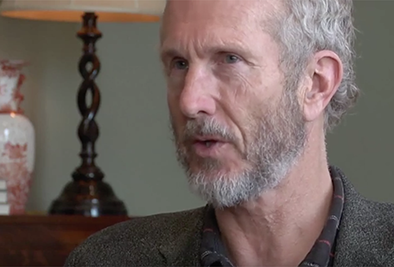

Perry G. Mehrling is professor of economics at Pardee School of Global Studies at Boston University. He was professor of economics at Barnard College in New York City for 30 years. There, he taught courses on the economics of money and banking, the history of money and finance, and the financial dimensions of the U.S. retirement, health, and education systems. His most recent book is The New Lombard Street: How the Fed became the dealer of last resort (Princeton 2011). His best-known book Fischer Black and the Revolutionary Idea of Finance (Wiley 2005, 2012) has recently been released in a revised paperback edition. Currently, Prof. Mehrling directs the educational initiatives of the Institute for New Economic Thinking, one of which is his course Economics of Money and Banking, available on Coursera at www.coursera.org/course/money.

Perry G. Mehrling

By this expert

Lethal Embrace? A Thought Experiment

At the heart of the Eurocrisis lies a vicious circle where once there was a virtuous one.

Maynard's Revenge: A Review

The Collapse of Free Market Macroeconomics

Maynard's Revenge: A Review

Below is a revised version of a talk I gave at the New School University, at a conference to launch Lance Taylor’s latest book. The date of the event was April 28, 2011, more than a year ago, and the delay in revision was entirely my fault—overcommitment and pressing deadlines on many fronts. Sorry about that.

Insights from Bagehot, for these Trying Times

Here is a talk I gave recently at Wake Forest University.

Featuring this expert

Bottom Up Fiscal Policy: Direct Employment of the Unemployed

To cure unemployment, mostly we prime the pump: we devise fiscal strategies on the presumption that jobs follow economic growth. But the strategies have not worked, unemployment remains high.

Why Economics Needs Data Mining

Cosma Shalizi urges economists to stop doing what they are doing: Fitting large complex models to a small set of highly correlated time series data.

Macroeconomics From the Bottom Up

In 2006, the Fed asked its macroeconometric model what would happen if house prices dropped by 20%. The model projected the past into the future and said: “Not much.” Well, the financial crisis proved it wrong.

Measuring Systemic Risk To Empower the Taxpayer

Banks take on excessive risk since they know, in case of failure, the taxpayer will step in to rescue them. That is a form of free insurance, and Ed Kane wants to end it.