Perry G. Mehrling is professor of economics at Pardee School of Global Studies at Boston University. He was professor of economics at Barnard College in New York City for 30 years. There, he taught courses on the economics of money and banking, the history of money and finance, and the financial dimensions of the U.S. retirement, health, and education systems. His most recent book is The New Lombard Street: How the Fed became the dealer of last resort (Princeton 2011). His best-known book Fischer Black and the Revolutionary Idea of Finance (Wiley 2005, 2012) has recently been released in a revised paperback edition. Currently, Prof. Mehrling directs the educational initiatives of the Institute for New Economic Thinking, one of which is his course Economics of Money and Banking, available on Coursera at www.coursera.org/course/money.

Perry G. Mehrling

By this expert

Global Money: A Work in Progress

A dollar-denominated global economy means the Fed is at once the bankers bank and government bank, as well as both U.S. central bank and global central bank — managing that hybrid is the challenge of our time

Independence vs. Accountability in the Evolution of the Fed

Peter Conti Brown’s new book explores and debunks a powerful meme shaping public understanding of the role of the Fed

Featuring this expert

Behind the Scenes of International Banking Regulation

Five years into the Great Recession, discussion and political fights continue about the right approach to international banking supervision. How to avert the next financial crisis or at the very least lessen its damage?

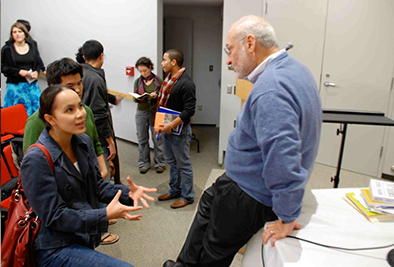

Azim Premji Winter School 2013

The Azim Premji University-Institute for Economic Thinking Advanced Graduate Workshop in Poverty, Development and Globalization is interested in identifying the complex global interactions that influence poverty and development as well as the development strategies that have proven successful in promoting equitable growth, promoting capabilities, and reducing poverty.

The Survival of the Riskiest

Financial fragility does not fall from the sky. That’s why treating risk as if it comes from exogenous shocks can’t capture the reality of financial markets.

Human Capital in the Industrial Revolution

Did the industrial revolution increase the relative demand for skilled labor, or decrease it?