environmental damage and social dislocation, citizen assessment may be politically positive. We need to know how citizens perceive their situations now and in comparison to past conditions.

We cannot say what the forecasting implications of the term limit elimination are and certainly cannot rely on standard financial ratios. For now we can only ask, what do China’s citizens and leadership see that we may not? To answer this question, in addition to listening carefully to what Chinese citizens and their leaders say, we need to look at other societies and conduct extensive cross-sectional and historical analyses of national economic, social and political conditions and their relations to strongman rule.

Footnotes

[1] Orrell, David John. Apollo’s Arrow: the Science of Prediction and the Future of Everything. Harper Perennial, 2008.

[2] Taleb, Nassim N. The Black Swan: The Impact of the Highly Improbable. New York: Random House, 2007.

[3] Dell’Ariccia, Giovanni, et al. “Credit Booms and Macrofinancial Stability.” Economic Policy, vol. 31, no. 86, 31 Mar. 2016, pp. 299–355, doi:10.1093/epolic/eiw002.

[4] Ioannidis, John P. A., et al. “The Power of Bias in Economics Research.” The Economic Journal, vol. 127, no. 605, 2017, doi:10.1111/ecoj.12461.

[5] BITSS Blog. “The Power of Bias in Economics Research.” Berkeley Initiative for Transparency in the Social Sciences, 24 Oct. 2017, www.bitss.org/2017/10/24/the-power-of-bias-in-economics-research/.

[6] “Credit-to-GDP, based on total credit to the private non-financial sector (J1 Gaps).” Bank for International Settlements (BIS), 20 Mar. 2018. https://www.bis.org/statistics/c_gaps.htm.

[7] “84th Annual Report, 2013/14.” The Bank for International Settlements, 29 June 2014, www.bis.org/publ/arpdf/ar2014e.htm.

[8] Drehmann, Mathias. “Total Credit as an Early Warning Indicator for Systemic Banking Crises.” SSRN, Bank for International Settlements (BIS), 28 Apr. 2014, papers.ssrn.com/sol3/papers.cfm?abstract_id=2401567.

[9] Dembiermont, Christian, et al. “How Much Does the Private Sector Really Borrow - a New Database for Total Credit to the Private Non-Financial Sector.” The Bank for International Settlements, 18 Mar. 2013, www.bis.org/publ/qtrpdf/r_qt1303h.htm.

[10] Lo, Chi. “Why China’s Debt Bomb Has Not Exploded.” Barron’s. 11 Apr. 2017. Web. 05 Mar. 2018.

[11] Aldasoro, Iñaki, et al. “Early Warning Indicators of Banking Crises: Expanding the Family.” BIS Quarterly Review, The Bank for International Settlements, 11 Mar. 2018, www.bis.org/publ/qtrpdf/r_qt1803e.htm.

[12] Chen, Sally, and Joong Shik Kang. “Credit Booms-Is China Different?” International Monetary Fund, 5 Jan. 2018, www.imf.org/en/Publications/WP/Issues/2018/01/05/Credit-Booms-Is-China-Different-45537.

[13] Ablan, Jennifer. “Kyle Bass Still Short Yuan, Says China Credit Bubble ‘Metastasizing’.” Reuters, Thomson Reuters, 15 June 2017, www.reuters.com/article/us-funds-hayman/kyle-bass-says-remains-short-chinas-currency-credit-bubble-metastasizing-idUSKBN1962IN.

[14] “F4.1 Total credit to non-financial corporations (core debt).” Bank for International Settlements (BIS), 20 Mar. 2018. https://stats.bis.org/statx/srs/table/f4.1.

[15] “F5.4 Total credit to the government sector at nominal value (core debt).” Bank for International Settlements (BIS), 20 Mar. 2018. https://stats.bis.org/statx/toc/CRE.html.

[16] “F4.1 Total credit to non-financial corporations (core debt).” Bank for International Settlements (BIS), 20 Mar. 2018. https://stats.bis.org/statx/srs/table/f4.1.

[17] Frame, W. Scott, Andreas Fuster, Joseph Tracy, and James Vickery. 2015. “The Rescue of Fannie Mae and Freddie Mac.” Journal of Economic Perspectives, 29 (2): 25-52. https://www.aeaweb.org/article…

[18] Aisen, Ari, and Francisco, Jose Veiga. “How Does Political Instability Affect Economic Growth?” European Journal of Political Economy, vol. 29, 2013, pp. 151–167., doi:10.1016/j.ejpoleco.2012.11.001.

[19] Aneja, Atul. “Chinese President Xi Joins Mao and Deng as Lingxiu.” The Hindu, The Hindu, 17 Jan. 2018, www.thehindu.com/news/international/chinese-president-xi-joins-mao-and-deng-as-lingxiu/article22458012.ece.

[20] Buckley, Chris. “Xi Jinping Thought Explained: A New Ideology for a New Era.” The New York Times, The New York Times, 26 Feb. 2018, https://www.nytimes.com/2018/02/26/world/asia/xi-jinping-thought-explained-a-new-ideology-for-a-new-era.html.

[21] Herrera, Helios, et al. “Political Booms, Financial Crises.” NBER, University of Chicago Press, July 2014, www.nber.org/papers/w20346.