Everyone is talking about the “labor share.” Once relevant only in certain corners of the ivory tower, it has moved front and center in the public debate over the causes and consequences of rising inequality. At least in principle, the labor share of income is straightforward to measure: it is the ratio of all wages to total income, both measured in current dollars. This definition implies that the labor share is conceptually equivalent to the ratio of average real wages to average labor productivity. A decline of the labor share therefore requires that labor productivity grow faster than real wages, placing the labor share smack in the middle of all the big questions regarding labor markets, technological change, and the potential for increases in living standards. Current research focuses on connections to structural change, i.e. the rise of a host of McJobs just as manufacturing disappears.

In our new INET working paper we present novel findings on the sectoral sources of the decline in the US labor share in recent decades. We provide a systematic analysis of sectoral contributions to changes in the aggregate labor share using a Divisia index decomposition of US data from 1948 to 2017. Specifically, we present statistics on contributions to the aggregate labor share from changes in sectoral real wage, sectoral labor productivity, the structure of the economy as measured by employment shares, and the structure of markets as measured by terms-of-trade or relative prices.

Key results can be summarized as follows. Firstly, growth of real compensation and labor productivity dominate the overall change in the labor share. Secondly, the manufacturing sector plays a critical role throughout the entire post-war period. Initially, strong real compensation gains relative to labor productivity growth increase the labor share. In the later period, the accelerating collapse of employment in manufacturing coincides with strong growth of labor productivity, which in turn consistently exceeds that of real compensation. Thirdly, sectors with rising employment shares especially in the neoliberal era, feature on average lower real compensation and lower labor productivity growth, and higher labor shares. These structural changes thus imply downward pressure on labor productivity growth, and at the same time buffer the overall decline of the labor share.

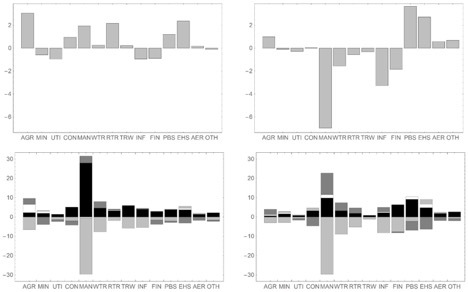

Figure 1 illustrates these issues for the “golden age” and the “neoliberal era.” As an example, consider manufacturing (MAN), fifth from the left. During the golden age, this sector’s strong productivity performance for a negative impact on the aggregate labor share of -29% was roughly matched by real compensation gains (+28%). Employment structure (-0.5%) and relative prices (+3.6%) played more limited roles. These four components add to a total contribution of manufacturing to the aggregate labor share change during the golden age of about 2% in the top left panel. As can be seen, the golden age features, roughly, balance across sectors, whereas the neoliberal era sees markedly negative sectoral contributions from dynamic, high-tech activities: manufacturing, wholesale trade (WTR), information (INF) and finance (FIN). Only select service sectors, specifically professional and business services (PBS) and education and health services (EHS), buffer these developments.

Based on these results we hypothesize that the U.S. economy is increasingly becoming a dual economy, where high productivity sectors—such as manufacturing—and high pay sectors—such as finance and professional services—co-exist with low pay and low productivity sectors that employ most workers. This hypothesis has been put forth by others; for important contributions see Storm (2017), Temin (2017) and Taylor and Ömer (2018). Our critical conclusion is that there is nothing benign about the ongoing process of tertiarization. Decades ago, William J. Baumol proposed a theory of structural change that implies a slowdown in productivity growth as service activities come to dominate. This does not need to be a problem, however, if prosperity is widely shared. Of course, that has not been the case, leading us to question the underlying mechanism. In contrast, high-productivity activities are shedding labor, and indeed, see the starkest gaps of compensation to productivity growth. This suggests that jobs with low productivity and pay absorb the released surplus labor. This shift is reminiscent of W. Arthur Lewis’ writings on dual economies, albeit in reverse: the US economy appears to become dual, once again.

Future research will need to clarify the linkages between the observed fall in the labor share, the observed changes in the structure of the economy, and the hypothesis of secular stagnation. Our decomposition results and placement in the context of Baumol and Lewis provide fertile ground for that discussion to occur.

Figure 1: Sectoral decomposition of aggregate change in US labor share. Left column: golden age (1948-1979); right column: neoliberal era (1979-2017). The bottom two panels show sectoral contributions of four components to the aggregate labor share change over the relevant period; black is real compensation, light gray labor productivity, dark gray relative prices and white employment structure. The sum across these four components is equal to the bar height in the top panel, which shows the total sectoral contribution to the aggregate labor share change over the relevant period.