Thomas Ferguson is the Research Director at the Institute for New Economic Thinking. He is Professor Emeritus at the University of Massachusetts, Boston and Senior Fellow at Better Markets. He received his Ph.D. from Princeton University and taught formerly at MIT and the University of Texas, Austin. He is the author or coauthor of several books, including Golden Rule (University of Chicago Press, 1995) and Right Turn (Hill & Wang, 1986). His articles have appeared in many scholarly journals, including the Quarterly Journal of Economics, International Organization, International Studies Quarterly, and the Journal of Economic History. He is a member of the editorial board of the International Journal of Political Economy and a longtime Contributing Editor at The Nation.

Thomas Ferguson

By this expert

The Great Inflation Debate: Supply Shocks and Wealth Effects in a Multipolar World Economy

Setting the record straight and identifying less destructive pathways forward than round after round of interest rate increases.

Myth and Reality in the Great Inflation Debate: Supply Shocks and Wealth Effects in a Multipolar World Economy

A critical reappraisal of the case in favor of monetary tightening pressed by inflation hawks is overdue.

Bankman-Fried, Political Money, and the Crash of FTX

How Showering Money on Both Parties Paralyzed Regulators

Featuring this expert

Thomas Ferguson is quoted in Rabble on money in politics

“Political scientist Thomas Ferguson has documented how U.S. big business interests poured money into local and state elections to ensure positive support for their largely unpopular policies. What Ferguson calls “political investment” is the practice of spending serious sums on party competition to keep hand-picked, docile representatives in power.” — Duncan Cameron, Rabble

INET's article on the dangers of reopening schools is featured in the Santa Fe New Mexican

“Right after the CDC made this announcement, the president of the American Federation of Teachers, Randi Weingarten, sent a letter to the Biden administration, citing a study by the Institute for Economic Thinking. … The authors of the study are Dr. Deepti Gurdasani, who did much of the research for the study and is a clinical epidemiologist and statistical geneticist and senior lecturer at the William Harvey Research Institute in London; Dr. Phillip Alveldi, CEO and chairman of Brain Works Foundry Inc, a U.S.-based developer of artificial intelligence-enhanced health care technologies and services; and Thomas Ferguson, the director of research projects for the Institute for New Economic Thinking.” — Dennis Donohue, Santa Fe New Mexican

Thomas Ferguson's article is featured in the International Economy Magazine

“The much-touted “new thinking” on fiscal policy and debt is actually very thin and little of it is new. In the 1990s, economist Luigi Pasinetti clarified the folly of the proposed Maastricht criteria for public finances and forecast the coming disaster with those. Subsequently, many economists, including more than a few working with the Institute for New Economic Thinking, showed in detail how austerity reduces potential output over time and how absurd theories about Phillips Curve trade-offs lead to big underestimates of real rates of unemployment. Running below full employment for long periods blows big holes in public finances and thus piles on debt.” – Thomas Ferguson

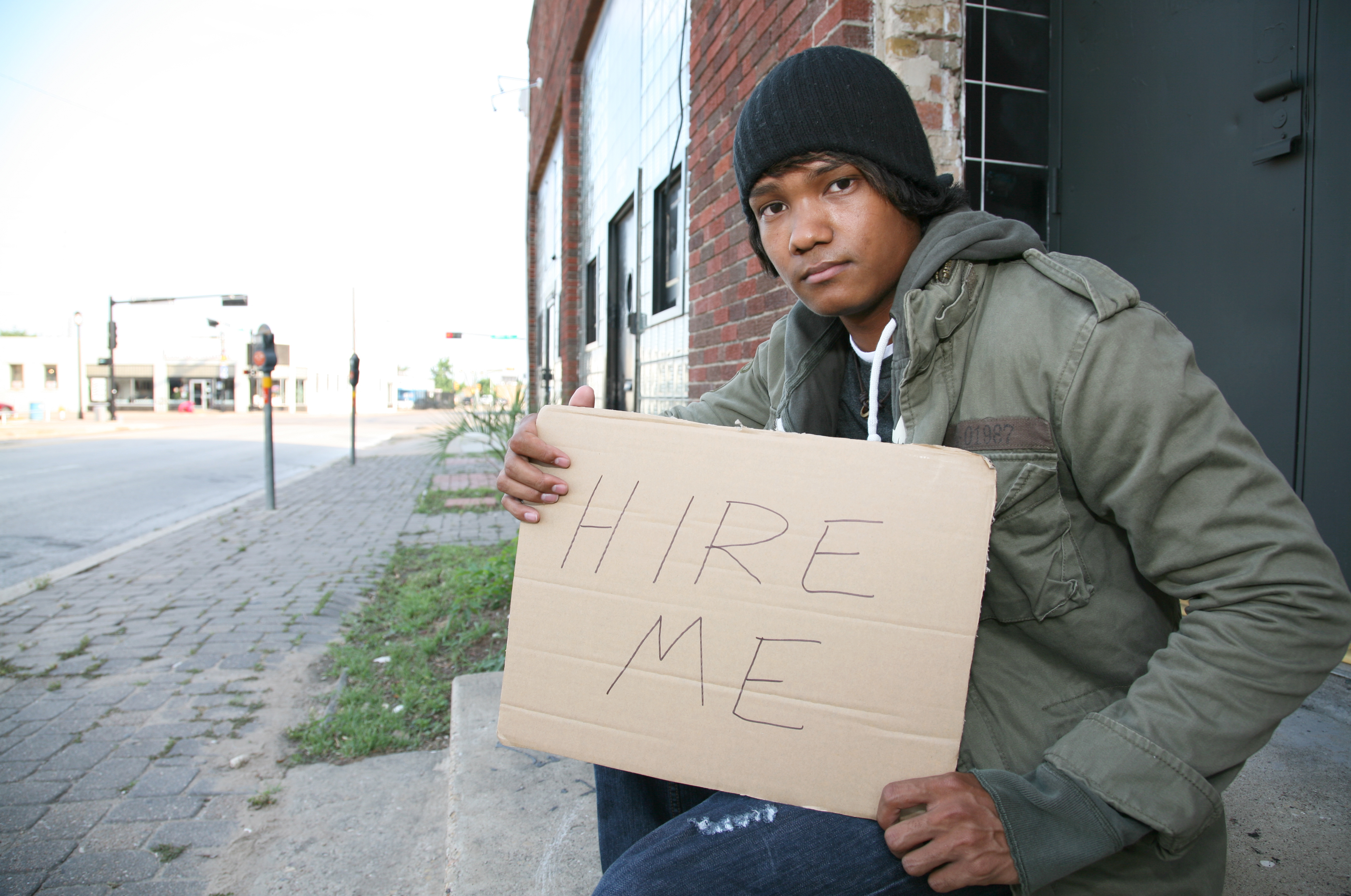

Survey Bias May Underestimate Unemployment, Particularly Among Young Black Men With Julie Yixia Cai, Dean Baker, William Spriggs, and John Schmitt. Moderated by INET’s Thomas Ferguson

Join us for this lively and timely presentation, followed by Q&A.