“Diamond-Dybvig-Bernanke, with minimalist models of how bank runs could happen and matter, again cut through the fog. After DDB economists could read Bagehot very differently and more productively than before.”

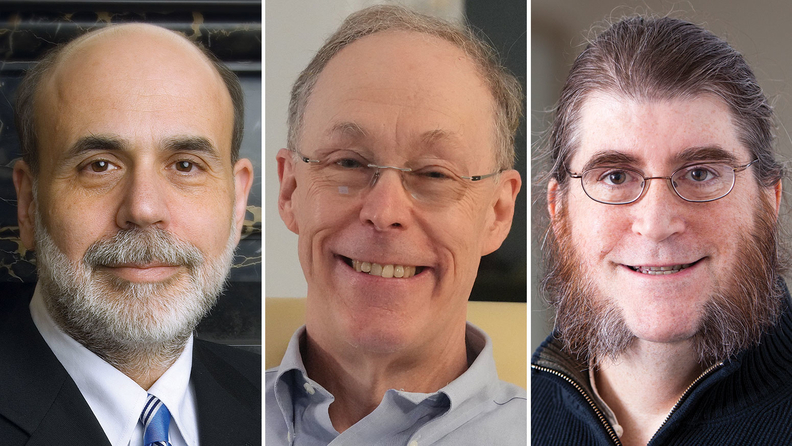

The Royal Swedish Academy of Sciences has awarded the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2022 to Ben S. Bernanke, Douglas W. Diamond, and Philip H. Dybvig for having “significantly improved our understanding of the role of banks in the economy, particularly during financial crises” (Royal Swedish Academy of Sciences 2022a).

The main justification for Diamond and Dybvig’s (DD) award is given by a paper published in 1983: “In an article from 1983, Diamond and Dybvig develop a theoretical model that explains how banks create liquidity for savers, while borrowers can access long-term financing” (Royal Swedish Academy of Sciences 2022b, p.4).

A short exposition of the model

Based on Diamond (2007), the model can be described relatively easily. The 2-period model assumes an economy populated by two types of agents. While type 1 agents must consume at the end of period 1 (T=1), type 2 agents only consume at the end of period 2 (T=2). At the beginning of period 1 (in T=0), agents do not know whether they will be type 1 or 2 at the end of the period.

The agents are equipped with one unit each of an all-purpose asset that can be consumed and also invested. If the asset is invested in T=0 it can be switched into a consumption good at zero costs at T=1. If the asset is not used for consumption in T=1, it yields a return at the end of period 2. Thus, in T=0 it is always optimal to invest the asset.

For type 1 agents, this return profile implies that they will not receive a return for their investment at T=1. This raises the question for an institutional design that would allow type 1 agents to participate in the return that is generated in the second period. The model of Diamond and Dybvig shows that banks can provide an implicit insurance for agents against the unlucky outcome of being a type 1 agent.

Depositing the all-purpose asset with a bank at T=0 allows for a pooling, which enables the bank to pay an interest rate (r1) already in T=1 so that the type 1 agents can participate in the return that is generated in the second period. This indirect insurance requires that the bank knows ex-ante the share of type 1 agents in the population so that it can calculate the interest rate in a way that the return for type 2 agents (r2) is always higher than for type 1 agents (r1).

While an explicit insurance against being type 1 would only allow type 1 agents to withdraw in period 1, the DD bank allows all agents to withdraw in T=1 with a return r1. This is due to the assumption that the risk of being type 1 is not publicly verifiable. Thus, the implicit insurance provided by banks suffers from the fact that it cannot exclude type 2 agents that do not require insurance in T=1.

With this design, the DD-Bank is inherently unstable. By offering an interest payment to all agents at T=1, the bank becomes insolvent as it has not yet received a return from its asset side. This built-in insolvency of the DD-Bank is not a problem if type 2 agents are not aware of it. But if they doubt the ability of the bank to generate a higher return for them at T=2 than at T=1, they will withdraw in T=1, whereby the insolvency actually occurs.

Does the DD-Bank use demand deposits to finance long-term investments?

But do Diamond and Dybvig “show that this process is how banks create liquidity” (Royal Swedish Academy of Sciences 2022b, p.4)? Does their model show that “the bank is an intermediary that transforms assets with long maturity into bank accounts with short maturity“? (Royal Swedish Academy of Sciences 2022b, p.4)

What the DD-bank does in the model is a pooling of the all-purpose asset. But it does not transform it into long-term investment goods. When the bank pays it out to the agents at T=1, the asset has not changed its character compared to a situation where the agents have invested it by themselves. As the balance sheet of the DD-Bank (Figure 1) shows, the maturity of assets and liabilities is identical. The only problem is the loss created by the premature paying of interest. Thus, the Academy gets it wrong when it states:

“The bank’s assets have a long maturity because it promises borrowers that they will not need to pay back their loans early. On the other hand, the bank’s liabilities have a short maturity.” (Royal Swedish Academy of Sciences 2022b, p.4)

Figure 1: Balance sheet of the DD-Bank at T=1

Assets | Liabilities |

100 APA | 100 (1+r) APA |

Loss: r 100 APA |

This leads to the concept of “liquidity creation,” which plays a decisive role in the model. Due to its nature, the all-purpose asset can always be transformed anytime from an investment good into a consumption good. In this sense, it is highly liquid. As the amount of this asset has not changed, the liquidity or the money stock has not changed. This is only the case with the specific definition of liquidity of DD, which implies that the interest payment on the all-purpose good has transformed it from an illiquid into a liquid asset.

The role of the banks is therefore limited to a redistribution of the all-purpose good to type 1 agents at a time when no investment returns have been generated. Equating this early participation in future earnings with the “creation of liquidity” by banks is a concept that, as we shall show, has nothing to do with reality.

Is the provision of interest payments to depositors before bank earnings are generated a typical feature of banking so that the DD-model “captures the central mechanisms of banking” (Royal Swedish Academy of Sciences 2022b, p.4)? In reality, banks typically do not pay interest, or only very marginal interest, on highly liquid bank accounts. Without the interest payment in T=1, the DD-bank becomes perfectly stable as its liability side is matched by investments in the all-purpose good that can be transformed at zero costs for consumption purposes. But in this case, banks would no longer provide any benefit for the economy.

A model that fits the arguments of the Royal Swedish Academy

Thus, the DD model is not able to explain the decisive function of maturity transformation by banks. This is due to a feature of the model which is difficult to reconcile with reality. The model assumes that if the all-purpose asset is “invested” in T=0, it can be withdrawn at T=1 and consumed at zero costs. Thus, it has not been transformed into a long-term investment good. It is still liquid in the sense that it can be consumed at T=1.

A more realistic assumption would be that by investing the good at T=0, it cannot be paid out and consumed at T=1. This is only possible at T=2. With this assumption, the model has two different assets:

- a liquid asset, i.e. the all-purpose asset has not been invested in T=0 and it can be consumed at T=1,

- an illiquid asset, i.e. the all-purpose asset been invested in T=0 and can only be consumed at T=2.

Without banks, risk-averse agents would not be able to participate in the returns of the investment good. As they all are confronted with the risk of being type 1, it would be very risky to invest the commodity. In T=1, Type 1 agents would then not be able to consume.

In such a model, banks can provide an obvious improvement if one assumes again that they know the share of type 1 and type 2 agents. In T=0, all agents deposit their endowment of the commodity with the bank. Assuming that the share of type 1 agents is 25 %, the bank keeps 25 % of the all-purpose asset unchanged and invests 75 % as illiquid long-term investment. It thus performs maturity transformation by transforming liquid assets into illiquid assets (Figure 2).

Figure 2: Balance of a bank with maturity transformation at T=0 and T=1

Assets | Liabilities |

25 APA | 100 APA |

75 Investment Good |

To safeguard the solvency of the bank, no interest is paid for deposits that are withdrawn after period 1. This arrangement is still an improvement for the agents as they have a chance to be type 2. In this case, they can participate in the returns of the investment without running the risk of being illiquid in period 1.

As long as the shares of type 1 and type 2 agents are stable and known to the public, there is no run risk in this model. This is different if the share of type 1 agents is higher than the share of liquid assets or if the agents doubt the solvency of liquidity of the bank. Thus, in this model, there is only a liquidity risk, but not a solvency risk as in the DD-bank.

In sum, by slightly modifying the assumptions of the DD-model one gets a model which perfectly fits the description of the Royal Swedish Academy of Sciences (2022b, p.4):

“The money in the depositors’ accounts is a liability for the bank, while the bank’s assets consist of loans to long-term projects. The bank’s assets have a long maturity because it promises borrowers that they will not need to pay back their loans early. On the other hand, the bank’s liabilities have a short maturity; depositors can access their money whenever they want. The bank is an intermediary that transforms assets with long maturity into bank accounts with short maturity. This is usually called maturity transformation.”

How do banks create liquidity?

But even this model does not show how banks create liquidity. In the DD model, the amount of the all-purpose asset remains constant. In the modified model, maturity transformation reduces the amount of the all-purpose asset, which is the liquid asset in this model. -

The difficulty of such models to explain liquidity or money creation reflects the fundamental weakness of models which are based on the assumption of an all-purpose asset. In this setting with an exogenous amount of the all-purpose good, there is no room for money as an independent asset that can be created by banks.

In reality and in monetary models, such as the IS/LM model, the creation of liquidity is simple. Whenever a bank provides a loan to a customer, it credits the account of the customer with the amount of the loan. Thus, the amount of liquid assets in the economy (money stock M1 or M3) increases with each act of bank lending. In such a monetary model, the creation of liquidity is identical with maturity transformation as the maturity of the loans is typically longer than the maturity of deposits. A comprehensive description of the money supply process in a monetary model is provided by the Bank of England (McLeay et al. 2014) and Deutsche Bundesbank (2017). Both institutions speak of the intermediation view as “a popular misperception.”

The role of the “lender of last resort”

In contrast to the DD model, monetary models differentiate between solvency and liquidity risks. In the DD model, the built-in insolvency is the cause of illiquidity. In a monetary model, even a solvent bank can become illiquid if depositors are in a panic. In this context one should mention that the risks of maturity transformation were identified a very long time ago, above all by Otto Hübner (1854):

“One cannot give the long loan when one has received only the short one without running the great risk of not being able to return the latter. This is the fact, the non-observance of which was the simple cause of the failure of old banks and will be that of most of the new ones. They procured large sums against notes or certificates of deposit, or on current account, which could be recalled at any time, and discounted against them bills of exchange, which had months to run, indeed they left the credit received on daily notice, on long irredeemable terms, sometimes for years, to the industrial landowners or governments.”

In a monetary model, the solution to bank runs is not deposit insurance but the central bank as the lender of last resort. In the DD model, the deposit insurance simply redistributes the all-purpose asset from those who withdraw in T=1 to type 2 agents. In a monetary model, bank depositors require an exchange of bank deposits into central bank money, which does not exist in the vaults of the banks. The required additional supply of cash can only be provided by the central bank. Walter Bagehot, in his 1873 book “Lombard Street”, therefore pointed out the need for the central bank to take action in the event of a bank run, as a “lender of last resort”:

“The holders of the cash reserve must be ready not only to keep it for their own liabilities but to advance it most freely for the liabilities of others. They must lend to merchants, to minor bankers, to ‘this man and that man,’ whenever the security is good.” (Bagehot 1873, p. 51.)

Summary

The DD model presents a flawed model of banking: The DD bank does not transform the liquidity of the assets on the asset side of its balance sheet. Instead, it pays interest to depositors in T=1 before a return on the asset side has been generated. This built-in insolvency of the DD bank is the main cause for the instability of the DD bank, not the maturity transformation of bank assets.

Thus, the Academy praises the DD model for a maturity transformation that is not taking place in the model. With a simple modification of the DD model, i.e., that an investment return excludes the conversion of the investment good in consumption T=1, one can construct a model with maturity transformation, but without a built-in insolvency.

At a more general level, the difficulty of analyzing liquidity or money creation, which is a central function of banks, can be related to the attempt to analyze the financial sphere with models without money. In monetary models, these mechanisms can be explained easily.

Due to the flawed structure, the DD model leads to flawed policy implications. It assumes that deposit insurance which redistributes the existing assets is the adequate approach to bank runs. In a monetary analysis, a bank run can only be stopped by the central bank which as a lender of last resort must increase the amount of central bank money to stop the panic.

Thus, in contrast to the Krugman-Tweet mentioned at the beginning, in the DD model there is no room for a lender of last resort which was the key message by Bagehot. DD blew smoke on the clear and very simple insights of Bagehot.

References

Bagehot, W. (1873). Lombard Street: A Description of the Money Market, London, Henry S. King.

Deutsche Bundesbank. (2017). The role of banks, non-banks and the central bank in the money creation process. Monthly Report, 69(4), 13-34, April.

Diamond, D. W., & Dybvig, P. H. (1983). Bank runs, deposit insurance, and liquidity. Journal of political economy, 91(3), 401-419.

Diamond, D. W. (2007). Banks and liquidity creation: a simple exposition of the Diamond-Dybvig model. FRB Richmond Economic Quarterly, 93(2), 189-200.

Hübner, O. (1854). Die Banken. Verlag von Heinrich Hübner, Leipzig.

McLeay, M., Radia, A., & Thomas, R. (2014). Money creation in the modern economy. Bank of England Quarterly Bulletin, Q1.

Royal Swedish Academy of Sciences (2022a). The Prize in Economic Sciences 2022. Press Release October 10. https://www.nobelprize.org/pri…

Royal Swedish Academy of Sciences (2022b). The Prize in Economic Sciences 2022. Popular Science Background. https://www.nobelprize.org/pri…