Josh Stillwagon is an associate professor of economics at Babson College, formerly at Trinity College, and has previously studied and taught at the University of New Hampshire and the University of Copenhagen. Stillwagon was a member of the 2012 INET Young Scholar Initiative. Stillwagon has also served as a consultant on the New Hampshire state senate finance committee, and conducted research for the Federal Reserve Bank of Boston about the effects of environmental policies on clean-technology patenting and employment. His primary research agenda pursues two complimentary approaches. The first is to use survey data on traders’ actual forecasts to better understand their expectations formation and risk behavior. In particular, his focus is on assessing whether they are more congruent with REH-based models or those of Imperfect Knowledge Economics (IKE). The second approach is to use more flexible econometric techniques which allow for non-stationarity, non-linearities, and evolving relationships over time. These more flexible techniques include the I(2) cointegrated VAR and automated model selection algorithms. His work frequently finds support for both IKE and these more complicated dynamics absent in more traditional econometrics.

Josh Stillwagon

By this expert

Market Participants Neither Commit Predictable Errors nor Conform to REH

Evidence from Survey Data of Inflation Forecasts

How Market Sentiment Underpins Knightian Uncertainty

We find empirical evidence that changes in market sentiment drive unforeseeable change in how stock returns unfold over time, thereby engendering Knightian uncertainty.

How Market Sentiment Drives Forecasts of Stock Returns

We reveal a novel channel through which market participants’ sentiment influences how they forecast stock returns: their optimism (pessimism) affects the weights they assign to fundamentals.

How Imperfect Knowledge Shapes Financial Markets

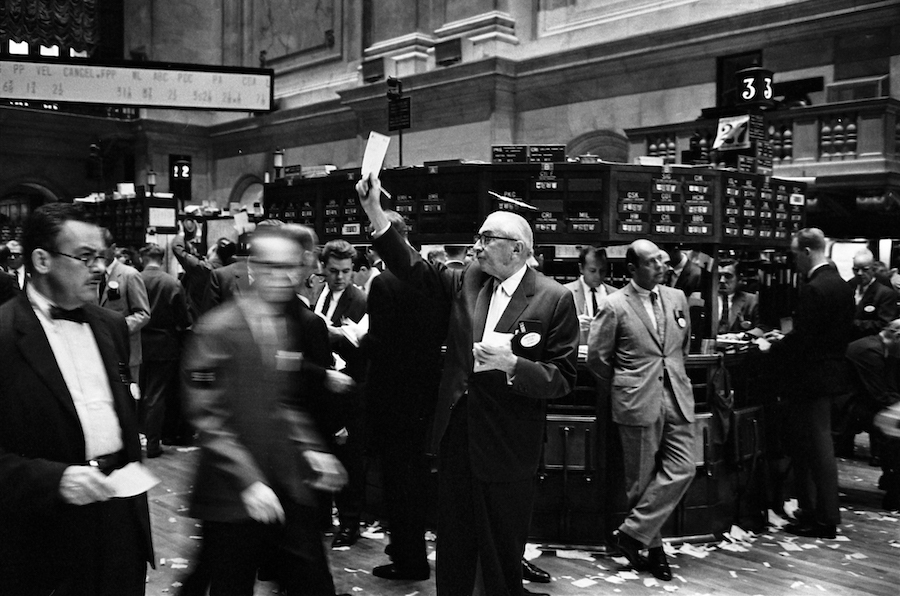

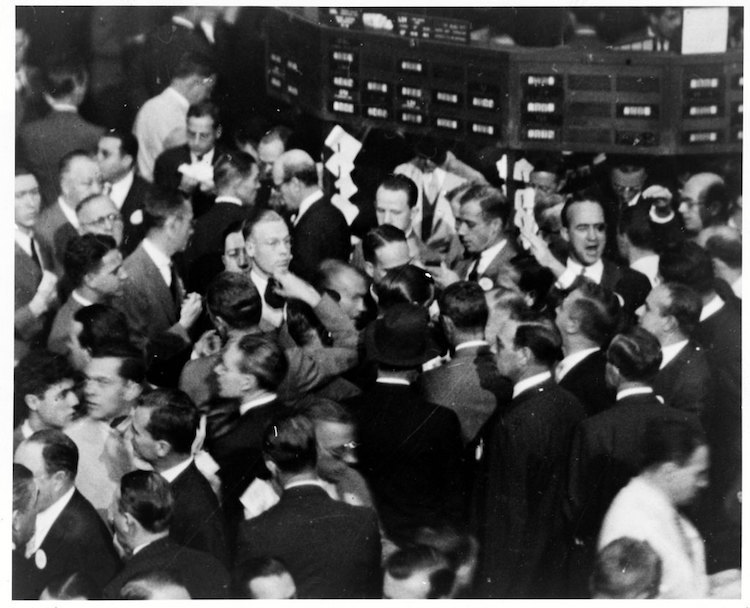

Asset markets are indispensable in harnessing society’s diverse views and insights about future business performance. But those views are shaped as much by emotion and crowd mentality as by rational expectations.

Featuring this expert

INET Announces Program on Knightian Uncertainity Economics

Rethinking the role of markets and government policy in light of our inherently limited ability to foresee economic and social outcomes

Knightian Uncertainty Economics (KUE)

Rethinking the role of markets and government policy in light of our inherently limited ability to foresee economic and social outcomes